In line with market intelligence agency Santiment, Bitcoin is trailing each gold and the S&P 500 after a pointy pullback in November. Gold has climbed 9% since early November, the S&P 500 is up 1%, and Bitcoin is down about 20%, buying and selling close to $88,000 as of Wednesday. Primarily based on studies, that hole has left crypto quieter whereas different markets present modest rebounds.

Associated Studying

Whale Accumulation Alerts

Santiment’s knowledge factors to a cut up in conduct amongst holders. Small wallets have been busy shopping for within the second half of 2025, whereas massive wallets largely held regular and bought after pushing as much as October’s all-time excessive.

Giant holders are sometimes handled as market movers, so their cautious posture has saved stress on costs. Traditionally, a shift the place large holders begin shopping for whereas retail eases off has marked actual development shifts, however that situation shouldn’t be totally apparent but.

The correlation between Bitcoin & crypto in comparison with different main sectors continues to be lagging behind. Since November started, worth performances are:

Gold: +9%

S&P 500: +1%

Bitcoin: -20%Heading to 2026, there’ll stay a chance for crypto to play “catch up”. pic.twitter.com/FW8JaQboTV

— Santiment (@santimentfeed) December 30, 2025

On-Chain Information Combined

Stories word some indicators of stabilization. Lengthy-term Bitcoin holders trimmed holdings from 14.8 million cash in mid-July to 14.3 million by December, then paused additional promoting. Lively Bitcoin addresses rose 5.51% within the final 24 hours, but transactions fell virtually 30% over the identical window.

That mismatch suggests extra persons are watching the market, whereas fewer are committing funds. The uncooked numbers present curiosity, however not a transparent shift again to broad buying and selling exercise.

Market Voices Weigh In

Garrett Jin, who as soon as ran change BitForex, mentioned merchants are already reallocating capital, arguing that cash strikes from one market to a different when alternatives seem. Capital is similar and as all the time, it’s smart to promote excessive and purchase low, Jin wrote, based on posts on social channels.

One other analyst, CyrilXBT, described the present setup as late-cycle positioning earlier than a doable rotation: when liquidity turns, gold may cool, Bitcoin may lead, and different tokens may comply with.

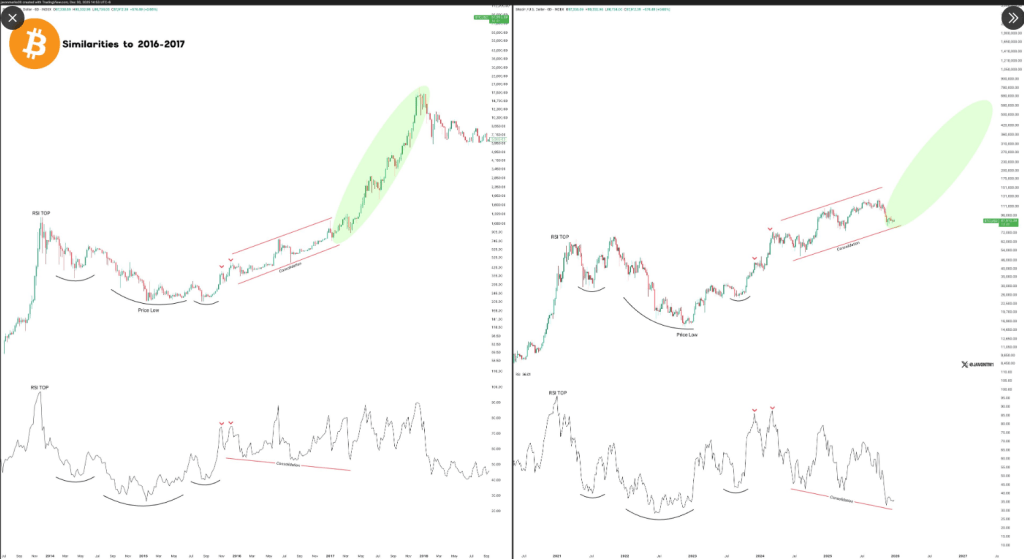

Bitcoin proper now continues to look similar to the 2016-2017 interval, simply earlier than a parabolic transfer.

These two setups proceed to flash in our thoughts because of the excessive similarities and bullish alerts are even holding & flashing right here too.$BTC‘s wanting prepared to utterly GO … pic.twitter.com/H1hInYwix8

— JAVONMARKS (@JavonTM1) December 30, 2025

Worth Calls And Technical Views

Technical commentators stay cut up. Javon Marks has pointed to parabolic patterns in Bitcoin’s chart that echo the 2016–2017 build-up and continues to forecast a rally towards $125K.

Primarily based on CoinCodex knowledge, a extra modest transfer is anticipated first: the platform forecasts BTC may attain $91,500 by January 30, 2026, an increase of three.68% from present ranges.

Associated Studying

CoinCodex lists sentiment as bearish and the Concern & Greed Index at 23 (Excessive Concern). The positioning additionally notes Bitcoin had 15/30 inexperienced days and a pair of.11% volatility over the previous 30 days, with the final replace on Dec 31, 2025.

Quick-term merchants ought to concentrate on whether or not massive wallets resume shopping for in quantity, and whether or not transactions decide up alongside rising lively addresses. If whales begin accumulating once more whereas long-term holders cease decreasing positions, that mixture would give a stronger sign than both metric alone.

Within the meantime, studies level to stabilization fairly than a confirmed reversal, leaving room for a catch-up transfer in 2026 if liquidity and sentiment flip.

Featured picture from Unsplash, chart from TradingView