Right here’s what the historic pattern of the Bitcoin Market Worth to Realized Worth (MVRV) Ratio suggests relating to whether or not the present bull run is over or not.

Bitcoin MVRV Ratio Might Trace At The place BTC Is In Present Cycle

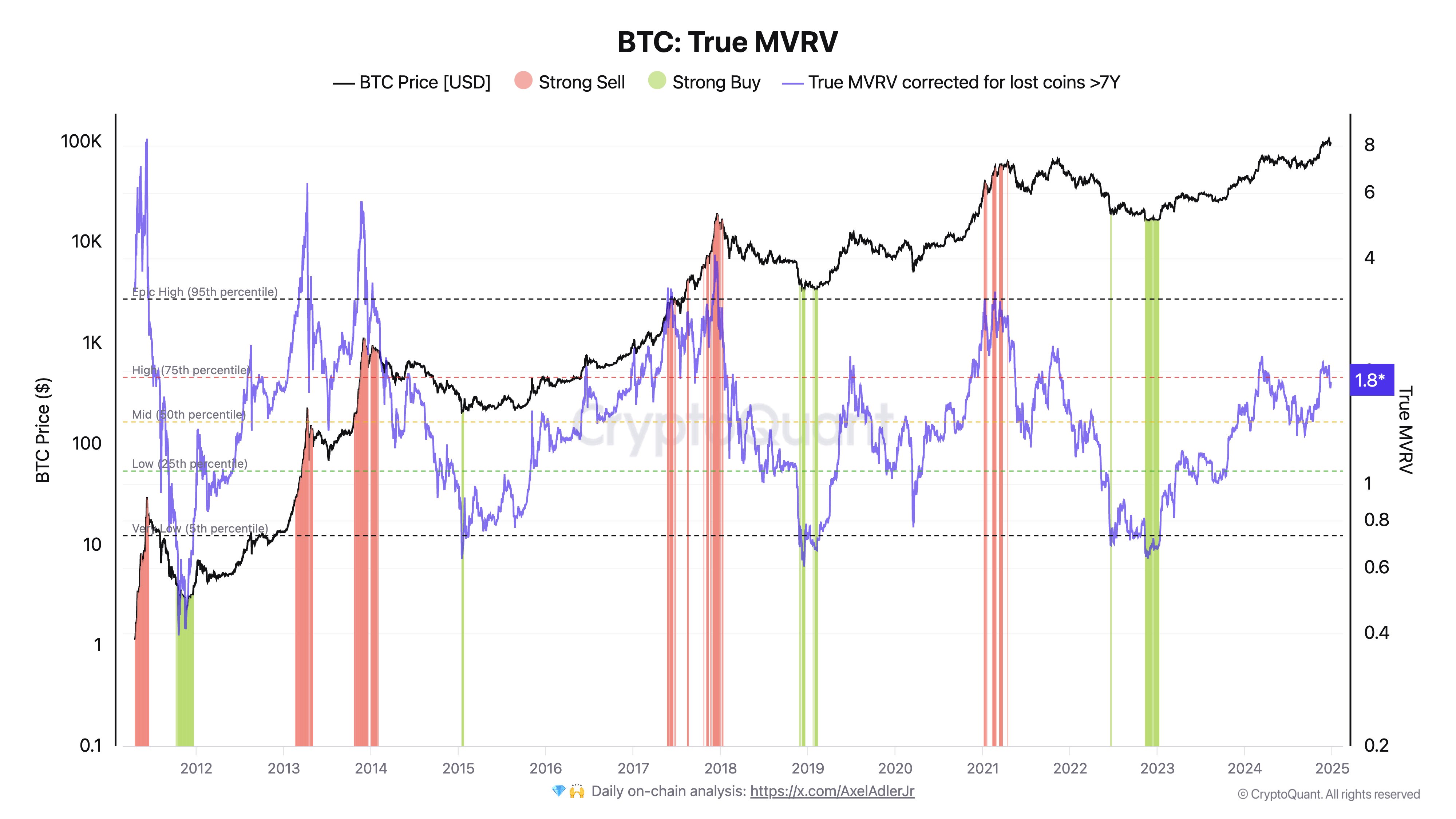

In a brand new publish on X, CryptoQuant founder and CEO Ki Younger Ju shared a chart showcasing the previous sample within the Bitcoin MVRV Ratio. The MVRV Ratio refers to a well-liked on-chain metric that, in brief, retains observe of how the worth held by the BTC buyers (that’s, the market cap) compares in opposition to the worth that they initially put into the asset (the realized cap).

When the worth of the ratio is bigger than 1, it means the buyers as an entire could be assumed to be in a state of revenue. Alternatively, it’s underneath the mark, implying the dominance of loss available in the market.

The model of the MVRV Ratio posted by Younger Ju isn’t the bizarre one, however slightly a modified type known as the “True MVRV.” This variation takes into consideration for under the information of the cash that have been concerned in some type of transaction exercise in the course of the previous seven years.

Cash which are older than seven years could be assumed to be misplaced without end, both because of being forgotten or due to having their pockets keys misplaced. As such, the True MVRV, which excludes these cash which are possible to by no means return again into circulation, can present a extra correct image of the sector than the traditional model of the metric.

Now, here’s a chart that exhibits the pattern on this Bitcoin indicator over the historical past of the cryptocurrency:

As displayed within the above graph, the Bitcoin True MVRV has climbed to comparatively excessive ranges throughout this bull run. This means the common investor is carrying notable income.

Traditionally, the upper the holder beneficial properties get, the extra seemingly they grow to be to take part in a mass selloff with the motive of profit-taking. Thus, every time the MVRV Ratio rises excessive, a high can grow to be possible for BTC.

From the chart, it’s seen that the tops in the course of the previous cycles occurred when the indicator surpassed a particular line. Thus far, the metric hasn’t come near retesting this degree within the newest epoch.

Based on the CryptoQuant founder, the rationale the market cap hasn’t overheated relative to the realized cap but is that there’s nonetheless $7 billion in capital inflows coming into the Bitcoin market each week.

If the present cycle goes to point out something much like the earlier ones, then the True MVRV being excessive, however not extraordinarily excessive, may doubtlessly counsel room for BTC left within the present bull run.

BTC Worth

Bitcoin has retraced its Christmas rally as its worth is now again all the way down to $95,700.