Este artículo también está disponible en español.

The Ethereum value might face some turbulence, as Justin Solar, the founding father of Tron (TRX), has unstaked a whopping $209 million from Lido Finance, a liquid decentralized staking platform for Ethereum. In comparison with prime cryptocurrencies like Bitcoin (BTC) and Dogecoin (DOGE), the Ethereum value has had a comparatively muted efficiency, skyrocketing to $4,000 earlier than consolidating and struggling to maneuver larger. With the potential of extra sell-offs, Ethereum might see its value crashing down if Solar decides to dump extra cash.

Justin Solar Dumps ETH

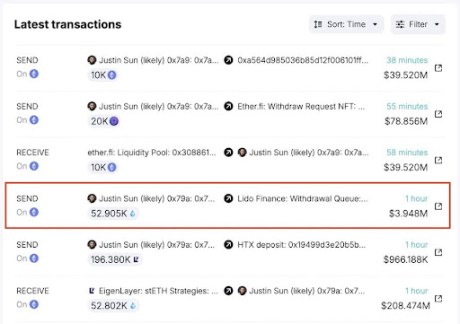

New reviews from Spot On Chain, an AI-driven crypto platform, revealed that Solar just lately utilized to withdraw a staggering 52,905 ETH tokens value about $209 million from Lido Finance. In accordance with the on-chain knowledge, this huge withdrawal was a part of the ETH stash Solar allegedly gathered between February and August 2024.

Spot On Chain has revealed that the entire quantity of Ethereum Solar purchased inside this era amounted to 392,474 ETH tokens, valued at $1.19 billion. All of those tokens had been bought by way of three pockets addresses at a median value of $3,027. Presently, the entire revenue the Tron founder has acquired since his buy is as much as $349 million, representing a 29% improve from its buying value.

Apparently, on October 24, Solar had unstaked a large 80,251 ETH tokens, value over $131 million, from Lido Finance. 4 days later, he transferred all the quantity to Binance, the world’s largest crypto alternate. This notable transfer passed off simply earlier than the value of Ethereum had dropped sharply by 5% in mid-October, which might have resulted in a loss for Solar.

Unsurprisingly, this isn’t the primary time Solar has dumped Ethereum. Spot On Chain revealed earlier this month that the Tron Founder had been cashing in his Ethereum holdings through the market rally.

In November, Solar deposited 19,000 ETH value $60.83 million to HTX, a crypto alternate. Moreover, he transferred 29,920 ETH valued at $119.7 million to HTX once more after its value surpassed $4,000 over the previous week. These are just some transactions the Tron founder has made with ETH over the previous month.

Given Solar’s historical past of large-scale asset actions, additional sell-offs might influence the already fragile Ethereum market. Nonetheless, the lingering query stays whether or not the Tron founder will proceed his Ethereum dumping spree.

Ethereum Worth Crash Forward?

Whereas Solar has not publicly commented on his current large-scale Ethereum withdrawals, the dimensions and timing of those transactions might pose an issue for the altcoin’s future trajectory. Traditionally, giant ETH liquidations have triggered a value crash as a consequence of rising promoting pressures.

Associated Studying

With the value of Ethereum nonetheless unstable and aiming for a stronger upward rally, additional large-scale ETH dumps might exacerbate market volatility, particularly if different buyers or whales observe go well with. For now, the value of Ethereum appears to be performing nicely, recording a greater than 7% improve within the final seven days and a 28% surge over the previous month, in line with CoinMarketCap.

Featured picture created with Dall.E, chart from Tradingview.com