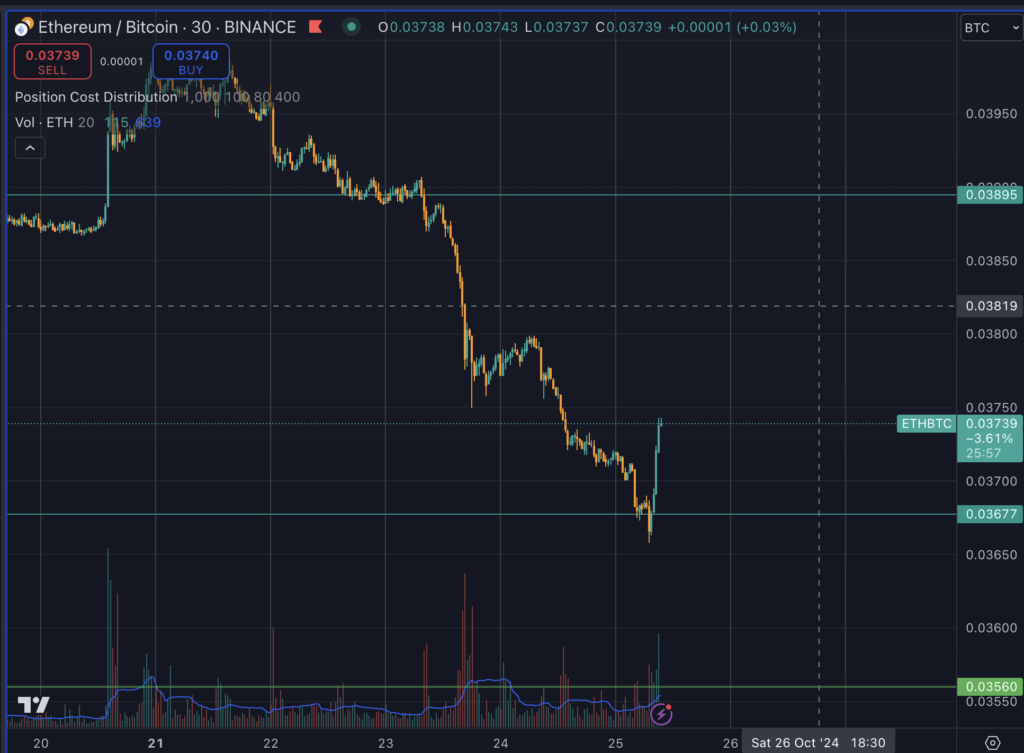

Ethereum has considerably underperformed Bitcoin over the 12 months, with the ETH/BTC ratio declining 58% from its 2021 peak of 0.086 to a current low of 0.0365. Within the final week, the pair exhibited excessive volatility, dropping 8% earlier than sharply rebounding 3% to 0.0374 as we speak.

A number of components contribute to Ethereum’s relative weak point. Bitcoin has reasserted its dominance because the main digital asset, attracting elevated institutional curiosity. Not like Bitcoin’s mounted provide, Ethereum’s issuance has been much less predictable, probably affecting investor confidence. The expansion of Layer-2 options has impacted Ethereum’s income and perceived worth, whereas competitors from different Layer-1 blockchains like Solana challenges its market place. Moreover, the success of Bitcoin ETFs has shifted institutional focus towards BTC, whereas Ethereum ETFs have seen muted inflows by comparability.

Regardless of the downtrend, some analysts see potential for a restoration within the ETH/BTC ratio. Ethereum’s ongoing growth and scaling options may renew traders’ curiosity. Some consultants predict a possible restoration in 2025, aligning with the following anticipated crypto bull market.