The World Sample

In recent times the IMF has:

- Efficiently pressured El Salvador to (de facto) drop Bitcoin as authorized tender, and rollback different Bitcoin insurance policies

- Efficiently pressured CAR’s 2023 Bitcoin repeal by way of regional banking our bodies

- Been chargeable for the dearth of comply with by way of from Bitcoin marketing campaign rhetoric to motion from Milei in Argentina.

- Cited “severe issues” with Pakistan’s Bitcoin plans

- Constantly framed crypto as a “danger” in mortgage negotiations

Right here’s a abstract

| Nation | GDP ($ Billion) | IMF Mortgage ($ Billion) | IMF Mortgage as % of GDP | IMF response | Outcome |

| Argentina | 670 | 54.8 | 8.18% | sturdy | Bitcoin coverage deserted |

| Central African Republic | 2.56 | 0.272 | 2.31% | sturdy | Bitcoin coverage deserted |

| El Salvador 2.0 (post-2025) | 34.87 | 1.4 | 4.01% | sturdy | 5 Bitcoin legal guidelines deserted |

| Pakistan | 346.79 | 9.35 | 2.70% | sturdy | TBD |

| El Salvador 1.0 (2021-2024) | 34.87 | 0 | 0% | sturdy | Bitcoin maintained |

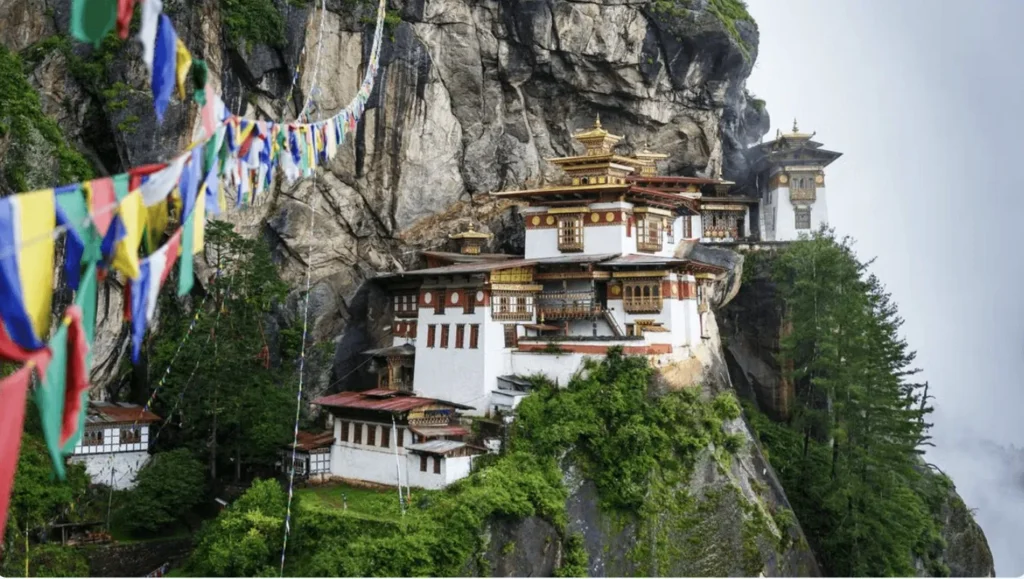

| Bhutan | 2.9 | 0 | 0% | gentle | Bitcoin maintained |

As we will see, the one nations that had been ready to withstand IMF stress had been El Salvador, previous to gaining an IMF mortgage, and Bhutan which doesn’t have an IMF mortgage.

Every nation with an IMF mortgage who has adopted, or tried to undertake Bitcoin at a nation-state degree has been efficiently thwarted, or largely thwarted by the IMF.

How is it that the IMF has been so profitable in stopping international nation state adoption, except Bhutan, and why do they aggressively transfer to forestall it?

On this detailed report we do a deep-dive into every of the three nations the place the IMF has efficiently pushed again towards Bitcoin adoption, and the indicators that it’s probably to achieve success reaching the identical end result with Pakistan.

Within the final part of this report, we have a look at the IMFs 5 causes to worry Bitcoin, and the way Bitcoin continues to be thriving from a grassroots degree regardless of top-down Bitcoin abandonment, or partial abandonment, by varied nation states.

