Crypto merchants preliminary worries a couple of hawkish Fed materialized Wednesday as Chairman Jerome Powell minimize rates of interest however expressed uncertainty concerning the pace and extent of future easing. And now the sentiment has deteriorated.

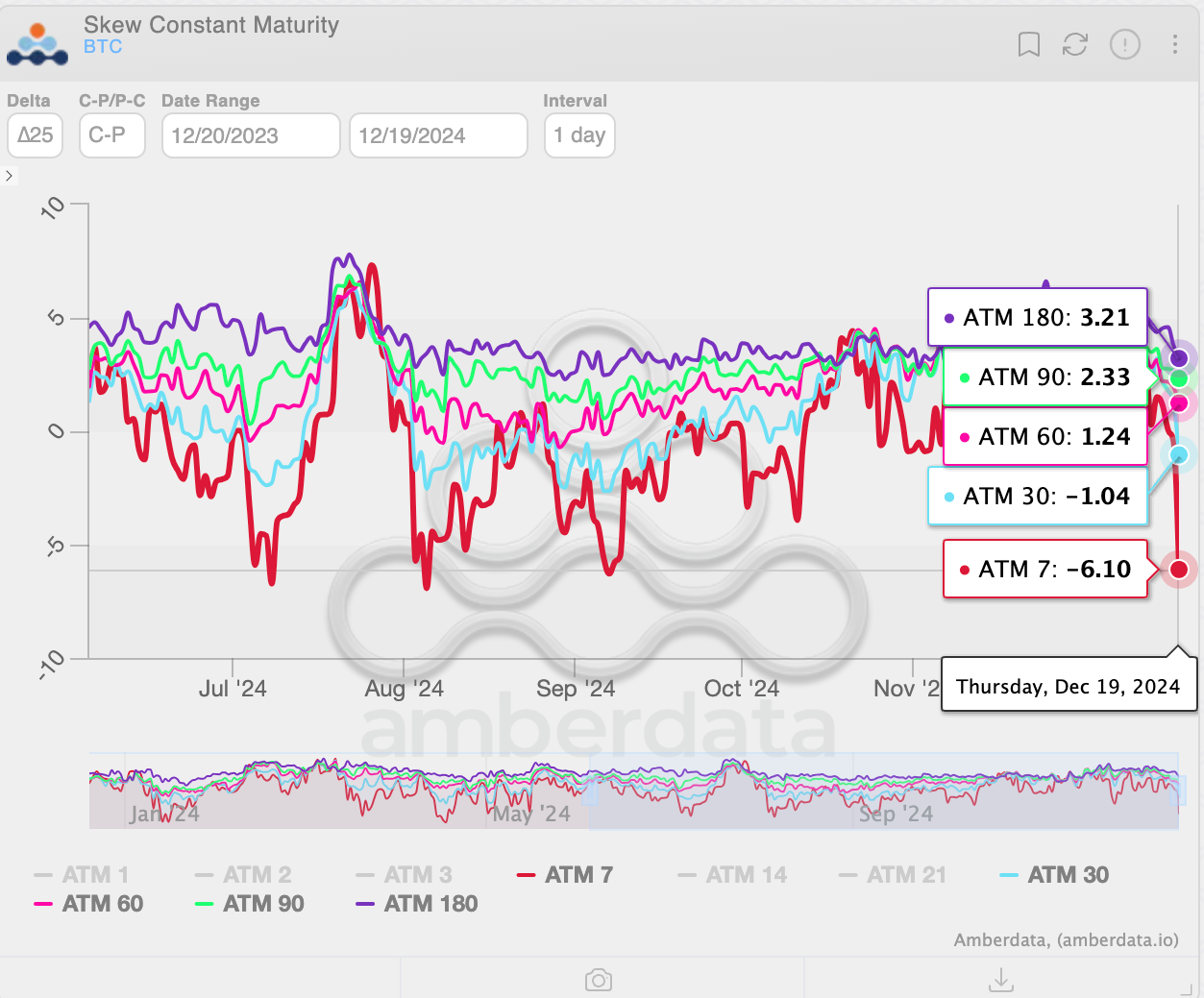

Bitcoin’s seven-day call-put skew reveals that Deribit-listed put choices providing draw back safety and expiring in a single week are buying and selling on the highest implied volatility premium to name choices since September, in response to information supply Amberdata. In different phrases, put choices are the costliest relative to calls in three months.

Its an indication of merchants scrambling to hedge their bullish bets towards a possible continuation of Wednesday’s value slide, triggered by a hawkish Fed.

The dour sentiment can be evident from the adverse one-month skew, reflecting a bias for places and a considerably weaker name bias in choices starting from two to 6 months. These calls traded at a 3 vol premium to places at press time, down from the 4-5 vol premium noticed early this month.

On Wednesday, the Fed minimize the benchmark rate of interest by 25 foundation factors to the 4.25% to 4.5% vary. That is 100 foundation factors decrease than the September ranges when it started the easing cycle.

Bitcoin declined following the speed minimize, as Fed Chairman Jerome Powell described it as a detailed name and emphasised warning relating to future strikes as charges method the impartial stage.

Powell additionally stated that the Fed has no intention of collaborating in any authorities plan to create a strategic bitcoin reserve, including that board members don’t intend to push for adjustments to the Fed legislation. This comes after President-elect Trump’s current point out that his administration would think about establishing a BTC reserve much like the nation’s oil stockpile.

In the meantime, the dot plot, an nameless graphical illustration of the place the 19 committee members mission the fed funds charges can be sooner or later, signaled solely two charge cuts in 2025 as an alternative of three anticipated and down from 4 in September.

The dot plot primarily out-hawked the markets, sending danger belongings decrease. Whereas Dow Jones ended bled 2.5% or over 1,000 factors, BTC slipped from roughly $105,000 to beneath $99,000, in response to information supply TradingView and CoinDesk.

As of this writing, BTC is buying and selling at round $101,200, aiming to get better from in a single day losses.

In the meantime, the greenback index, which gauges the dollar’s worth towards main currencies, continues to carry on to its in a single day positive aspects, holding regular close to 108, the very best stage since October 2022. A persistent power within the USD might add to danger belongings’ woes.