Bitcoin and the broader crypto market is heading into 2026 with extra questions than clear solutions.

A brand new outlook from Constancy urges warning for buyers chasing short-term positive factors, whereas arguing that long-term holders should still have room to enter the market.

The message displays a broader shift: crypto is now not only a high-beta commerce for speculators. It’s being handled as a strategic asset by governments, companies, and institutional buyers.

That shift accelerated this yr.

This yr, extra governments and corporations added digital belongings to their treasuries, creating a brand new supply of demand that didn’t exist in prior cycles.

In March, President Donald Trump signed an government order establishing a Strategic Bitcoin Reserve for the USA. The order formally designated BTC and choose cryptocurrencies already held by the federal authorities as reserve belongings.

The long-term influence of that call stays unclear. However the symbolism issues. BTC is now formally acknowledged by the U.S. authorities as a retailer of worth. That recognition is feeding debate over whether or not crypto’s acquainted four-year market cycle nonetheless applies, the report argued.

Is Bitcoin’s four-year cycle over?

Bitcoin has traditionally moved in boom-and-bust patterns tied loosely to its halving schedule. Main tops fashioned in 2013, 2017, and 2021. Every was adopted by deep drawdowns. Immediately, costs are once more pulling again across the four-year mark, elevating the query of whether or not the present bull market has already peaked.

Some buyers assume the cycle is breaking down. The argument is easy: structural demand is altering. Sovereign adoption and company stability sheet shopping for might dampen volatility and scale back the severity of future bear markets.

Others go additional, suggesting bitcoin could also be coming into a “supercycle” that extends larger for years, with solely shallow corrections alongside the best way.

Constancy Digital Asset’s Chris Kuiper isn’t satisfied cycles are lifeless. Human conduct hasn’t modified, he notes, and concern and greed nonetheless drive markets. If the four-year sample holds, bitcoin would wish to have already set its cycle excessive and be coming into a sustained bear market.

To date, it’s too early to say. The latest drawdown might mark the beginning of a downturn. Or it may very well be one other mid-cycle shakeout.

Governments and companies are shopping for Bitcoin

Additionally, authorities adoption provides one other layer of complexity. A rising variety of nations already maintain crypto, however few have formally designated it as a reserve asset.

Which will change. Kyrgyzstan handed laws establishing a crypto reserve in 2025. In Brazil, lawmakers superior a proposal that might permit as much as 5% of international reserves to be held in bitcoin.

Kuiper factors to sport idea. If one nation adopts bitcoin as a reserve, others could really feel stress to comply with. Any incremental demand, he says, might help costs, although the size issues and promoting stress can offset shopping for.

Firms are additionally taking part in a bigger position. Greater than 100 publicly traded corporations now maintain crypto, with roughly 50 companies controlling over a million bitcoin mixed, per Constancy. Technique stays essentially the most seen purchaser, however it’s now not alone. For some companies, bitcoin provides a solution to entry capital markets and arbitrage investor demand for publicity.

That demand cuts each methods. Company shopping for can carry costs. Compelled promoting in a downturn might amplify losses.

So, is it too late to purchase?

Constancy’s Kuiper says it depends upon the time horizon. Quick-term buyers could face poor odds if the cycle is close to its finish. Lengthy-term holders face a distinct equation. On a multi-decade view, Kuiper argues bitcoin’s fastened provide stays its core enchantment. If that holds, the query isn’t timing the cycle. It’s whether or not adoption continues. In 2026, that reply continues to be unfolding.

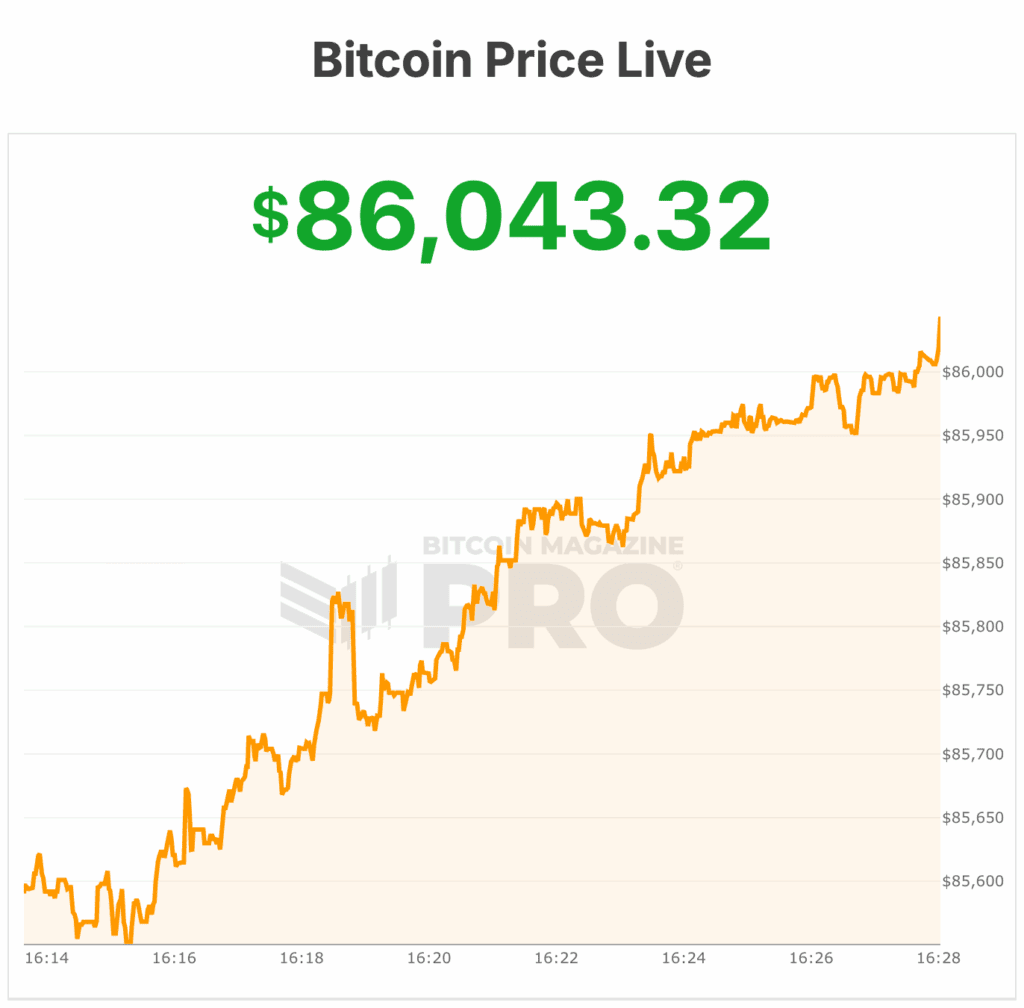

On the time of writing, Bitcoin’s value is quickly dipping close to $86,000.