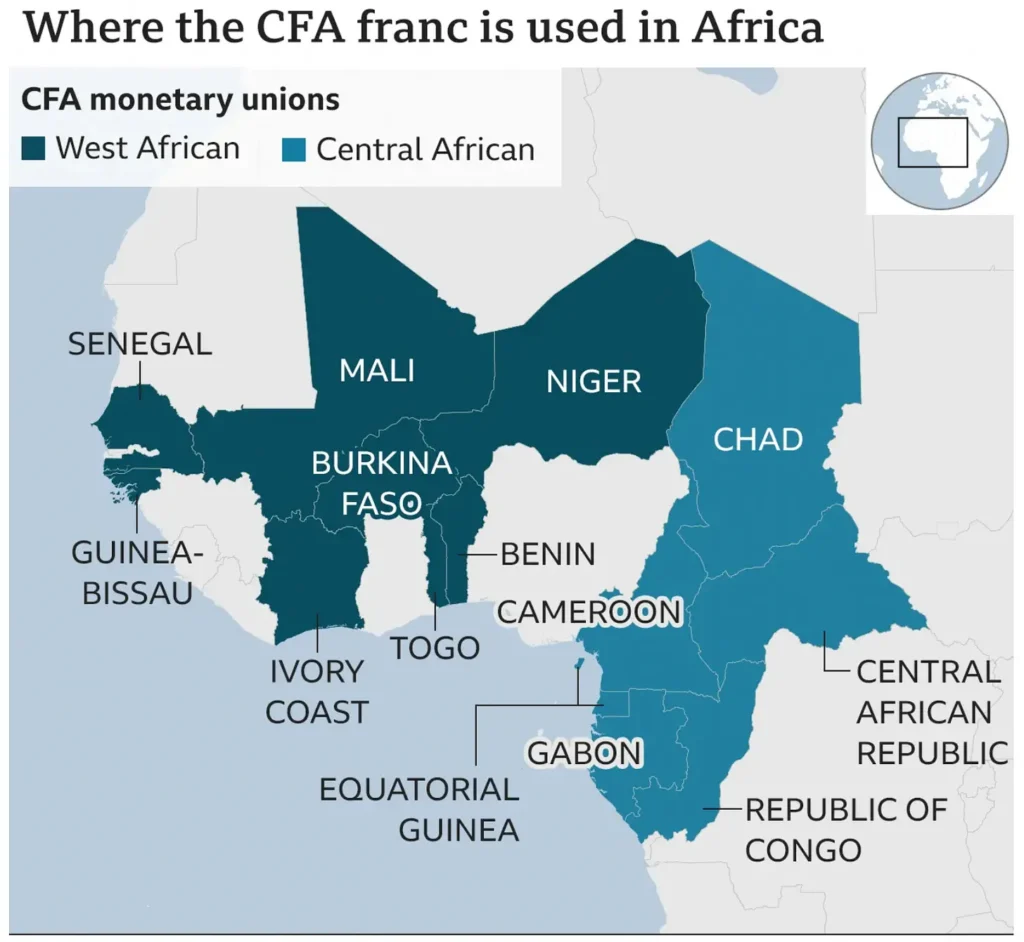

The Central African Republic (CAR) makes use of the CFA franc. The CFA isn’t simply forex—it’s a geopolitical chain, backed by France and ruled by the Financial institution of Central African States (BEAC). Of its 14 member nations, the 6 Central African nations (together with CAR) should nonetheless deposit 50% of international reserves in Paris.

This management over reserves fosters financial dependency, whereas establishing export markets for French items at favorable phrases. In 1994 for instance, the CFA was devalued by half, a coverage that was influenced by Western stress, notably from the IMF. This prompted the price of imports to leap, resulting in exporters (primarily EU primarily based) having the ability to procure sources from CFA nations at half the price. Regionally the impression was devastating, resulting in wage freezes, layoffs, and widespread social unrest throughout CFA nations.

When the Central African Republic (CAR) introduced in 2022 it was adopting Bitcoin as authorized tender, BEAC and its regulatory arm COBAC instantly voided the regulation, citing violations of the CEMAC Treaty; The treaty which established the financial and financial neighborhood of Central Africa. This wasn’t forms—it was a warning shot from the financial guardians of la Françafrique.

Why it mattered: To today, CAR’s economic system depends closely on IMF bailouts. With $1.7Billion in exterior debt (61% of GDP), defying BEAC meant risking monetary isolation.

