XRP grabbed contemporary consideration after two well-known chart analysts outlined bullish setups that might push the token a lot greater if the present momentum holds.

Associated Studying

In line with Javon Marks and Ali Martinez, technical indicators are lining up for a doable sturdy transfer, however merchants are watching whether or not key resistance ranges give method.

Analysts See Breakout Potential

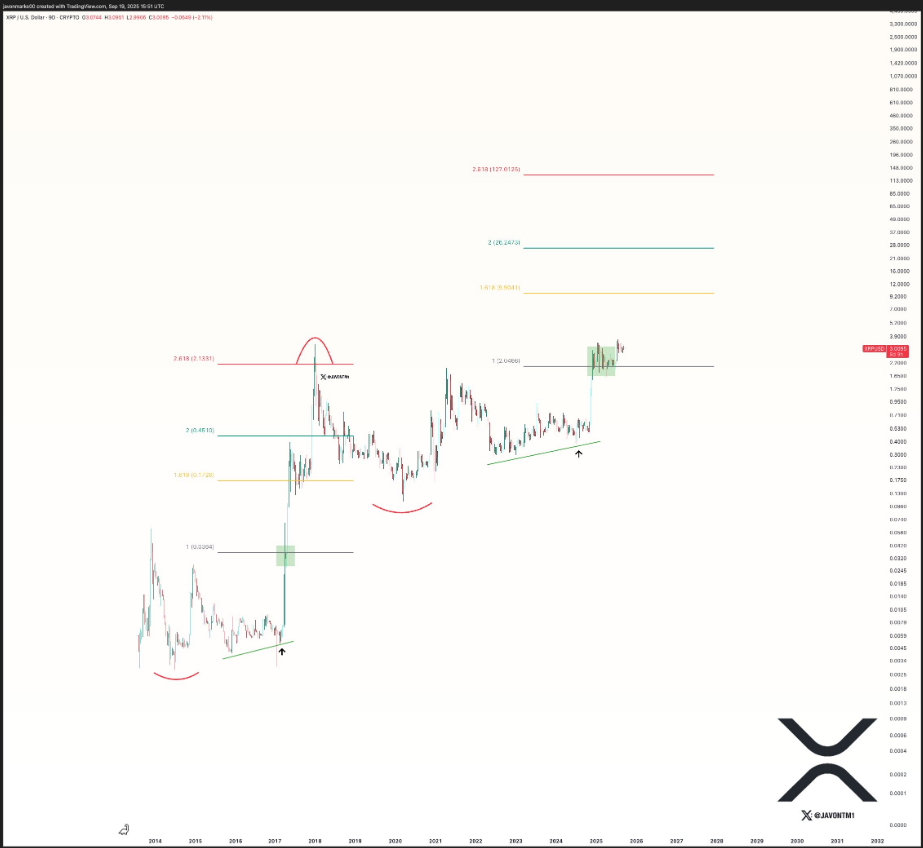

Dealer Javon Marks posted a chart displaying what he known as a big accumulation sample. Primarily based on his view, XRP might climb by 226% to succeed in $9.90, and if that zone is cleared the trail to $20 might open.

