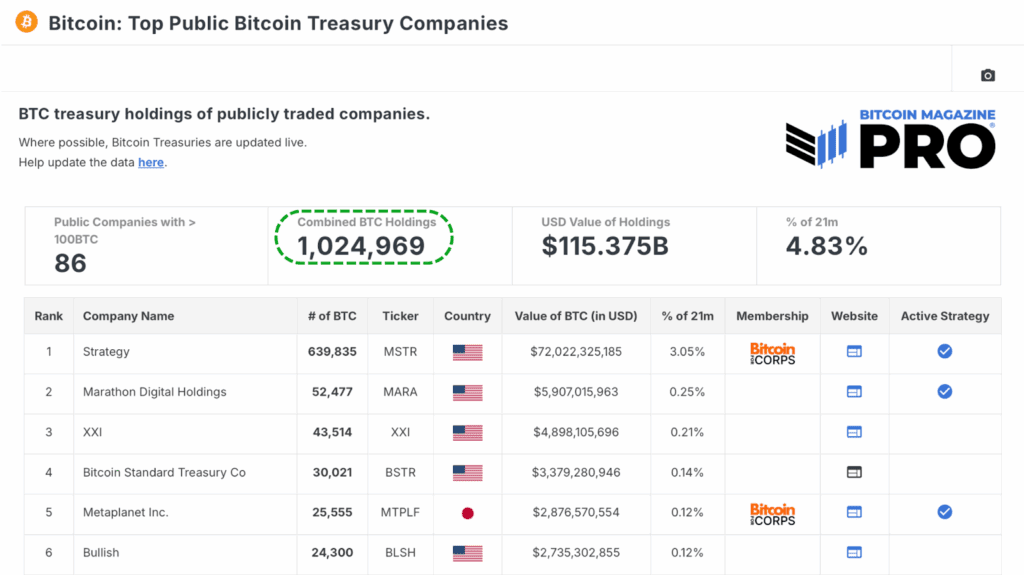

Bitcoin treasury firms have change into probably the most essential demand drivers on this cycle. Collectively, 86 publicly traded corporations now maintain greater than 1 million BTC on their steadiness sheets. What started with MSTR (Technique) in 2020 has since unfold throughout the company panorama, with new entrants becoming a member of seemingly each week. However a better take a look at their buy historical past reveals a stunning perception that many of those firms may very well be holding significantly extra Bitcoin at this time if they’d adopted a easy, rules-based technique for accumulation.

MSTR Leads the Present State of Bitcoin Treasury Holdings

MSTR (Technique) stays the clear chief amongst company Bitcoin holders, with virtually 640,000 BTC. Throughout all Prime Public Bitcoin Treasury Firms, over 1 million BTC is now successfully locked away, a dynamic that completely reduces liquid provide and strengthens Bitcoin’s financial premium (assuming, in fact, they by no means promote!) Whereas this has been an enormous internet constructive for Bitcoin’s supply-demand economics, the information reveals that a big share of those purchases occurred throughout overheated market situations, significantly at native peaks.

MSTR’s Instance: Shopping for the Prime in Bitcoin Cycles

Take MSTR’s (Technique) exercise for example. The corporate made a few of its heaviest allocations throughout late 2024, as Bitcoin surged above $70,000 following ETF approvals. This was removed from distinctive, because the broader treasury sector confirmed the identical sample of front-loading purchases throughout euphoric phases.

Whereas comprehensible (capital is best to boost when costs are rising and sentiment is excessive), the result’s that treasury firms are sometimes overpaying. In reality, backtesting reveals that ready for even modest pullbacks may have saved corporations 10–30% on common in comparison with their precise entry costs. In fact, no person has a crystal ball to foretell value motion, however on the very least, not shopping for instantly after triple-digit share positive factors in a number of weeks would most likely assist!

A Easy MVRV Knowledge-Pushed Repair for MSTR and Treasuries

One easy adjustment may have made an enormous distinction: utilizing the MVRV Ratio as a filter. This strategy just isn’t advanced. It doesn’t try and time precise bottoms, nor does it depend on subjective judgment. As a substitute, it makes use of a rolling MVRV percentile threshold to keep away from allocating throughout probably the most overheated phases of bull markets.

By avoiding purchases when the MVRV ratio was in its high 20% of historic readings (a proxy for overvaluation) and easily deploying that capital throughout cooler durations, MSTR (Technique) alone can be holding virtually 685,000 BTC at this time, practically 50,000 BTC greater than it at the moment owns.

At present costs, that’s over $5 billion in further Bitcoin. To place that in perspective, the “missed” Bitcoin is roughly equal to the mixed lifetime holdings of the opposite Energetic Bitcoin Treasury Firms (besides Marathon Digital).

Related frameworks have been examined on different markets equivalent to altcoins, equities, and even the S&P 500, they usually persistently outperform blind dollar-cost averaging. Strategic dollar-cost averaging beats emotional dollar-cost averaging just about no matter market situations.

Implications for MSTR, Treasuries, and Particular person Buyers

For treasury firms, implementing this mannequin may imply billions in further worth over time. For particular person traders, the identical precept applies of merely avoiding chasing rallies throughout euphoric phases, and as a substitute let the market come to you.

In fact, we should acknowledge the nuances. Companies face constraints in elevating capital, executing giant block trades with out slippage, and managing shareholder expectations. However even inside these limits, a easy data-driven filter may materially enhance outcomes.

Conclusion: MSTR’s Path to Smarter Bitcoin Accumulation

Bitcoin treasury firms have been an unlimited internet constructive for the community. Their mixed 1 million BTC holdings cut back provide, enhance the cash multiplier impact, and spotlight the rising institutional adoption of Bitcoin. However the knowledge reveals that almost all of them may virtually definitely be doing higher. A easy technique of avoiding purchases throughout overheated situations would have netted MSTR (Technique) alone an additional 50,000 BTC, value greater than $5 billion at this time.

For each companies and people, the message is identical: self-discipline outperforms FOMO. Treasury accumulation has reshaped Bitcoin’s provide panorama, however the subsequent evolution could also be smarter accumulation methods that maximize returns and restrict the markets draw back volatility with out rising danger.

For a extra in-depth look into this matter, watch our most up-to-date YouTube video right here:

This Easy Bitcoin Technique Would Have Made Them Billions

For deeper knowledge, charts, {and professional} insights into bitcoin value developments, go to BitcoinMagazinePro.com.

Subscribe to Bitcoin Journal Professional on YouTube for extra professional market insights and evaluation!

Disclaimer: This text is for informational functions solely and shouldn’t be thought-about monetary recommendation. All the time do your personal analysis earlier than making any funding selections.