The IMF’s Silent Marketing campaign

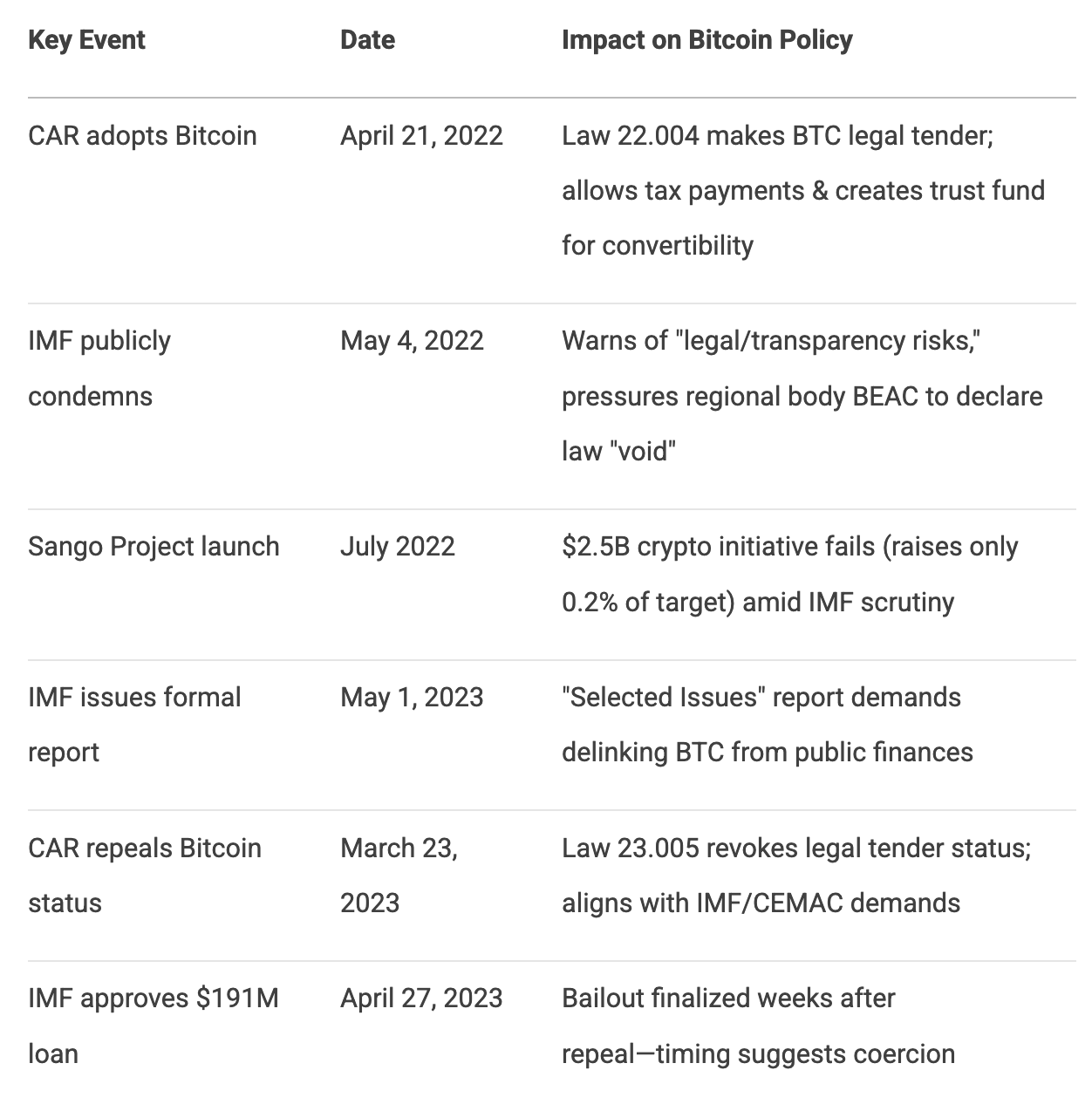

The IMF moved quick. Inside two weeks (Could 4, 2022), it publicly condemned CAR’s “dangerous experiment,” citing authorized contradictions with CEMAC’s crypto ban. The transfer raised “main authorized, transparency, and financial coverage challenges,” the IMF stated, that had been much like the issues the IMF raised about El Salvador’s Bitcoin adoption: dangers to monetary stability, client safety, and monetary liabilities. (For context, none of these dangers materialized in El Salvador).

However their actual weapon was leverage. As CAR’s largest creditor, the IMF tied its new Prolonged Credit score Facility (ECF)—a $191M lifeline—to coverage compliance.

The Timeline That Tells All

This desk traces the IMF’s shadow marketing campaign:

Key to scuttling CAR’s Bitcoin ambitions was making certain that the Sango challenge — a blockchain-hub initiative from the CAR authorities to promote “e-residency” and citizenship for $60K in Bitcoin — didn’t proceed.

The Sango Undertaking – coincidence or collusion?

In July 2022, CAR launched the Sango Undertaking. It aimed to boost $2.5B (100% of GDP).

It failed catastrophically. By January 2023, solely $2M (0.2% of goal) was raised. Whereas IMF studies cite “Technical obstacles with 10% web penetration” as the rationale for the failure, our evaluation reveals a distinct image. Two components scuttled the challenge.

- Investor flight

- A CAR Supreme Court docket ruling formally blocked the Sango challenge

Nevertheless, on nearer examination, each of those components trace at IMF involvement.

Let’s take a better have a look at the proof.

Investor Flight

The IMF’s position on this investor flight is circumstantial however compelling. On Could 4, 2022, the IMF expressed issues about CAR’s bitcoin adoption, stating it raised main authorized, transparency, and financial coverage challenges. This assertion, made earlier than the Sango Undertaking launch, highlighted dangers to monetary stability and regional financial integration, doubtlessly deterring buyers. Additional, in July 2022, throughout a workers go to for the Workers-Monitored Program (SMP) evaluate, the IMF famous “financial downturns attributable to rising meals and gasoline costs”, which may have compounded investor warning. Reviews additionally point out that the IMF and COBAC warned of inherent dangers in CAR’s crypto transfer, including to the skepticism.

The timing of those IMF statements aligns with the noticed investor flight, suggesting that their cautionary stance could have influenced perceptions. Whereas circumstantial, the sequence of occasions suggests IMF affect as a revered monetary establishment within the investor neighborhood probably performed a task in investor flight.

