Exodus Motion, Inc. (NYSE American: EXOD), a number one self-custodial Bitcoin and cryptocurrency platform, has introduced unaudited monetary outcomes for Q1 2025, showcasing record-setting income and a notable enhance in digital asset holdings.

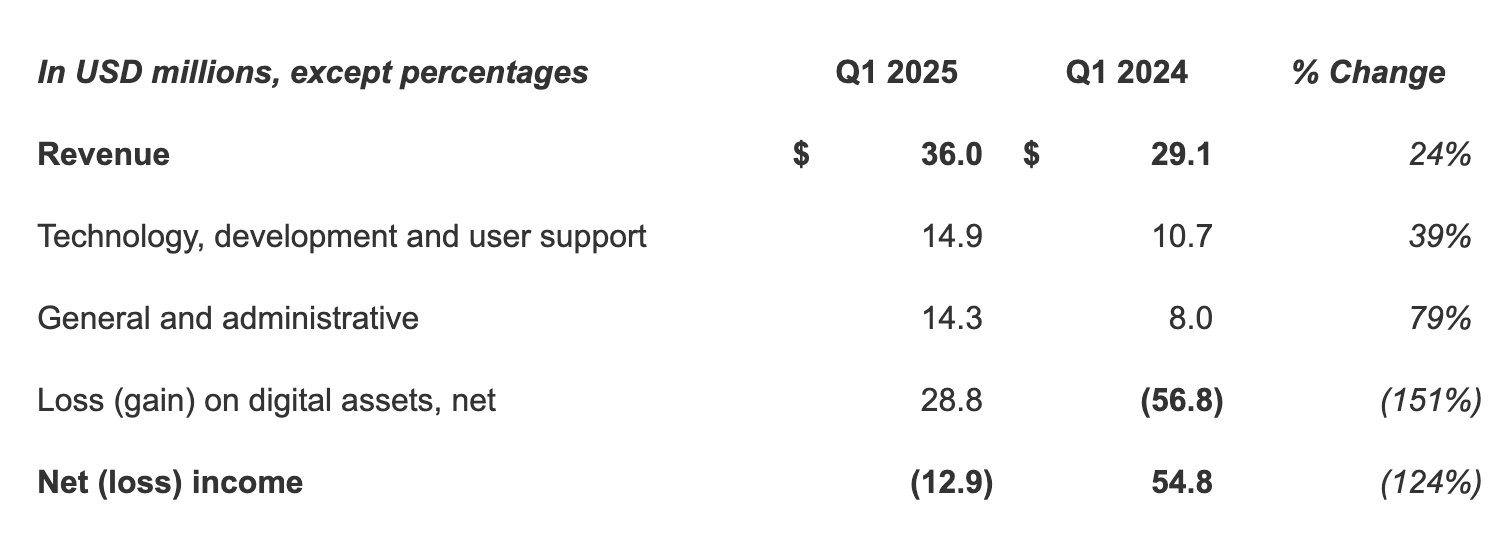

In its strongest first quarter but, Exodus reported $36.0 million in income, up 24% from $29.1 million in Q1 2024. The corporate attributed the expansion to continued product innovation and demand for self-custody options. “Exodus continues to supply revolutionary options that capitalize on the rising marketplace for digital property,” mentioned JP Richardson, CEO and co-founder. “In the meantime, our deal with self-custody stays a difference-maker.”

Along with the income milestone, the corporate now holds 2,011 BTC, in line with its Q1 submitting—a rise of 70 BTC since December 31, 2024. The bitcoin holdings are valued at $166.0 million, comprising the majority of the corporate’s $238.0 million in digital property, money, and money equivalents. The corporate additionally holds 2,693 ETH valued at $4.9 million and $62.8 million in USD Coin and Treasury payments.

Regardless of a decline in consumer exercise—month-to-month energetic customers dropped 30% to 1.6 million—Exodus maintained a powerful consumer base, with 1.8 million funded customers by quarter finish. Trade quantity processed in Q1 totaled $2.18 billion.

Bills rose considerably, with expertise, growth, and consumer assist up 39% to $14.9 million, and normal and administrative prices up 79% to $14.3 million. Exodus posted a internet lack of $12.9 million, in comparison with a $54.8 million internet earnings in Q1 2024, largely because of a $28.8 million loss on digital property.

Nonetheless, Exodus management stays optimistic. “Q1 noticed our highest first quarter income and second greatest income quarter on file,” mentioned James Gernetzke, CFO. “With an abundance of alternatives at our doorstep, Exodus is well-positioned to develop inside our trade and past, nicely into the long run.”

A webcast to debate Q1 outcomes will probably be held at 4:30 PM ET on Might 12, obtainable at exodus.com/traders.