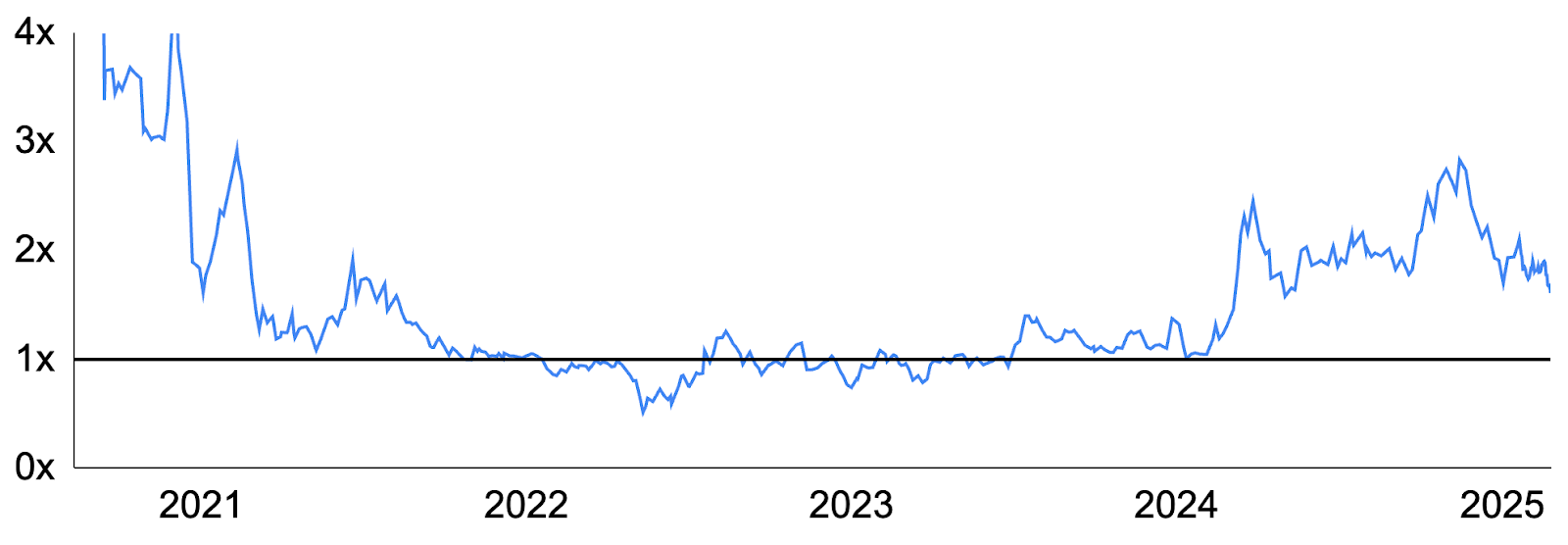

Technique (NASDAQ: MSTR), the SaaS-based enterprise intelligence firm previously often called MicroStrategy that pioneered a bitcoin treasury technique, is at the moment buying and selling at a $73 billion market cap, ~1.6x the worth of its underlying bitcoin holdings. This so-called “MSTR premium” has prompted a lot misunderstanding, wholesome skepticism and even consternation, however with a decade of deep equities expertise, we consider that there are three the reason why the MSTR premium is justified. These are significantly legitimate during times of rising bitcoin worth expectations, as we’re in now.

You are studying Crypto Lengthy & Brief, our weekly publication that includes insights, information and evaluation for the skilled investor. Enroll right here to get it in your inbox each Wednesday.

CHART: MSTR’s premium to NAV

Supply: MSTR-Tracker.com, GSR

First, Technique takes on leverage by issuing fairness and debt to speculate the proceeds into bitcoin, incomes the distinction between the return on bitcoin and its price of capital (ie. “carry”). Importantly, Technique earns this carry not simply this yr, but in addition in future years as properly, and traders merely present-value this anticipated future carry and embrace it in MSTR’s market cap.

In reality, this can be a main motive why MSTR’s premium will fluctuate with market expectations of future bitcoin returns. However, the primary motive MSTR trades at a premium to its BTC holdings is that traders pull future BTC carry to the current.

Second, Technique monetizes clever capital markets issuance for the advantage of shareholders. It accretes worth through convertible debt issuance, the place it not solely will get paid to supply bitcoin-like returns to the bond market, but in addition for the volatility inherent in its inventory as convertible bond arbitrageurs make more cash with a extra risky underlying asset. As well as, MSTR points fairness, principally by means of at-the-money fairness issuance applications, at a premium to ebook worth, which is by definition accretive to shareholders. In reality, issuing fairness at twice ebook worth is tantamount to promoting $1 for $2, or conversely, shopping for BTC at 50% off. That is how Technique was in a position to generate a 74% improve within the quantity of its bitcoin held per share final yr, equal to 140,630 BTC, or $14 billion of worth for shareholders.

