Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Ethereum is as soon as once more below heavy promoting strain after dropping the important $2,000 stage — a psychological and technical zone that bulls have struggled to defend in current weeks. With value motion turning more and more bearish, investor sentiment is weakening, and analysts are warning {that a} deeper correction could also be on the horizon. As Ethereum slides decrease, issues are rising throughout the broader crypto market, which regularly depends on ETH’s power to steer restoration phases.

Associated Studying

The present scenario is each tense and delicate. Ethereum’s incapacity to carry key help ranges has rattled short-term holders and is now testing the resolve of long-term buyers. Many at the moment are intently looking forward to any indicators of stabilization or contemporary accumulation.

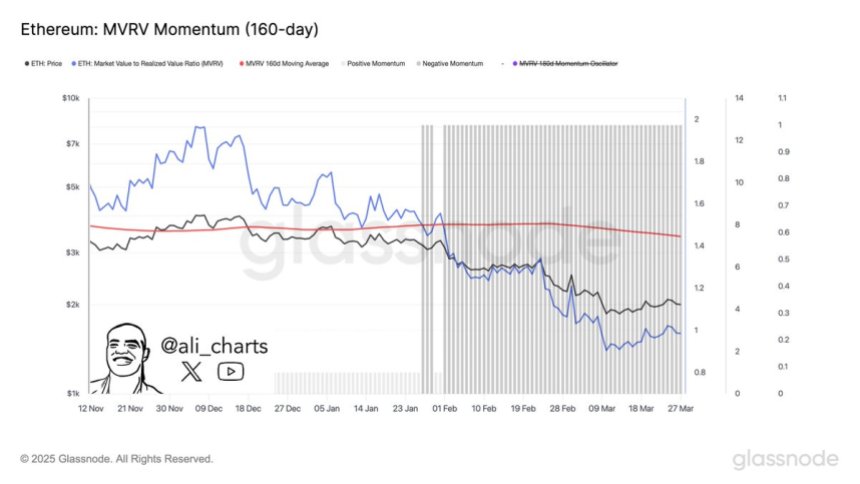

One promising on-chain sign comes from Glassnode’s MVRV (Market Worth to Realized Worth) metric. Traditionally, a crossover of the MVRV ratio above its 160-day shifting common has marked the start of sturdy Ethereum accumulation zones — typically previous vital value rebounds. That sign is now approaching as soon as once more, and if confirmed, it may provide a glimmer of hope to bulls ready for a shift in momentum. Till then, Ethereum stays in a fragile state.

Ethereum Faces Crucial Breakdown As Accumulation Sign Nears

Ethereum is now in a important place, with bulls persevering with to lose management as key help ranges break one after the other. Promoting strain has intensified over the previous few weeks, dragging ETH additional into a chronic downtrend that started in late December. Macroeconomic uncertainty, rising rates of interest, and heightened world tensions proceed to create a hostile surroundings for danger belongings — and the crypto market has felt the impression most severely.

At present, Ethereum is buying and selling 55% under its native excessive of $4,100, reached earlier this cycle. The sharp decline has shaken investor confidence, and the continued breakdown in value construction leaves little room for error. And not using a swift restoration and robust protection of help zones, Ethereum dangers additional draw back, with analysts warning of continued weak spot if sentiment doesn’t shift quickly.

Amid the decline, some analysts are watching intently for indicators of a possible backside. Prime analyst Ali Martinez shared a key perception on X, pointing to the MVRV (Market Worth to Realized Worth) ratio as a dependable indicator of accumulation zones. In response to Martinez, when the MVRV ratio crosses above its 160-day shifting common, it has traditionally marked sturdy accumulation phases — moments when long-term buyers start quietly positioning for the following leg increased.

This crossover has not but occurred, however it’s approaching. If confirmed, it may sign that Ethereum is getting into a high-value zone regardless of the present bearish situations. Whereas the market stays fragile, such on-chain metrics provide a glimmer of hope that accumulation is quietly underway — whilst value motion continues to look weak on the floor. Bulls might want to act rapidly to reverse the pattern, however for now, Ethereum’s outlook stays on edge.

Associated Studying

Bulls Defend Essential $1,800 Assist

Ethereum is buying and selling at $1,830 after struggling a pointy 14% drop since final Monday, reflecting renewed promoting strain throughout the crypto market. The steep decline has pushed ETH towards a important help stage at $1,800 — a zone that now stands as a must-hold for bulls. This stage has traditionally acted as a powerful pivot level, and dropping it may set off a deeper correction.

If ETH fails to carry above $1,800, the following vital help lies close to the $1,500 zone, which might mark a dramatic shift in market construction and certain speed up bearish sentiment. A breakdown to this stage would erase a lot of the 12 months’s beneficial properties and deal a severe blow to investor confidence.

Nevertheless, if bulls handle to defend $1,800 efficiently, a rebound may observe, doubtlessly pushing ETH again above the $2,000 mark. Reclaiming this psychological stage would assist restore momentum and open the door for a broader restoration.

Associated Studying

The subsequent few days shall be essential for Ethereum’s short-term outlook. With macroeconomic uncertainty nonetheless looming, bulls should step in with conviction — as a result of if $1,800 breaks, the autumn may very well be quick and steep.

Featured picture from Dall-E, chart from TradingView