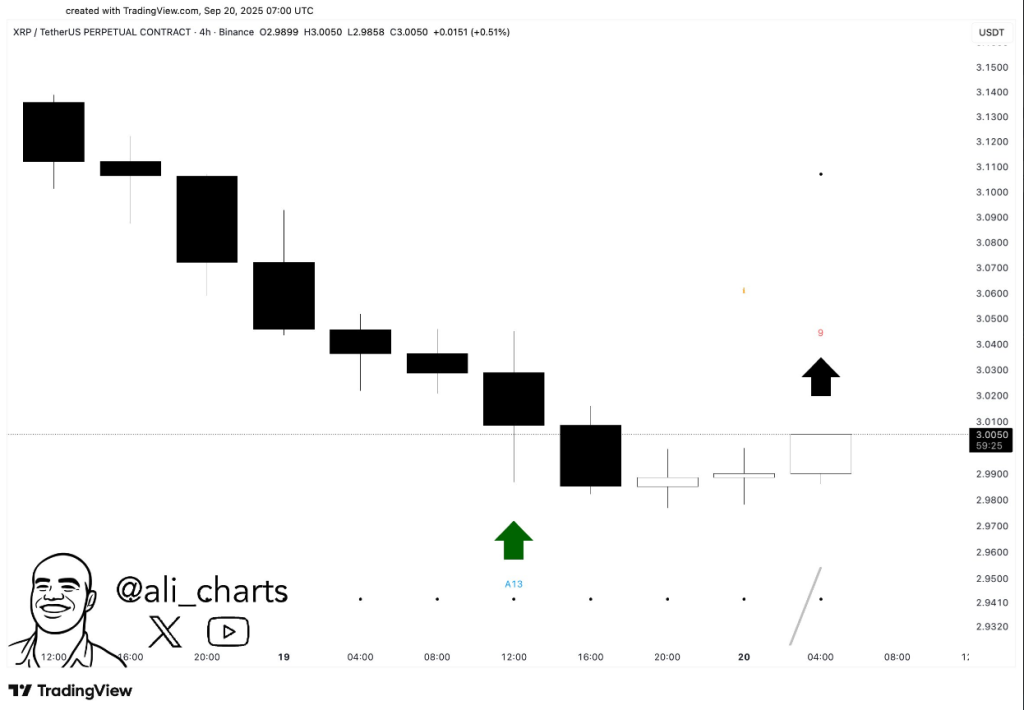

$XRP is a BUY, in response to the TD Sequential! pic.twitter.com/fY7GTgXEB0

— Ali (@ali_charts) September 20, 2025

Marks in contrast at this time’s worth construction to prior lengthy swings that led to sharp positive aspects after prolonged sideways durations. Primarily based on stories from Martinez, the TD Sequential on the four-hour chart flashed a purchase sign.

That indicator is utilized by many merchants to identify when a pattern might cease and reverse. Martinez mentioned latest consolidation improved the chances for consumers, and that the shorter-term pattern now favors upward motion. Each analysts emphasised patterns and indicators reasonably than a set timetable for any rally.

Institutional Strikes Add Liquidity

Studies have disclosed that the primary US spot XRP ETF started buying and selling this week, a improvement many see as an indication of rising institutional entry. On the similar time, the CME Group has plans to launch futures choices for XRP and Solana, which might carry extra skilled merchants and deeper liquidity.

$XRP seems to be getting ready right here for ANOTHER +226% SURGE TO $9.90+ and a break above might ship it in direction of $20 and better! pic.twitter.com/ia5jJOcdkp

— JAVONMARKS (@JavonTM1) September 19, 2025

Tokenized fund plans on the XRP Ledger have additionally surfaced; these funds would commerce like tokens and provides buyers regulated publicity with quicker settlement, in response to sources.

Market response has been cautious. XRP has been holding above $3, however worth motion slowed because it neared resistance. Merchants at the moment are watching whether or not the token can push past the subsequent provide zone or retreat again into consolidation.

XRP market cap at the moment at $178 billion. Chart: TradingView

Associated Studying

Carbon Market May Create Demand

In the meantime, there’s a separate line of debate that hyperlinks XRP to tokenized carbon credit. Primarily based on a Priority Analysis projection cited in stories, the carbon credit score market might broaden from about $933 billion in 2025 to greater than $16 trillion by 2034.

Different analysis pointed to the carbon offsets section being round $1.06 trillion in 2023 and presumably rising previous $3 trillion by 2032.

If tokenization of credit positive aspects scale, these engaged on market plumbing say quick, low-cost rails might be helpful. The XRP Ledger is reported to be carbon impartial, which supporters argue might make it a beautiful possibility for shifting tokenized credit.

Nonetheless, this can be a hypothetical demand case and no clear mannequin ties that potential on to a particular XRP worth stage.

Featured picture from Meta, chart from TradingView