Fast Take

Samson Mow just lately stirred dialogue on X by declaring that “$58k is the brand new $9k” for Bitcoin. Intrigued by this daring assertion, we determined to place Mow’s idea to the take a look at by analyzing Bitcoin’s buying and selling patterns, particularly in gentle of its historic value habits.

Since reaching its all-time excessive of roughly $73,000 in March, Bitcoin hasn’t seen a lot value volatility, dipping to a low of round $49,000 on Aug. 5. Coincidentally, this was roughly the identical value as when the Bitcoin ETF launched in January.

Regardless of this volatility, Bitcoin has predominantly traded inside the $60,000 vary, sometimes spiking to $70,000 earlier than retreating. This sample attracts parallels to the 2020 cycle, when Bitcoin spent a protracted interval of round $9,000 from June 2019 to September 2020. Even in the course of the COVID-19 crash, when Bitcoin briefly plummeted to $4,000, it rapidly returned to the $9,000 vary.

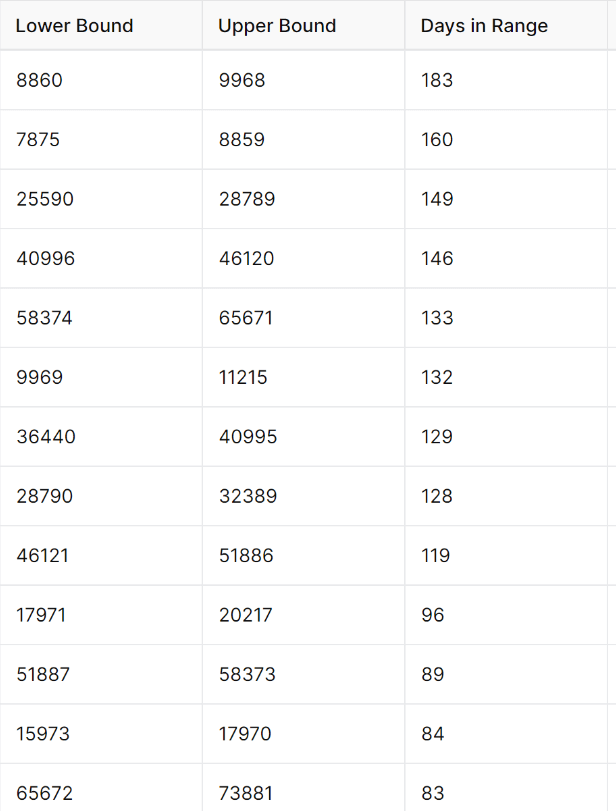

We rigorously analyzed these tendencies utilizing roughly a 12% value vary. This strategy permits for a good comparability throughout completely different value ranges by sustaining a constant share vary quite than a hard and fast greenback quantity.

Our findings revealed that Bitcoin spent 183 days within the vary of $8,860 to $9,968 and 160 days between $7,875 and $8,859. At the moment, Bitcoin has spent 133 days buying and selling between $58,374 and $65,671.

With 50 days till Oct. 9, the beginning of the fourth quarter — a historically bullish interval for Bitcoin — market observers are eager to see if historical past will repeat itself and validate Mow’s assertion.

The submit Is $58k the brand new $9k for Bitcoin? appeared first on CryptoSlate.