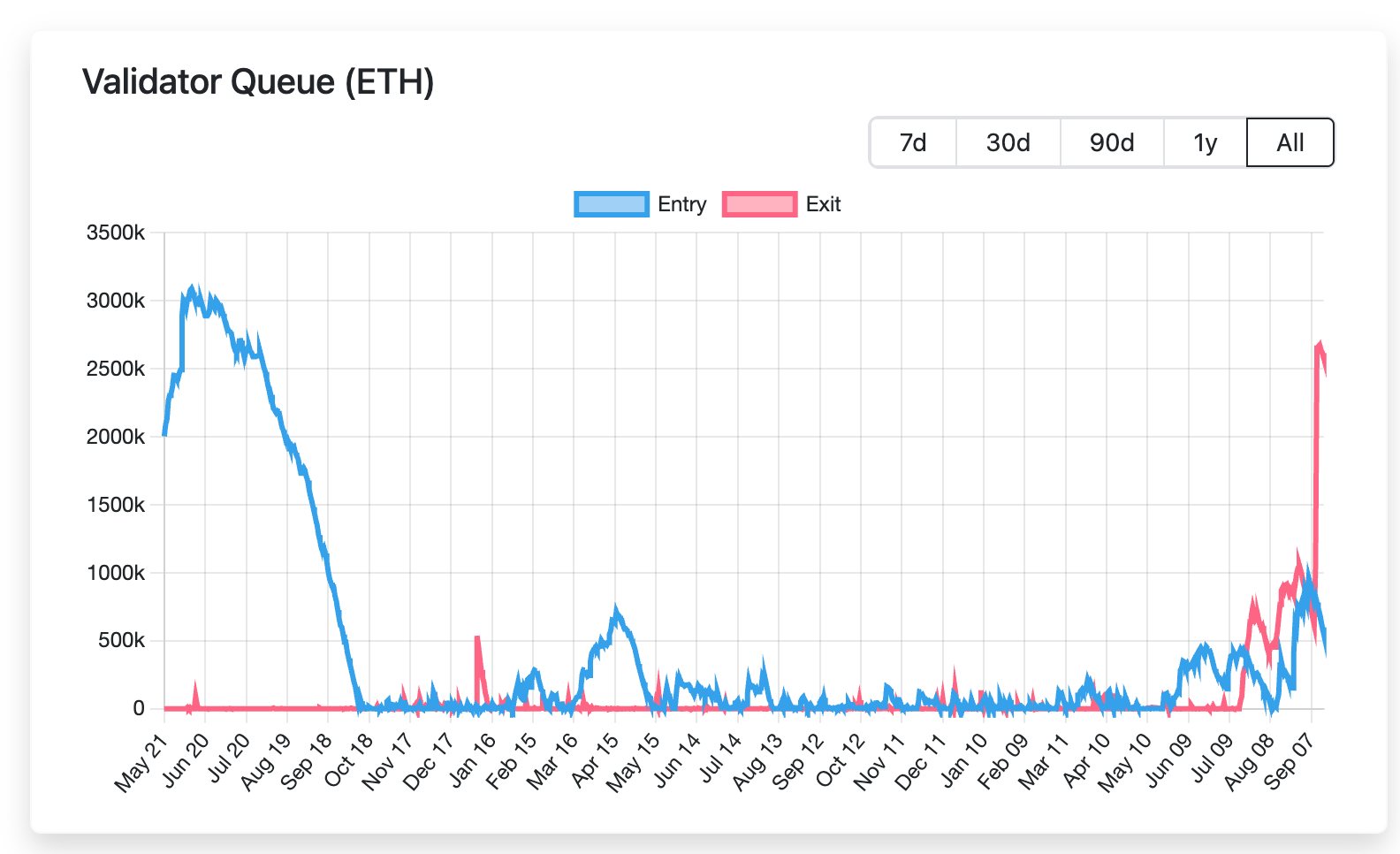

Ethereum’s proof-of-stake system is going through its largest take a look at but. As of mid-September, roughly 2.5 million ETH — valued at roughly $11.25 billion — is ready to depart the validator set, in response to validator queue dashboards.

The backlog pushed exit wait occasions to greater than 46 days on Monday, the longest in Ethereum’s quick staking historical past, dashboards present. The final peak, in August, put the exit queue at 18 days.

The preliminary spark got here on Sept. 9, when Kiln, a big infrastructure supplier, selected to exit all of its validators as a security precaution. The transfer, triggered by latest safety incidents together with the NPM supply-chain assault and the SwissBorg breach, pushed round 1.6 million ETH into the queue directly. Although unrelated to Ethereum’s staking protocol itself, the hacks rattled confidence sufficient for Kiln to hit pause, highlighting how occasions within the broader crypto ecosystem can cascade into Ethereum’s validator dynamics.

In a weblog submit from staking supplier Figment, Senior Analyst Benjamin Thalman famous that the present exit queue construct up isn’t solely about safety. After ETH has rallied greater than 160% since April, some stakers are merely taking earnings. Others, particularly institutional gamers, are shifting their portfolios publicity.

On the similar time, validators coming into the Ethereum staking ecosystem have been steadily rising. The SEC’s Might assertion clarifying that staking just isn’t a safety has renewed pursuits in staking. Anticipation of ETH ETF approvals is one other driver, as funds put together for regulated methods to seize staking yield, Thalman famous.

Ethereum’s churn restrict, which is a protocol safeguard that caps what number of validators can enter or exit over a sure time interval, is presently capped at 256 ETH per epoch (about 6.4 minutes), proscribing how shortly validators can be a part of or depart the community, and is supposed to maintain the community secure.

With greater than 2.5M ETH lined up, stakers on Wednesday face 44 days earlier than even reaching the cooldown step.

Thalman believes that a lot of the ETH present will merely be restaked beneath new validators, which means that if even 75% of the present queue is re-deposited, almost 2 million ETH will flood the activation queue, bringing delays for brand new ETH staking, and a backlog on each side of the validator queue.

“The activation queue is presently 13 days, to this add the ~2M ETH from these presently exiting (35 days) and 4.7M from ETFs (81 days), and the whole is 129 days. This assumes that there are not any different ETH holders that select to stake and enter the queue, like company treasuries,” Thalman wrote within the weblog.

The swelling queue underscores a paradox: Ethereum is working “as supposed” Thalman notes, and the demand to each exit and re-enter highlights staking’s central position within the ecosystem. The community is thus experiencing the rising pains of a maturing, institutionalized system the place infrastructure scares, revenue cycles, and regulatory shifts all collide in actual time.

Learn extra: Ethereum Staking Queue Overtakes Exits as Fears of a Promote-off Subside