The next is a visitor article from Vincent Maliepaard, Advertising and marketing Director at IntoTheBlock.

Staking

Staking is a elementary yield technology technique in DeFi. It entails locking a blockchain’s native tokens to safe the community and validate transactions, incomes rewards in transaction charges and extra token emissions.

The rewards from staking fluctuate with community exercise—the upper the transaction quantity, the larger the rewards. Nevertheless, stakers should be aware of dangers reminiscent of token devaluation and network-specific vulnerabilities. Staking, whereas usually steady, requires a radical understanding of the underlying blockchain’s dynamics and potential dangers.

For instance, some protocols, like Cosmos, require a particular unlock interval for stakers. Which means that whenever you’re withdrawing your belongings from staking, you received’t be capable to truly transfer your belongings for a 21-day interval. Throughout this time, you might be nonetheless topic to cost fluctuations and may’t use your belongings for different yield methods.

Liquidity Offering

Liquidity offering is one other technique of producing yield in DeFi. Liquidity suppliers (LPs) normally contribute an equal worth of two belongings to a liquidity pool on decentralized exchanges (DEXs). LPs earn charges from every commerce executed throughout the pool. The returns from this technique depend upon buying and selling volumes and price tiers.

Excessive-volume swimming pools can generate substantial charges, however LPs should pay attention to the chance of impermanent loss, which happens when the worth of belongings within the pool diverges. To mitigate this danger, traders can select steady swimming pools with extremely correlated belongings, making certain extra constant returns.

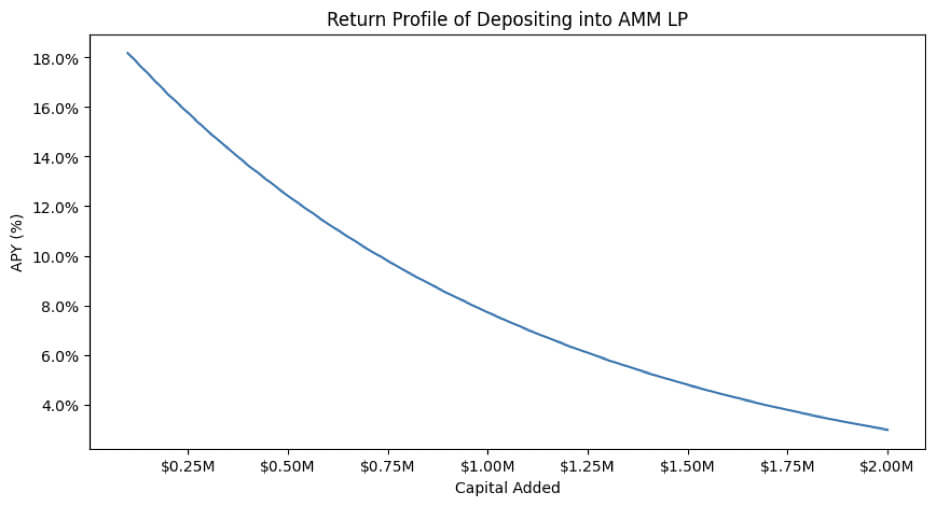

It is usually vital to do not forget that the projected returns from this technique are instantly depending on the full liquidity within the pool. In different phrases, as extra liquidity enters the pool, the anticipated reward decreases.

Lending

Lending protocols supply an easy but efficient yield-generation technique. Customers deposit belongings, which others can borrow in change for paying curiosity. The rates of interest range primarily based on the provision and demand for the asset.

Excessive borrowing demand will increase yields for lenders, making this a profitable choice throughout bullish market situations. Nevertheless, lenders should think about liquidity dangers and potential defaults. Monitoring market situations and using platforms with sturdy liquidity buffers can mitigate these dangers.

Airdrops and Factors Programs

Protocols usually use airdrops to distribute tokens to early customers or those that meet particular standards. Extra not too long ago, factors programs have emerged as a brand new method to make sure these airdrops go to precise customers and contributors of a particular protocol. The idea is that particular behaviors reward customers with factors, and these factors correlate to a particular allocation within the airdrop.

Making swaps on a DEX, offering liquidity, borrowing capital, and even simply utilizing a dApp are all actions that might usually earn you factors. Factors programs present transparency however are in no way a fool-proof method of incomes returns. For instance, the latest Eigenlayer airdrop was restricted to customers from particular geographical areas and tokens have been locked upon the token technology occasion, sparking debate among the many neighborhood.

Leverage in Yield methods

Leverage can be utilized in yield methods like staking and lending to optimize returns. Whereas this will increase returns, it additionally will increase the complexity of a method, and thus its dangers. Let’s take a look at how this works in a particular state of affairs: lending.

Recursive lending capitalizes on incentive constructions inside DeFi lending protocols. It entails repeated lending and borrowing of the identical asset to accrue rewards provided by a platform, considerably enhancing the general yield.

