Bitcoin is now holding floor across the $90K degree because the market transitions into a brand new and unsure part. Sentiment is sharply divided: some analysts argue that the breakdown beneath $100K marks the start of a brand new bear market, whereas others consider Bitcoin is setting the stage to interrupt its conventional four-year cycle and rally more durable than ever within the months forward. This stress displays a market struggling to cost in concern, macro stress, and structural shifts in liquidity.

Associated Studying

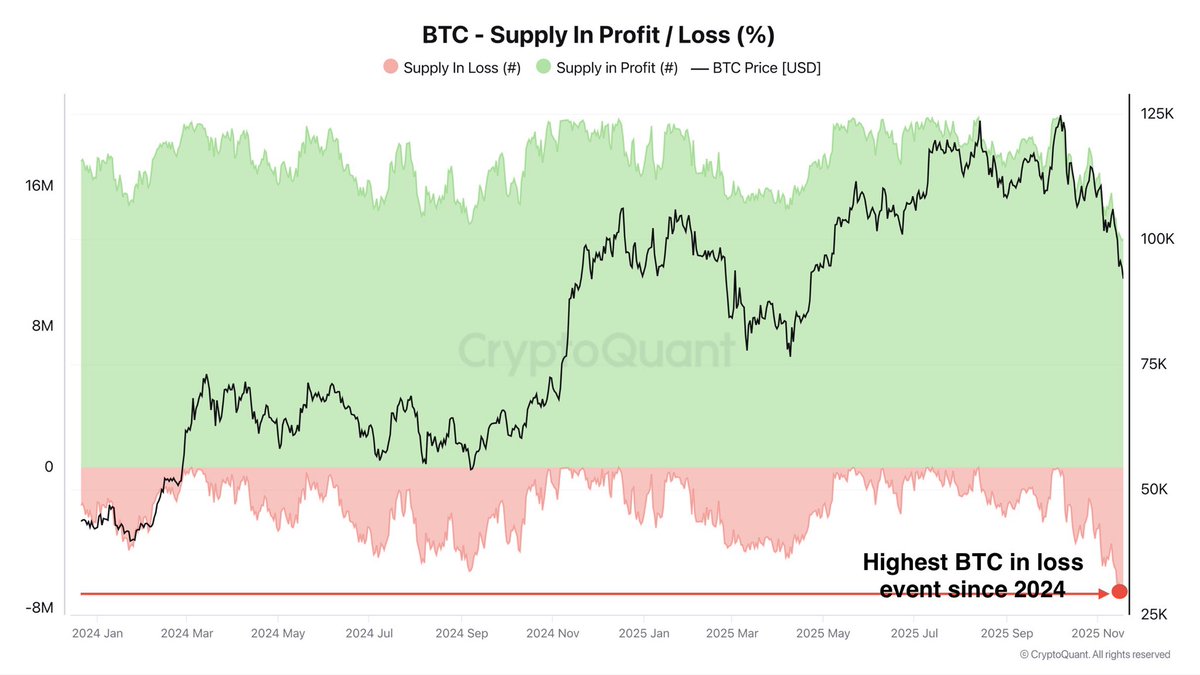

In accordance with new knowledge shared by prime analyst Darkfost, greater than 6.96 million BTC accrued by traders at the moment are sitting at an unrealized loss. This marks the best degree of unrealized loss since January 2024, regardless that the present correction has not but surpassed the steepest drawdown seen earlier within the cycle. The implication is obvious: an enormous portion of provide was accrued close to Bitcoin’s earlier all-time highs, making current promoting stress particularly emotional and reactive.

Regardless of this, Bitcoin continues to defend the $90K area — an indication that demand is absorbing excessive stress. Whether or not this marks the early stage of a bear market or the ultimate flush earlier than a significant rebound stays the central query dominating the market.

Rising Unrealized Losses Sign a Basic “Change of Fingers” Part

Darkfost explains that the spike in unrealized losses displays a easy however crucial actuality: an enormous quantity of Bitcoin was accrued close to the earlier all-time highs, that means many current patrons at the moment are underwater. That is very true for short-term holders (STHs), who are inclined to react shortly to volatility. Their elevated value foundation — clustered close to cycle tops — makes them extra weak to panic promoting, which is strictly what the market is witnessing as BTC hovers close to $90K.

This phenomenon helps clarify the extreme promoting stress seen in current days. STHs, pushed by concern and deteriorating sentiment, have been sending cash to exchanges at a loss, amplifying short-term volatility. However Darkfost notes an necessary historic sample: throughout bullish market buildings, rising unrealized losses have constantly produced sturdy shopping for alternatives.

Associated Studying

These phases usually mark the transition the place weak fingers capitulate and long-term, conviction-driven patrons soak up provide. That is the defining second of the “change of fingers” narrative — the place Bitcoin shifts from emotionally pushed individuals to strategic holders who form the following main transfer.

BTC Worth Evaluation: Testing Main Help as Momentum Weakens

Bitcoin continues to commerce beneath heavy stress, holding simply above the crucial $90K area after a pointy multi-week decline. The three-day chart reveals a decisive break beneath the 50-day and 100-day shifting averages, signaling a lack of short- and medium-term momentum. Worth is now sitting instantly on the 200-day shifting common — a degree that traditionally acts as the ultimate line of protection throughout deep corrections in bullish cycles.

The current candles present lengthy decrease wicks, suggesting patrons are trying to defend this zone, however the rebound power stays restricted. Quantity has elevated on draw back strikes, confirming that sellers are driving the present construction. This sample resembles earlier late-cycle shakeouts, the place excessive volatility clusters close to main shifting averages precede a development reset or additional breakdown.

Associated Studying

Structurally, BTC is forming decrease highs and decrease lows on this timeframe — a transparent signal of short-term bearish situations. A sustained break beneath the 200-day MA may speed up draw back momentum and expose decrease liquidity pockets round $85K–$88K.

Nonetheless, if bulls handle to stabilize the worth above $90K and reclaim the 100-day MA within the coming periods, it may sign vendor exhaustion. Proper now, Bitcoin sits at a pivotal crossroads, with market sentiment fragile and route depending on how this assist zone holds.

Featured picture from ChatGPT, chart from TradingView.com