Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Ethereum is buying and selling beneath the $1,900 degree, going through ongoing promoting stress because the broader crypto market continues to weaken. After a pointy rejection from the $2,500 mark in late February, bulls have didn’t regain momentum, and ETH has steadily declined — disappointing many traders who entered the 12 months with excessive expectations for a bullish development. The lack of key help ranges has additional broken sentiment, and Ethereum’s value motion stays bearish within the brief time period.

Associated Studying

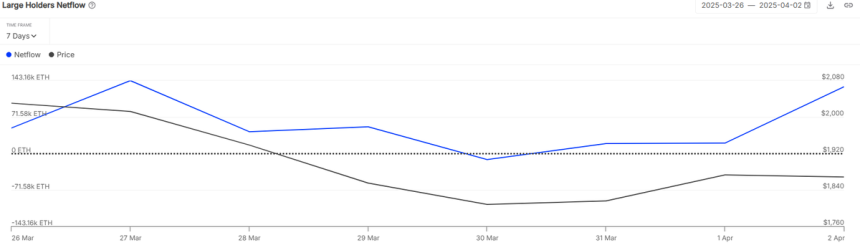

Regardless of the unfavorable outlook, there are indicators of accumulation beneath the floor. Based on information from IntoTheBlock, Ethereum whales are shopping for the dip. The most important ETH wallets added over 130,000 ETH to their holdings simply yesterday — a transfer that implies confidence from long-term gamers whilst retail sentiment wavers.

This accumulation might sign a shift in momentum if sustained, particularly if whales proceed to soak up provide whereas costs stay low. Nevertheless, for any actual restoration to take maintain, Ethereum should reclaim vital resistance ranges and present stronger shopping for exercise throughout the board. For now, the market stays beneath stress, however whale conduct might provide a touch of what’s to come back as soon as the present downtrend begins to ease.

Ethereum Huge Gamers Purchase Amid Market Uncertainty

Ethereum is presently down 55% from its December excessive, reflecting the broader ache throughout the crypto market. The selloff has been fueled largely by rising macroeconomic uncertainty, with U.S. President Donald Trump’s aggressive commerce insurance policies and unpredictable tariff bulletins including to world monetary instability. As conventional markets wrestle to seek out footing, high-risk belongings like Ethereum have been among the many hardest hit.

Bulls are having a troublesome time defending key help ranges, and value motion suggests the downtrend could proceed within the brief time period. With Ethereum buying and selling nicely beneath the $1,900 mark and no clear indicators of bullish momentum, the outlook stays fragile.

Nonetheless, not all alerts are bearish. Based on information from IntoTheBlock, Ethereum whales look like accumulating. On a single day, the biggest ETH wallets added over 130,000 ETH to their holdings — a transfer that implies quiet confidence amongst main gamers. This degree of accumulation, particularly during times of concern and weak spot, usually hints at a long-term bullish outlook.

Whereas value continues to development decrease, the conduct of those giant holders provides to the speculative setting, signaling that some traders could also be positioning early for a possible surge. If macro situations start to stabilize or sentiment shifts, Ethereum may benefit from this quiet accumulation part — however for now, the market stays in correction mode.

Associated Studying

Technical Evaluation: ETH Bulls Defend Crucial Assist

Ethereum is buying and selling at $1,830 following a wave of heavy promoting stress that pushed the value sharply beneath the important thing $2,000 degree. Panic promoting has gripped the market, with bulls struggling to regain management amid a broader downturn throughout the crypto house. The breakdown beneath $2,000 marked a major shift in sentiment, turning what was as soon as seen as a consolidation part right into a deeper correction.

At this stage, bulls should maintain the $1,800 help degree — a vital threshold that, if misplaced, might result in an additional decline towards $1,750 or decrease. Holding above $1,800 would enable for stabilization and the prospect to construct a basis for restoration. Nevertheless, to sign a significant reversal, Ethereum must reclaim the $2,100 degree, which now acts as short-term resistance.

Associated Studying

Solely a decisive push above that mark would affirm renewed power and doubtlessly reestablish bullish momentum. Till then, ETH stays susceptible to additional draw back. With broader market situations nonetheless unsure, Ethereum’s subsequent transfer round these help ranges will probably be essential in figuring out whether or not it will possibly recuperate within the close to time period or slide deeper into correction territory.

Featured picture from Dall-E, chart from TradingView