Lastly, all the assemble takes benefit of bitcoin and crypto’s nascency, the truth that cryptocurrencies are in secular growth and that bitcoin’s worth has tended to rise over time.

For these not but satisfied, we provide the next thought experiment: If I had a magic checking account with $100 USD in it that paid you a 69% rate of interest, how a lot cash would you pay me for that? Whereas the reply might fluctuate from individual to individual, it’s seemingly rather more than $100, which means that the checking account would commerce at a premium to its underlying USD (i.e. NAV).

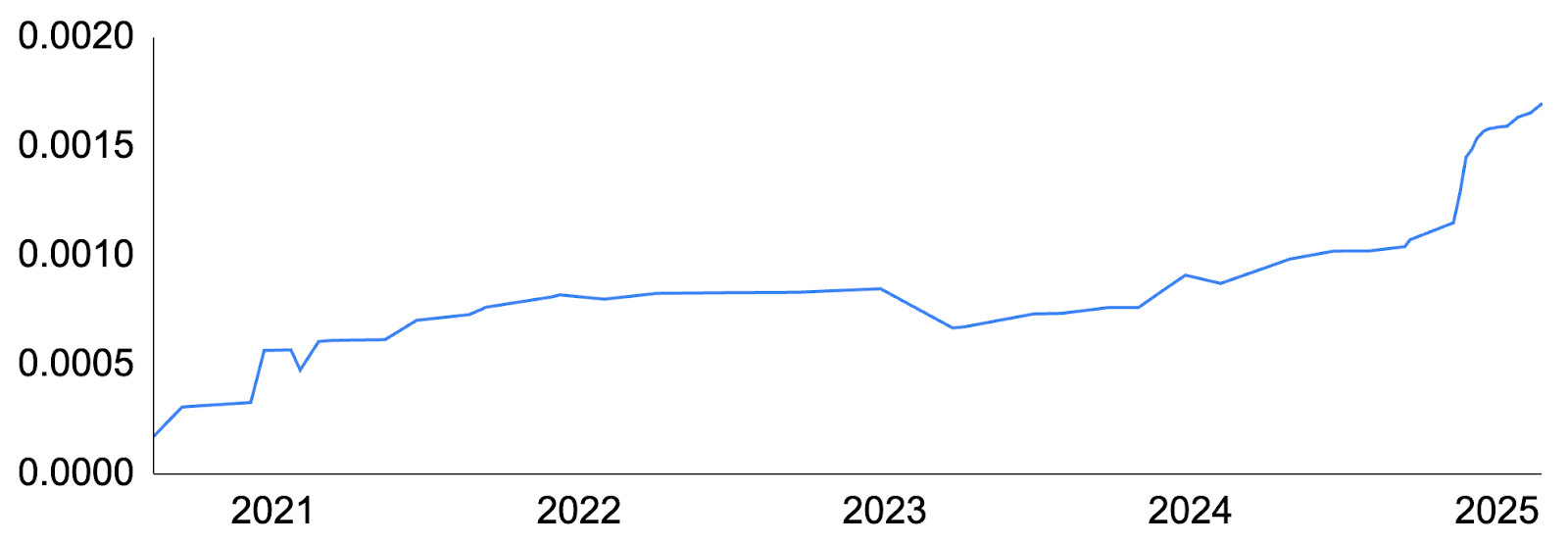

That is precisely what is occurring with MSTR, because it has elevated its BTC per share at a 69% annual price because it started investing in bitcoin in August 2020. This improve in BTC per share (i.e. in-kind yield) is greater throughout bull markets and decrease throughout bear markets, but it surely has usually risen over time. And whereas there isn’t any assure that Technique will proceed to extend its BTC per share sooner or later, MSTR is guiding for a 15%+ improve this yr and 6-10% in every of the next two years.

Dangers abound, in fact — MSTR traders tackle foundation threat to the worth of BTC and the inventory tends to maneuver greater than bitcoin in each instructions. Relatedly, the premium might transfer up or down sooner or later, and the inventory will seemingly commerce at a reduction (i.e., beneath the worth of its bitcoin holdings) throughout bear markets. However the premium exists as a result of traders consider MSTR will proceed to extend the quantity of its bitcoin per share sooner or later, and they’re prepared to pay up for that now.

CHART: MSTR’s improve in bitcoin per share (i.e. bitcoin yield)

Supply: MSTR-Tracker.com, GSR