BlackRock pushed into digital belongings massively in 2025, with on-chain knowledge revealing simply how aggressive the main asset supervisor turned in accumulating Bitcoin and Ethereum.

Blockchain monitoring knowledge exhibits that the world’s largest asset supervisor expanded its cryptocurrency holdings by greater than $23 billion in 2025, and this is likely one of the greatest institutional accumulation phases seen within the yr. The figures spotlight a sustained dedication to Bitcoin and Ethereum, whilst worth motion turned bearish in direction of the tip of the yr.

BlackRock’s Crypto Portfolio Enlargement By means of 2025

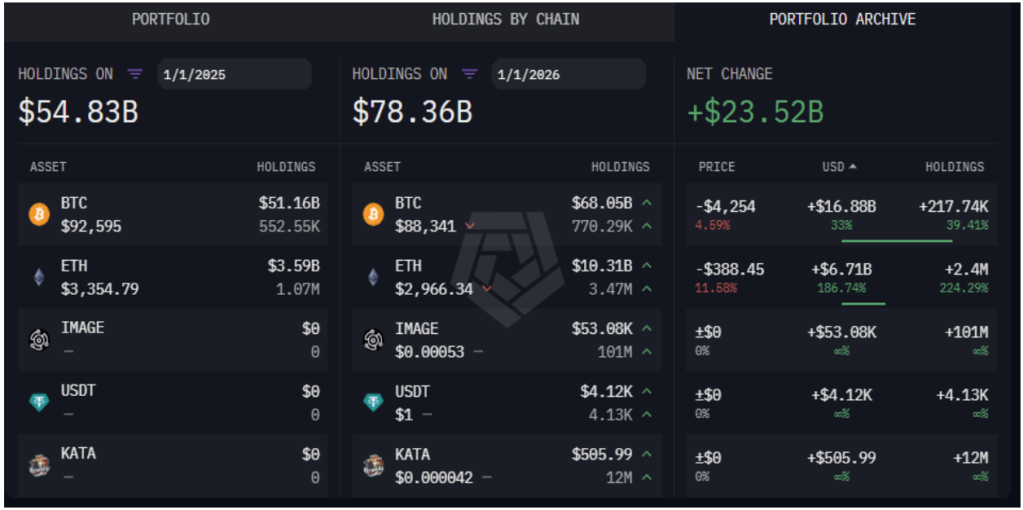

Crypto was on the forefront of BlackRock’s funding technique in 2025. In accordance to knowledge from on-chain analytics platform Arkham Intelligence, BlackRock’s on-chain cryptocurrency holdings in the beginning of 2025 have been $54.83 billion. By January 1, 2026, that determine had risen to about $78.36 billion, representing a internet enhance of roughly $23.52 billion over the course of the yr.

These figures imply that by the tip of 2025, BlackRock’s crypto portfolio had grown by about 43% in comparison with the beginning of the yr. Unsurprisingly, the buildup was concentrated nearly totally in Bitcoin and Ethereum, the 2 greatest belongings main institutional publicity to the crypto business.

Bitcoin was the dominant holding by worth. BlackRock’s BTC stash grew from round 552,550 BTC value about $51.16 billion in January 2025 to about 770,290 BTC valued at $68.05 billion in January 2026. This interprets to a rise of roughly 217,740 BTC, including about $16.88 billion to the agency’s portfolio based mostly on year-end valuations.

Even with Bitcoin’s worth down about 5% from January 2025, the rise in BTC models held grew by 39%, which, in flip, pushed the full worth increased.

Ethereum, though smaller in absolute phrases, noticed even sooner relative progress. Holdings expanded from 1.07 million ETH valued at $3.59 billion in January 2025 to about 3.47 million ETH value $10.31 billion in January 2026. That represents a rise of practically 2.4 million ETH, contributing round $6.71 billion to BlackRock’s crypto holdings in 2025.

These numbers imply that BlackRock’s ETH holdings grew by greater than 224% over the yr, far outpacing Bitcoin’s 39% enhance.

ETFs And Institutional Demand Motivated $23 Billion Accumulation

The majority of BlackRock’s crypto shopping for in 2025 was as a consequence of persistent inflows into its spot exchange-traded merchandise. Investor demand for regulated publicity to Bitcoin and Ethereum was sturdy for a lot of the yr, significantly throughout rallies that pushed each belongings towards recent all-time highs.

On the similar time, corrective phases within the crypto market have been accompanied by notable ETF outflows. This development helps the view that Bitcoin and Ethereum worth motion is turning into more and more linked to ETF exercise, and BlackRock is the dominant issuer inside these flows.

BlackRock has not but established a presence within the XRP market. The asset supervisor doesn’t at present provide a Spot XRP ETF, and spokespersons have beforehand acknowledged that the corporate has no quick plans to launch one.

Featured picture from Getty Photos, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our workforce of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.