Supreme Court docket Ruling

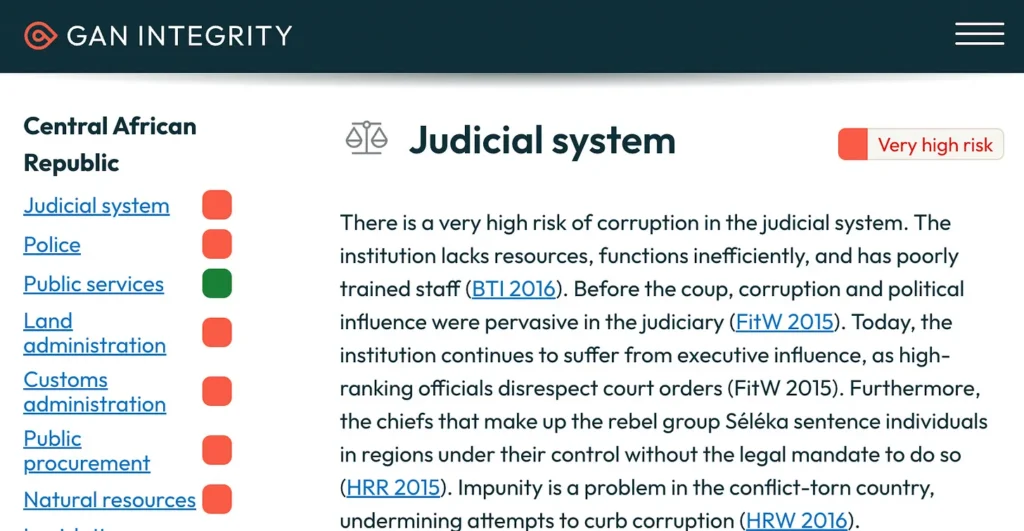

On the floor, the Supreme Court docket ruling appears to be like like an unbiased occasion, till we dig beneath the floor and discover large question-marks over the independence of CAR’s judiciary, a rustic that itself ranks 149/180 on its Corruption Notion Index (extraordinarily low).

As talked about, one week after CAR introduced its Bitcoin technique, the IMF reported “issues”, together with dangers to monetary stability, transparency, anti-money laundering efforts, and challenges in managing macroeconomic insurance policies because of the volatility. (Bloomberg, 4 Could, 2022)

On 29 Aug 2022, 117 days later, the Supreme Court docket of CAR dominated that the Sango challenge was unlawful. For context, the Supreme Court docket which types a part of CAR’s judiciary is described by worldwide transparency our bodies akin to Gan Integrity as one of the vital corrupt establishments within the nation, with proof pointing to inefficiency, political interference, and certain affect from bribes or political stress.

The Sango challenge’s collapse turned the IMF’s Exhibit A: “Proof Bitcoin can’t work in fragile economies.” However the actuality was, the IMF’s constant expression of “issues” created the setting the place the challenge was structurally undermined prematurely, in order that this conclusion turned attainable.

5,200 miles away, within the small nation of Bhutan we see the stark distinction of the profitable Bitcoin rollout that was attainable with out IMF’s “involvement”.

The Unstated Conclusion: Bitcoin’s Resilience Past Borders

CAR’s reversal wasn’t about Bitcoin’s viability. It was about uncooked energy. The IMF weaponized regional banking unions (CEMAC), starved CAR of capital, and leveraged a $191M mortgage to extinguish the specter of monetary sovereignty. When the Sango Undertaking struggled—the entice snapped shut.

But this defeat reveals Bitcoin’s enduring energy. Discover what the IMF didn’t destroy:

The sample is obvious: The place grassroots adoption takes root—Bitcoin survives. However for nations asserting top-down Bitcoin manifestos who’ve giant IMF loans, all 4 have met with crushing ranges of resistance: El Salvador, CAR, Argentina and now Pakistan.

CAR’s excellent $115.1 million IMF mortgage stability made it weak to heavy IMF stress. In nations with out IMF loans akin to Bhutan, Bitcoin slips by way of the IMF’s grip. Each peer-to-peer fee, each Lightning transaction, erodes the previous system’s foundations.

The IMF gained the CAR spherical. However the international struggle for monetary sovereignty is simply starting.

If CAR was thwarted in its Bitcoin plans, Argentina by no means made it to the beginning line. Precampaign rhetoric from President Milei prompt large issues had been in retailer for Bitcoin. But nothing materialized. Was this only a politician’s rhetoric petering out post-election, or was one thing else at play? This part pulls again the lid on what actually occurred to Argentina’s aborted Bitcoin aspirations.

Understanding how Bitcoin adoption goes, is like assessing whether or not a rocket goes to achieve escape velocity: we should have a look at each the thrust and drag components.

My intention is that this article is the place the place we will objectively assess not solely the optimistic top-down and grass-roots adoption tales (thrust), but additionally the sturdy oppositional forces to adoption (drag) that seldom get mentioned, not to mention analyzed both on Bitcoin Twitter, or at Bitcoin conferences. One main drag has been environmental FUD, however there may be an arguably even greater one: main establishments that may use their current debt-entrapment of countries as leverage to forestall Bitcoin adoption.