Right here’s the way it works:

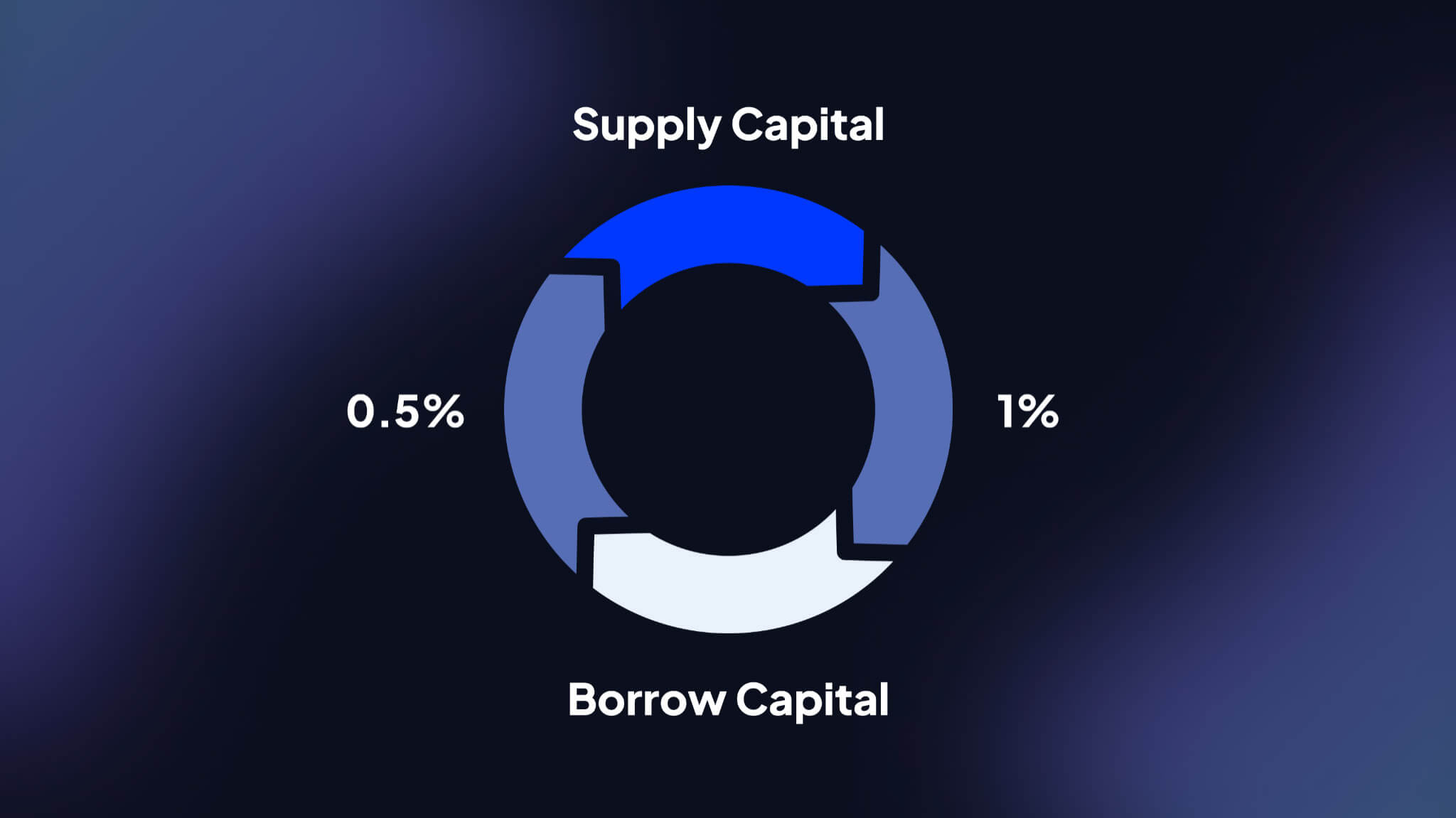

- Asset Provide: Initially, an asset is equipped to a lending protocol that provides increased rewards for supplying than the prices related to borrowing.

- Borrow and Re-Provide: The identical asset is then borrowed and re-supplied, making a loop that will increase the preliminary stake and the corresponding returns.

- Incentive Seize: As every loop is accomplished, extra governance tokens or different incentives are earned, growing the full APY.

For instance, on platforms like Moonwell, this technique can remodel a provide APY of 1% to an efficient APY of 6.5% as soon as extra rewards are built-in. Nevertheless, the technique entails important dangers, reminiscent of rate of interest fluctuations and liquidation danger, which require steady monitoring and administration. This makes methods like this yet one more appropriate for institutional DeFi contributors.

The way forward for DeFi & Yield Alternatives

Till 2023, DeFi and conventional finance (TradFi) operated as separate silos. Nevertheless, growing treasury charges in 2023 spurred a requirement for integration between DeFi and TradFi, resulting in a wave of protocols coming into the “real-world asset” (RWA) house. Actual-world belongings have primarily provided treasury yields on-chain, however new use circumstances are rising that leverage blockchain’s distinctive traits.

For instance, on-chain belongings like sDAI make accessing treasury yields simpler. Main monetary establishments like BlackRock are additionally coming into the on-chain financial system. Blackrock’s BUIDL fund, providing treasury yields on-chain, amassed over $450 million in deposits inside a number of months of launching. This means that the way forward for finance is prone to turn out to be more and more on-chain, with centralized firms deciding whether or not to supply providers on decentralized protocols or via permissioned paths like KYC.

This text relies on IntoTheBlock’s most up-to-date analysis paper on institutional DeFi. You’ll be able to learn the total report right here.