Ether (ETH), the second-largest cryptocurrency, has fallen out of investor relative to bitcoin (BTC), returning the worst bull-cycle efficiency towards its bigger rival because the Ethereum blockchain’s inception in 2015.

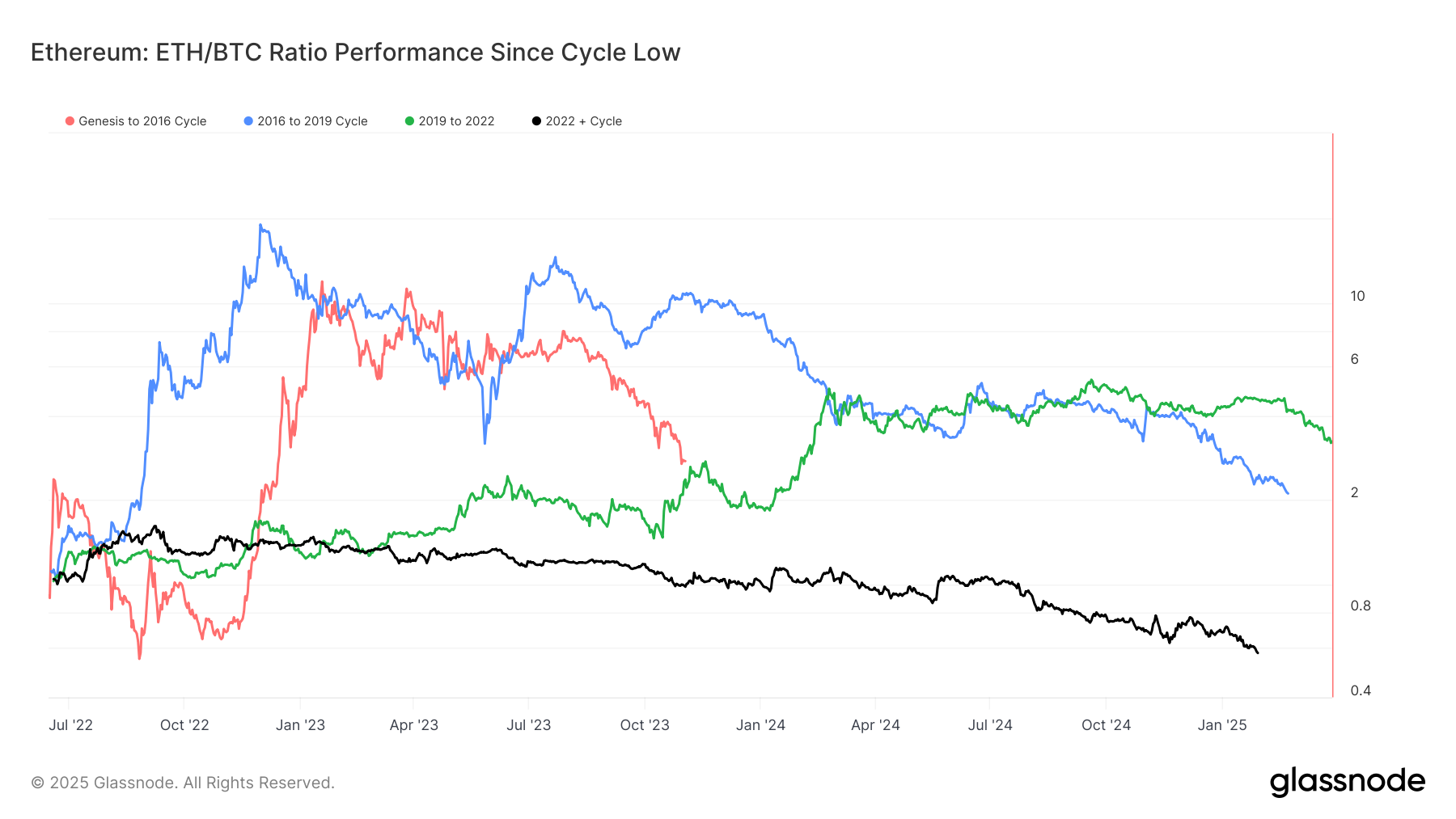

A comparability of the ether to bitcoin ratio throughout previous cycles from the tokens’ respective lows reveals constant underperformance. The black line within the chart above represents the present cycle that began in November 2022, when bitcoin bottomed at round $15,500 in the course of the collapse of crypto alternate FTX. With every cycle, ether’s return towards bitcoin has diminished.

On Wednesday, the ratio dropped under 0.0300 to the touch 0.02993, a four-year low. The earlier low was recorded on Jan. 19, a day earlier than President Trump’s inauguration. This month, the ratio — the alternate price between the 2 largest cryptocurrencies — is down 15%. It has declined 44% over the previous 12 months.

Bitcoin is at present buying and selling round $105,000, having recovered from the stoop to $98,000 attributable to the discharge of DeepSeek, a Chinese language synthetic intelligence (AI) program. Ether, at present at $3,202, would want to succeed in roughly $3,360 to undo the DeepSeek injury.

“My basic take is that the ether to bitcoin ratio underperformance is extra as a result of a power of bitcoin quite than a weak point of ether,” mentioned Andre Dragosch, head of analysis at Bitwise’s European desk. “Ether tends to endure from ‘center youngster syndrome,’ it isn’t as scalable as sensible contract rivals like solana (SOL) whereas it isn’t actually competing with bitcoin because the prime store-of-value.”