I’m an optimist: I imagine Bitcoin will win: it’s so clearly a greater answer to the damaged cash legacy system we at present have. However I’m additionally a realist: I feel most individuals underestimate the power of entrenched forces which oppose Bitcoin.

Once I was operating my tech firm, we encountered the identical factor. Our expertise was 10x higher, quicker and more economical than the legacy system we ultimately changed. However they didn’t relinquish their incumbent monopoly simply!

What occurred in Argentina?

When libertarian Javier Milei was elected Argentina’s president in November 2023, many Bitcoin advocates cheered. Right here was a frontrunner who known as central bankers “scammers,” vowed to abolish Argentina’s central financial institution (BCRA), and praised Bitcoin as “the pure response towards Central Financial institution scammers.” The case turned a litmus take a look at for whether or not Bitcoin may acquire mainstream acceptance by way of authorities adoption relatively than grassroots development.

Supply: Coinsprout. 14 Aug 2023

But eighteen months into his presidency, Milei’s Bitcoin imaginative and prescient stays unfulfilled. The rationale? A $45 billion leash held by the Worldwide Financial Fund.

The IMF’s Bitcoin Veto in Argentina

The constraints had already been put in place by the point of Milei’s election. On 3 March, 2022, Argentina’s earlier authorities signed a $45 billion IMF bailout settlement. Within the weeks following, particulars emerged that the settlement had contained an uncommon clause: a requirement to “discourage cryptocurrency use.” This wasn’t a suggestion—it was a mortgage situation documented within the IMF’s Letter of Intent, citing issues about “monetary disintermediation.”

The speedy impact:

- Argentina’s central financial institution banned monetary establishments from crypto transactions (BCRA Communication A 7506, Could 2022)

- The coverage stays enforced beneath Milei, regardless of his pro-Bitcoin rhetoric

Milei’s Pivot

After taking workplace, Milei:

Slashed inflation from 25% month-to-month to beneath 5% (Could 2024)

Lifted forex controls (April 2025)

Secured a brand new $20 billion IMF deal (April 2025)

However his manifesto’s flagship proposals—Bitcoin adoption and abolition of BCRA (Argentina’s Central Financial institution) — are conspicuously absent. The maths explains why: Argentina owes the IMF greater than every other nation, giving the Fund unparalleled leverage.

But there’s irony in Argentina’s case: whereas the IMF blocks official Bitcoin adoption, Argentinians are embracing Bitcoin anyway. Cryptocurrency possession grew by 116.5% between 2023-2024 in South America.

Throughout the area, Argentina has the very best possession charges, at 18.9%, a determine virtually 3 instances the worldwide common, and which has surged as residents hedge towards excessive annual inflation of 47.3% (April 2025) — a quiet insurrection the IMF can’t management.

.

What Comes Subsequent?

All eyes are on the October 2025 mid-term elections. If Milei good points legislative help, he could take a look at the IMF’s crimson traces. However for now, the lesson is obvious: when nations borrow from the IMF, their financial sovereignty comes with strings hooked up.

Key Takeaways

- The IMF’s 2022 mortgage explicitly tied Argentina’s bailout to anti-crypto insurance policies

- Milei has prioritized financial stabilization over Bitcoin advocacy, to take care of IMF help

- Parallels exist in El Salvador, CAR and now Pakistan revealing a constant IMF playbook

- Argentinians are circumventing restrictions by way of grassroots Bitcoin adoption

When El Salvador made Bitcoin authorized tender in 2021, it wasn’t simply adopting a cryptocurrency—it was declaring monetary independence. President Nayib Bukele framed it as a insurrection towards greenback dominance and a lifeline for the unbanked. Three years later, that insurrection hit a $1.4 billion roadblock: the IMF.

The Value of the Bailout

To safe its 2024 mortgage, El Salvador agreed to dismantle key pillars of its Bitcoin coverage. The circumstances reveal a scientific unwinding:

- Voluntary Acceptance Solely

Companies are not required to simply accept Bitcoin (2021 mandate repealed). supply - Public Sector Ban

Authorities entities prohibited from Bitcoin transactions or debt issuance. This contains bans on tokenized devices tied to Bitcoin. supply - Bitcoin Accumulation Freeze

All authorities purchases halted (6,000+ BTC reserve now frozen)

Full audit of holdings (Chivo pockets, Bitcoin Workplace) by March 2025. supply - Belief Fund Liquidation

Fidebitcoin (conversion fund) to be dissolved with audited transparency. supply - Chivo Pockets Phaseout

The $30 incentive program winds down after surveys confirmed most customers traded BTC for USD. supply - Tax Cost Rollback

USD turns into the only real choice for taxes, eliminating Bitcoin’s utility as sovereign fee. supply

Bukele’s Calculated Retreat

El Salvador’s compliance makes fiscal sense:

- The mortgage stabilizes debt (84% of GDP) as bond funds loom

- Dollarization stays intact (USD nonetheless major forex)

But the backtrack is putting given Bukele’s 2021 rhetoric. The Chivo pockets’s low uptake probably made concessions simpler.

What’s Left of the Experiment?

