Iran’s central financial institution quietly constructed up a big stash of Tether’s USDT final 12 months because the rial struggled and commerce with the skin world grew tougher. The transfer turned elements of the crypto ledger right into a public path of a coverage that will usually be personal.

Central Financial institution’s Crypto Strikes

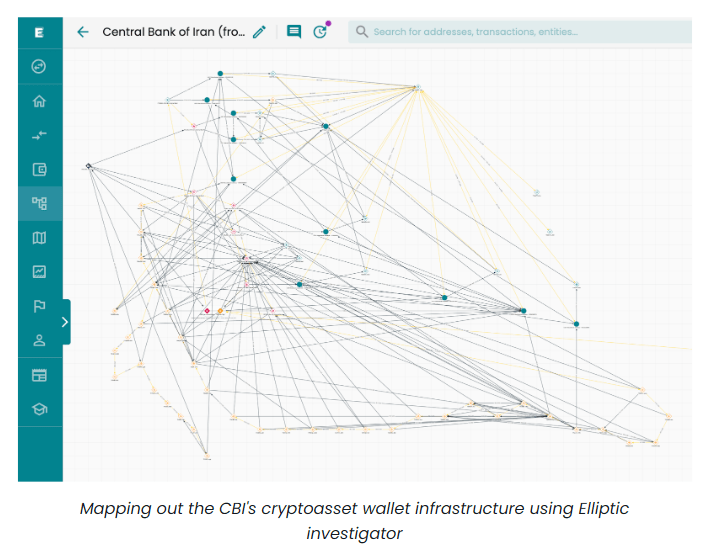

In line with a blockchain evaluation by Elliptic, the Central Financial institution of Iran acquired at the very least $507 million in USDT over 2025, a determine the agency treats as a conservative minimal as a result of it solely counts wallets it may tie to the financial institution with excessive confidence.

Studies say a lot of the shopping for occurred within the spring months of 2025 and that funds have been routed by way of channels that included Emirati dirhams and public blockchains. These stablecoins have been then utilized in native crypto markets so as to add dollar-linked liquidity and assist gradual the rial’s slide.

New Elliptic analysis: We’ve got recognized wallets utilized by Iran’s Central Financial institution to amass at the very least $507 million value of cryptoassets.

The findings counsel that the Iranian regime used these cryptoassets to evade sanctions and help the plummeting worth of Iran’s foreign money,… pic.twitter.com/I7NHGO0wtP

— Elliptic (@elliptic) January 21, 2026

How The Cash Flowed

Elliptic’s tracing reveals an early circulate of USDT into Nobitex, Iran’s largest crypto change, the place the cash may very well be swapped into rials and fed into the market. After a breach and rising scrutiny in mid-2025, different paths have been used, together with cross-chain bridges and decentralized exchanges, to maneuver and convert funds.

Supply: Elliptic

A Freeze And A Warning

That open ledger additionally left the transactions seen to outdoors observers. On June 15, 2025, Tether blacklisted a number of wallets linked to the central financial institution and froze about $37 million in USDT, displaying that stablecoins could be reduce off when issuers or regulators step in. That intervention narrowed some choices for on-chain liquidity.

This episode issues for 2 causes. First, it reveals how a state establishment can use stablecoins to achieve entry to greenback worth when regular banking routes are closed.

Second, it highlights a weak spot: if a non-public issuer can freeze balances, these reserves will not be the identical as money held in laborious overseas accounts.

Commerce, Sanctions, And A New Instrument

Studies notice the purchases probably served a twin objective — to easy home change charges and to assist settle commerce with companions who keep away from direct greenback banking.

The tactic is blunt. It provides a method to transfer worth, however it additionally creates new factors of management and publicity that may be tracked on public ledgers.

Analysts shall be watching how regulators and stablecoin issuers reply. They will even observe whether or not different international locations beneath stress flip to related mixes of centralized and decentralized instruments.

The general public tracing of those flows makes it tougher to cover huge strikes, even when actors attempt to obscure them throughout chains and exchanges.

Featured picture from Unsplash, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our staff of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.