Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

In a thread on August 19, analyst Miles Deutscher argued that MicroStrategy’s market-implied internet asset worth (mNAV) premium—the core gear in Michael Saylor’s Bitcoin acquisition flywheel—has compressed sharply, weakening the suggestions loop that helped the corporate outpace Bitcoin via a lot of the cycle. “Michael Saylor constructed the craziest BTC flywheel in historical past. However his shopping for energy is beginning to fade. The market is now asking one query: ‘Is the BTC treasury bubble lastly popping?’”

MicroStrategy’s Bitcoin Premium Is Fading

Deutscher grounds the dialogue in how traders at the moment worth MicroStrategy. “Individuals typically overlook that MicroStrategy has a legacy software program enterprise, which continues to generate income. Nevertheless, MicroStrategy has basically develop into an organization whose valuation is primarily influenced by its BTC holdings. Your complete system is powered by mNAV (Market-Implied NAV).”

In sensible phrases, the mNAV a number of is the premium traders pay over the corporate’s look-through Bitcoin worth to entry leveraged BTC publicity through MSTR. “An mNAV of ~1.58x means the market is paying a 58% premium for his or her BTC.” Based on Deutscher, that premium “was as soon as a 3.4x mNAV” when Bitcoin was surging, nevertheless it has “now decreased to 1.58x. Demand is slowing down.” In different phrases, what had been a robust flywheel—excessive premium enabling low cost fairness issuance that funded extra Bitcoin purchases, which in flip stored NAV rising and the premium elevated—now spins with a lot much less torque.

Associated Studying

That shift intersected with a contentious company motion. “Not too long ago, Saylor sparked controversy by revealing that Technique had revised its MSTR Fairness ATM Steering to supply better ‘flexibility’ in executing its capital markets technique.” The implication, Deutscher argues, is that better issuance flexibility “might dilute shareholder worth and improve monetary threat tied to Bitcoin’s volatility.”

He notes that “the market is sort of divided” on the change. On the constructive facet, he quotes @thedefivillain’s take—“Slower focus of provide in Saylor’s fingers,” “Better leverage to justify mNAV,” and “Lowered shopping for strain for BTC in greenback phrases”—as causes the revision may in the end be benign.

However critics fear about “the potential for a ‘loss of life spiral.’ The elimination of the two.5x mNAV safeguard for fairness issuance might permit MicroStrategy to promote shares at decrease valuations.” Reflexivity, in Deutscher’s telling, is the operative threat issue: “Reflexivity is a brutal drive that operates in each instructions.”

A Hypothetical State of affairs

Deutscher then units up a stress-test as an instance how that reflexivity may chew if Bitcoin weakens and the premium compresses to parity. “If BTC’s value drops 20% and MicroStrategy’s mNAV a number of falls to 1.0x, the inventory would possibly plummet by 46.5%.”

He walks via the arithmetic from a notional baseline of $115,000 per BTC, which on a 20% decline would fall to $92,000. On MicroStrategy’s “226,331 BTC,” he calculates that will put look-through NAV at $20.82 billion.

To align an mNAV of precisely 1.0x, he backs into enterprise worth and market cap beneath that state of affairs: “Beginning with an enterprise worth of $20.82 billion, we subtract MicroStrategy’s $2.2 billion in debt and add its $0.1 billion in money. This calculation unveils the corporate’s market cap, hitting $18.72 billion, a major pullback from its authentic $35 billion market cap.”

Associated Studying

The conclusion he attracts from the modeled path—BTC −20% to ~$92,000, mNAV → 1.0x, MSTR market cap −46.5%—is that MicroStrategy’s fairness stays a leveraged instrument with an end result path that may be materially worse than Bitcoin itself when the premium compresses.

Past the state of affairs math, Deutscher hyperlinks latest spot value motion to altering marginal demand. “I believe BTC’s latest weak spot might be attributed to the market beginning to value in lowered Saylor demand/tail potential threat of the revised ATM steering.”

In parallel, he highlights how the proliferation of spot ETFs erodes the unique rationale for paying a big listed-company premium to personal BTC “beta”: “Spot Bitcoin ETFs are plentiful now. Why would you pay a 58% premium for MSTR’s leveraged publicity when you’ll be able to seize IBIT at a clear ~1.0x NAV?”

By his framing, the mNAV premium itself “was indicative of the market’s view that MSTR was going to outperform BTC.” With that view fading, the premium seems to be much less like a permanent structural characteristic and extra like a belief-sensitive variable. “In my view, the MSTR premium is basically a raffle. You’re betting on three fragile issues: unwavering market confidence, open capital markets, and Saylor’s management. If any of these pillars begin to wobble, the premium collapses.”

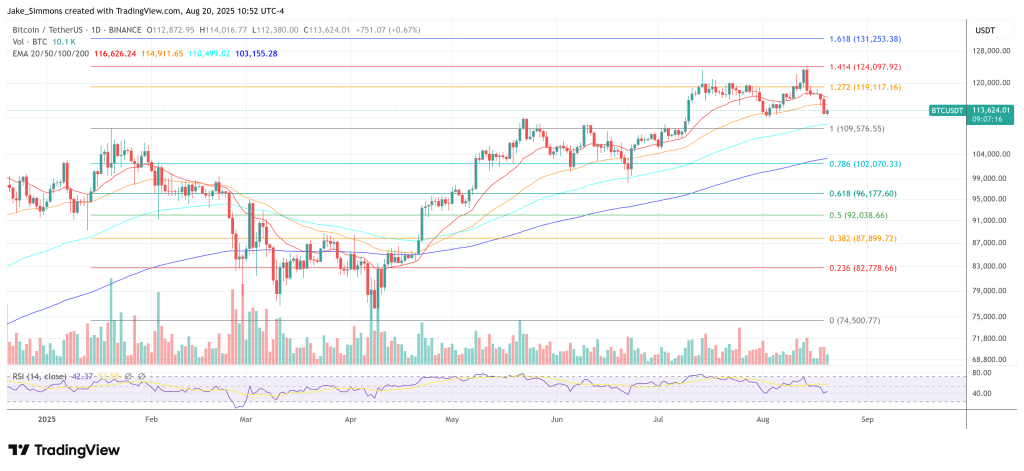

At press time, BTC traded at $113,624.

Featured picture created with DALL.E, chart from TradingView.com