The IMF hasn’t killed Bitcoin in El Salvador—simply official adoption. Grassroots use persists:

- Bitcoin Seaside (native round economic system) nonetheless operates, the truth is thrives

- Tourism attracts growing numbers of Bitcoin lovers

However with out state help, Bitcoin’s position doubtlessly shrinks to a distinct segment instrument relatively than a financial revolution, at the least within the brief time period.

The Street Forward

Two eventualities emerge:

- Gradual Fade: Bitcoin turns into a vacationer curiosity as IMF circumstances take full impact

- Shadow Revival: Non-public sector retains it alive regardless of authorities retreat

One factor’s clear: when the IMF writes the checks, it additionally writes the foundations.

Key Takeaways

- IMF mortgage compelled El Salvador to reverse 6 key Bitcoin insurance policies

- Precedent set for different nations looking for IMF help

- Grassroots Bitcoin use could outlast authorities involvement

El Salvador made a number of Bitcoin concessions. Whereas arguably this doesn’t damage El Salvador a lot, it sends a powerful message to different LATAM nations akin to Ecuador and Guatemala who had been watching El Salvador and considering of copying their playbook (till they checked the scale of the IMF mortgage that they had). So on web stability it was a partial IMF win, a partial El Salvador win.

We at the moment are 2 years into Bhutan’s Bitcoin experiment.

Meaning we now have some good information on the way it has affected the economic system.

The IMF warned that nations embracing Bitcoin would destabilize their economic system, be much less efficient at attracting international direct funding, and endanger their decarbonizing and environmental initiatives. It particularly voiced issues over Bhutan’s “lack of transparency” with crypto-adoption.

What does the information say?

1. The bitcoin reserves have immediately addressed urgent fiscal wants. “In June 2023, Bhutan allotted $72 million from its holdings to finance a 50% wage improve for civil servants”

2. Bhutan was capable of “use Bitcoin reserves to avert a disaster as international forex reserves dwindled to $689 million”

3. Prime Minister Tshering Tobgay in an interview stated that bitcoin additionally “helps free healthcare and environmental initiatives”

4. Tobgay additionally stated their Bitcoin reserves helped in “stabilizing [the nation’s] $3.5 billion economic system”

5. Impartial analysts have now stated that “this mannequin may appeal to international funding, notably for nations with untapped renewable sources”

Contemplating how the IMF evaluation was not simply improper, however roughly 180° off beam, it begs the query, had been the IMF’s predictions ever primarily based on information?

“Get all your pals, libertarians, democrats, republicans, get everybody to purchase Bitcoin – after which it turns into democratized.” inspired John Perkins ~ Bitcoin 2025

What if the IMF’s biggest worry isn’t inflation… however Bitcoin, and might Bitcoin Break the IMF/World Financial institution Debt Grip?

Throughout my latest dialog with John Perkins (Confessions of an Financial Hit Man), one thing clicked. Alex Gladstein beforehand and brutally uncovered how IMF “structural changes” didn’t eradicate poverty, however the truth is enriched creditor nations. Perkins layered this along with his personal first-hand accounts.

Perkins laid naked to me how the World South is trapped in a cycle of debt—one designed to maintain wealth flowing West. However right here’s the twist: Bitcoin is already dismantling the playbook in 5 key methods.

1. Lowering Remittance Prices to Loosen the Debt Noose

Chris Collins’ Sculpture symbolically captures the debt noose

Remittances—cash despatched house by migrant staff—typically make up a major a part of growing nations’ GDP. Conventional intermediaries akin to Western Union cost charges as excessive as 5–10%. This acts as a hidden tax that drains international reserves. For nations like El Salvador or Nigeria, each remittance greenback that doesn’t move into the nation is a greenback their central financial institution should retailer to stabilize their currencies. Usually this retailer of US {dollars} is offered by the IMF.

1. Bitcoin Adjustments the Sport

With Lightning, charges drop to virtually zero, and transactions settle in seconds. In 2021, El Salvador’s president Bukele optimistically predicted that bitcoin may save $400 Million in remittance funds. The truth has been there’s little proof remittance funds utilizing bitcoin have reached wherever close to that threshold. Nevertheless the potential is obvious: extra remittances in bitcoin results in larger greenback reserves, which results in much less want for IMF loans.

Little marvel the IMF talked about Bitcoin 221 instances of their 2025 mortgage circumstances for El Salvador. They’d like to stay a related lender.

Bitcoin isn’t simply cheaper for remittances—it bypasses the greenback system totally. In Nigeria, the place the naira struggles, households now maintain BTC as a tougher asset than native forex. No want for central banks to burn by way of greenback reserves. No determined IMF bailouts.

The numbers converse for themselves:

• Pakistan loses $1.8 billion yearly on remittance charges—Bitcoin may save most of that

• El Salvador already saves $4M+ yearly with simply 1.1% Bitcoin remittance adoption

Adoption isn’t common but—solely 12% of Salvadorans use Bitcoin repeatedly, whereas over 5% of Nigeria’s remittances move by way of crypto. However the development is obvious: each Bitcoin switch weakens the debt dependency cycle.

The IMF sees the menace. The query is: how briskly will this silent revolution unfold?”

