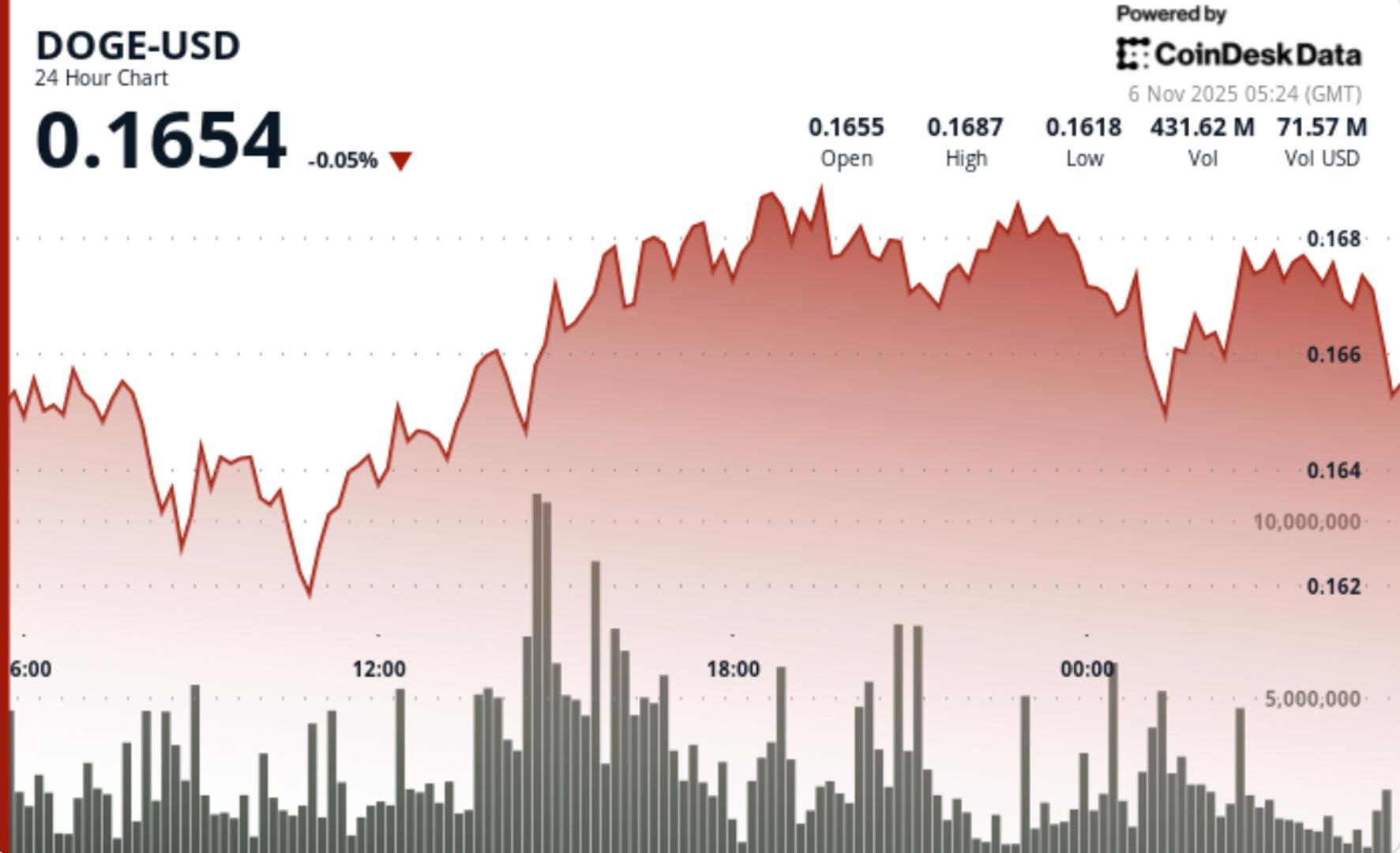

Dogecoin edged 0.5% decrease to $0.1657 in Wednesday’s session as institutional flows rotated close to resistance following a 104% quantity spike above every day averages. The token defended its ascending channel construction regardless of distribution stress on the higher boundary, protecting short-term bias neutral-to-bullish above $0.16.

Information Background

- Institutional positioning continued to outline DOGE’s intraday construction. Massive-cap holders accrued close to $0.1620 early within the week, then trimmed publicity as bids thinned close to $0.1670.

- The Tuesday breakout try on 774M quantity marked the session’s pivot — confirming that smart-money participation, not retail noise, drove the transfer.

- Broader sentiment throughout the meme-coin advanced remained muted, although spinoff open curiosity in DOGE futures climbed modestly on Binance and Bybit, hinting at speculative hedging fairly than outright risk-taking.

- Analysts mentioned the pair’s resilience above $0.16 mirrored disciplined revenue rotation fairly than development exhaustion.

Worth Motion Abstract

• DOGE superior from $0.1646 to $0.1665 earlier than gentle pullback to $0.1657

• Assist held at $0.1617–$0.1620 throughout 4 consecutive hourly checks

• Quantity concentrated at $0.1665 highs (8.9M throughout 02:10–02:11) exhibiting institutional distribution

• Channel construction stays constructive with greater lows, suggesting potential for renewed breakout makes an attempt above $0.16.

Technical Evaluation

• Development: Sideways-to-bullish inside ascending channel

• Assist: $0.1620 major; $0.1617 secondary buffer

• Resistance: $0.1665–$0.1670 zone repeatedly rejected on excessive quantity

• Quantity: 774M turnover (+104% vs SMA) confirms institutional participation

• Construction: Channel intact, volatility 4.2% — compression part previous subsequent directional transfer.

What Merchants Are Watching

• Potential of bulls to defend $0.1620 on declining quantity — key for construction integrity

• Breakout affirmation above $0.1670 for continuation towards $0.17–$0.175

• Any intraday closes under $0.1615 signaling structural failure and draw back enlargement

• Cross-asset circulate from BTC or SOL rotations as broader market gauges urge for food for danger