Hyperliquid worth consolidates close to $45, backed by sturdy on-chain knowledge and rising consumer exercise, whereas quantity hints at a doable bullish reversal towards $53.

Abstract

- $45 acts as main confluence assist with Fibonacci, Bollinger Band, and POC alignment.

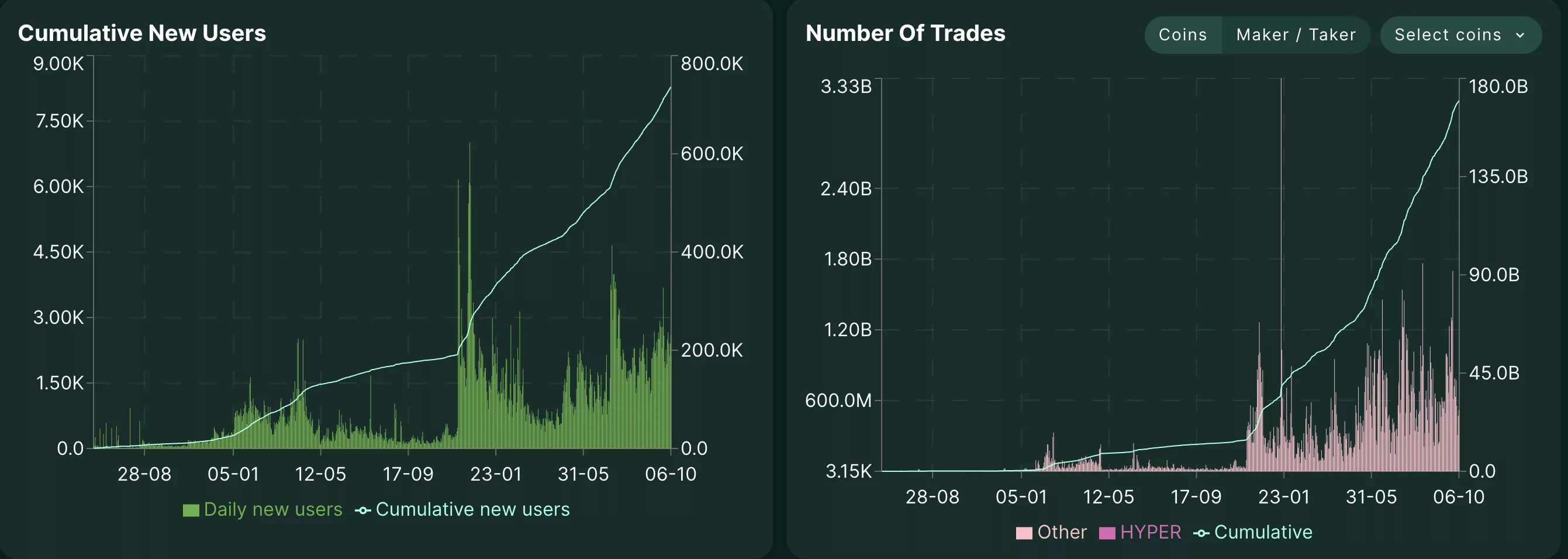

- On-chain metrics present rising cumulative customers and each day trades.

- Market construction stays bullish, concentrating on $53 resistance as the subsequent upside goal.

After a short correction from its latest highs, Hyperliquid worth (HYPE) is discovering strong footing on the $45 assist stage. This zone is strengthened by a number of key technical confluences, together with the purpose of management, the 0.618 Fibonacci retracement, and the decrease boundary of the Bollinger Bands.

The convergence of those indicators usually marks a area the place consumers step in, forming a possible basis for a reversal. On the identical time, on-chain metrics are displaying continued development in consumer exercise, additional strengthening the bullish outlook. Including to the optimism, Hyperliquid has launched its personal USDH stablecoin, a transfer that underscores confidence in its ecosystem and will additional enhance liquidity and community exercise.

Hyperliquid worth key technical factors

- Assist Zone: The $45 area aligns with the purpose of management, the 0.618 Fibonacci retracement, and the decrease Bollinger Band.

- On-Chain Progress: Cumulative new customers and whole each day trades on Hyperliquid proceed to extend.

- Bullish Construction: Market construction stays intact, with a possible larger low forming close to $45 to maintain the macro uptrend.

From a technical standpoint, the $45 assist area represents an space of excessive confluence and significance. The alignment of the 0.618 Fibonacci stage with the decrease Bollinger Band and POC means that this isn’t a random pause in worth motion, however moderately a managed pullback inside an ongoing uptrend. Traditionally, such confluence zones have acted as springboards for sturdy recoveries when quantity helps the transfer.

Worth motion at this stage will decide whether or not Hyperliquid can set up a brand new larger low, which might affirm the continuation of the broader bullish market construction. If worth begins to rotate upward from this zone, it will reaffirm the pattern of upper highs and better lows, signaling that the macro bullish projection stays legitimate.

Quantity knowledge helps this potential reversal. Current periods have recorded sturdy bullish inflows, suggesting energetic demand at lower cost ranges. Sustained shopping for strain is essential for validating the restoration transfer.

On-chain knowledge offers an extra layer of affirmation. Cumulative new consumer counts and each day commerce numbers are each trending larger, indicating increasing community utilization and elevated liquidity.

Such conduct is usually noticed throughout phases of accumulation or early-stage bullish reversals. The rise in consumer exercise displays rising curiosity within the ecosystem, aligning with the technical indicators pointing towards renewed upward motion.

What to anticipate within the coming worth motion

If Hyperliquid maintains assist round $45 and confirms the next low formation, a rotation towards the $53 resistance stage turns into more and more possible. A breakout above $53 would open the door for additional worth discovery, pushed by strengthening on-chain fundamentals and sustained buying and selling quantity.