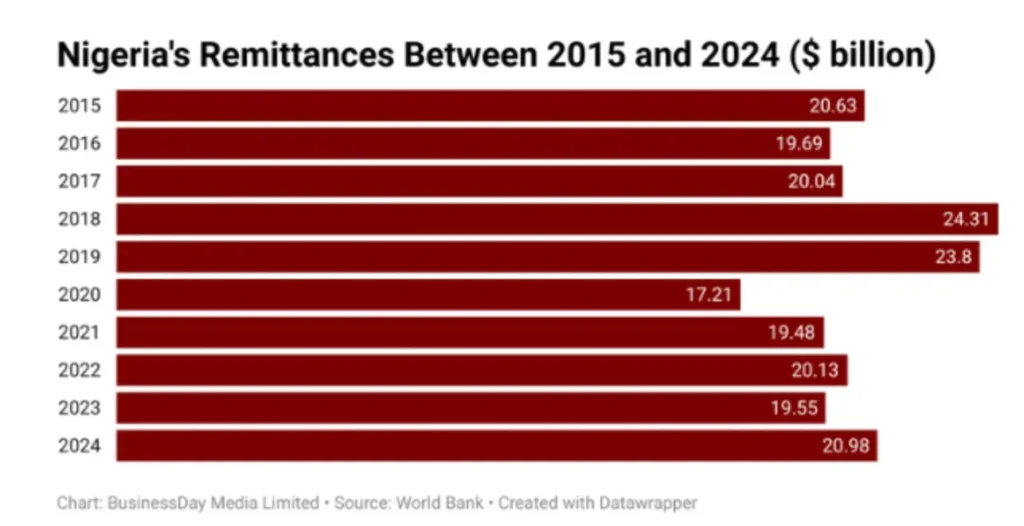

Remittances totaled virtually $21 billion in 2024, representing over 4% of Nigeria’s GDP

2. Evading Sanctions and Commerce Limitations

Oil-rich Iran, Venezuela and Russia have had restricted USD entry attributable to US sanctions in 1979, 2017 and 2022 respectively, ensuing within the export of vastly fewer barrels per day of oil in every case.

Whether or not we agree with the ideologies of those nations or not, Bitcoin breaks this cycle. Iran already evades sanctions by utilizing Bitcoin as a solution to successfully “export oil”, whereas Venezuela has used Bitcoin to pay for imports, evading sanctions.

Iran can also be capable of bypass sanctions by monetizing its vitality exports by way of mining. This avoids the IMF’s “reform-for-cash” ultimatums whereas conserving economies operating.

The petrodollar’s grip weakens as Russia and Iran pioneer Bitcoin oil offers.

One other nation that has used Bitcoin to keep away from the financial hardship brought on by sanctions is Afghanistan, the place humanitarian support flows by way of utilizing Bitcoin. NGOs like Code to Encourage bypassed Taliban banking freezes, and Digital Citizen Fund have used Bitcoin to ship support post-Taliban takeover, stopping households from ravenous.

Afghanistan’s “Code to Encourage” NGO makes use of Bitcoin donations, which can’t be intercepted by the Taliban, to coach ladies to put in writing software program.

Although Bitcoin’s share of sanctioned commerce is small—beneath 2% for Iran and Venezuela’s oil exports—the development is rising.

Sanctions are a crucial instrument for geopolitical leverage, typically supported by the IMF and World Financial institution by way of their alignment with main economies just like the U.S. Sanctioned nations utilizing Bitcoin reduces IMF management over monetary flows whereas concurrently threatening U.S. greenback dominance.

3. Utilizing Bitcoin as a Nation State Inflation Defend

When nations like Argentina face hyperinflation, they borrow USD from the IMF to bolster forex reserves and stabilize their forex, solely to face austerity or the enforced sale of strategic property at a low value when repayments falter. Bitcoin gives a means out by appearing as a world, non-inflatable forex that operates independently of presidency oversight, and which appreciates in worth.

El Salvador’s experiment reveals how Bitcoin can scale back greenback dependency. By holding BTC, nations can hedge towards forex collapse with out IMF loans. If Argentina had allotted simply 1% of its reserves to Bitcoin in 2018, it may’ve offset the peso’s 90%+ devaluation that yr, sidestepping an IMF bailout. Bitcoin’s neutrality additionally means no single entity can impose circumstances, not like IMF loans that demand privatization or unpopular reforms.

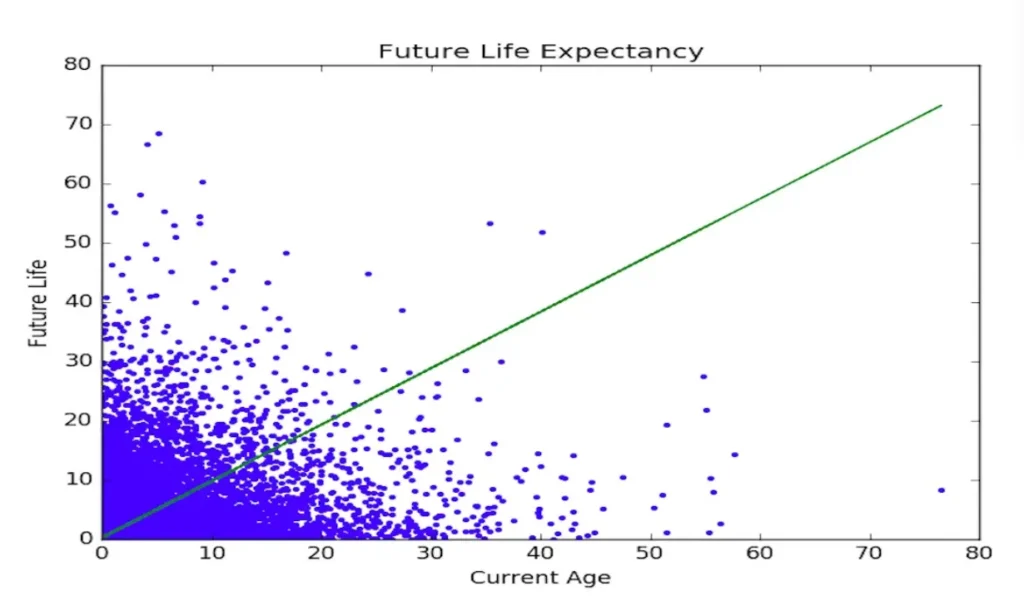

Bitcoin doesn’t have debt-leverage or a protracted historical past of the IMF to attract on when encouraging adoption. Nevertheless, because of the Lindy Impact (see chart beneath), every passing yr Bitcoin turns into a extra viable various.

Lindy Impact: The longer one thing has been profitable, the extra probably it’s to proceed being profitable. Bitcoin’s longevity strengthens its potential to disrupt

4. Bitcoin Mining: Turning Vitality into Debt-Free Wealth

Many growing nations are energy-rich however debt-poor, trapped by IMF loans for infrastructure like dams or energy vegetation. These loans demand low cost vitality exports or useful resource concessions when defaults hit. Bitcoin mining flips this script by turning stranded vitality—like flared gasoline or overflow hydro—into liquid wealth with out middlemen or transport prices.

Paraguay’s incomes $50 million yearly from hydro-powered mining, masking 5% of its commerce deficit. Ethiopia made $55 million in 10 months. Bhutan’s the standout: with 1.1 billion in Bitcoin (36% of its $3.02 billion GDP), its hydro-powered mining may produce $1.25 billion yearly by mid-2025, servicing its $403 million World Financial institution and $527 million ADB money owed with out austerity or privatization. In contrast to IMF loans, mined Bitcoin appreciates in worth and can be utilized as collateral for non-IMF borrowing. This mannequin—monetizing vitality with out surrendering property—scares the IMF, because it cuts their leverage over the vitality sector.

Bhutan’s Prime Minister, Tshering Tobgay, calls Bitcoin a “strategic selection to forestall mind drain”

5. Grassroots Bitcoin Economies: Energy from the Floor Up

Bitcoin isn’t just for nations—it’s for communities. In locations like El Salvador’s Bitcoin Seaside or South Africa’s Bitcoin Ekasi, locals already use BTC for each day transactions, financial savings, and neighborhood initiatives like faculties or clinics. These round economies, typically sparked by philanthropy, intention for self-sufficiency. In Argentina, the place inflation typically tops 100%, 21% of individuals used crypto by 2021 to guard wealth. If scaled up, these fashions may scale back reliance on nationwide debt-funded packages, which is in fact the very last thing the IMF need.

Hermann Vivier, founding father of Bitcoin Ekasi, says his neighborhood was impressed by El Salvador’s Bitcoin Seaside to duplicate their Bitcoin round economic system in S.Africa

Conclusion

By fostering native resilience, Bitcoin undermines the IMF’s “disaster leverage”. Thriving communities don’t want bailouts, so the IMF can’t demand privatization in change for loans. In Africa, initiatives like Gridless Vitality’s – which has already introduced 28,000 rural Africans out of vitality poverty utilizing renewable microgrids tied to Bitcoin mining – minimize the necessity for IMF-backed mega-projects. If hundreds of cities undertake this, greenback shortages would matter much less, and commerce may bypass USD methods.

Whereas the IMF sometimes engages in spreading misinformation about Bitcoin vitality consumption and environmental impression as a solution to impede adoption, its most well-liked and way more highly effective instrument is just to make use of the monetary leverage it has over IMF-indebted nations to “strongly encourage” compliance with its Bitcoinless imaginative and prescient of the longer term.

The IMF fought Bitcoin adoption in El Salvador, CAR, and Argentina. Now they’re preventing Pakistan’s intention to mine Bitcoin as a Nation State. Scaling these grassroots efforts is more likely to pressure the IMF’s hand to crack down increasingly more transparently.

Above: Kids from South Africa’s poorest villages be taught to surf through the Bitcoin Ekasi township challenge

Grassroots Bitcoin economies empower communities to thrive with out IMF bailouts. And other people-power is required to search out new modern methods to beat the IMF’s counterpunch.

It is a visitor publish by Daniel Batten. Opinions expressed are totally their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.