Ethereum’s (ETH) newest worth rally has sparked renewed debate over whether or not the market is nearing a vital turning level. Analysts are trying intently at previous cycles for perception, with some suggesting that historical past could also be repeating itself. If the patterns maintain true, ETH may very well be solely weeks away from a cycle peak, making this a decisive second for traders to think about when it is likely to be time to promote the whole lot.

Ethereum’s Cycle Prime Alerts When To Exit

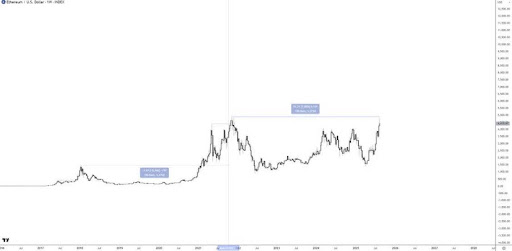

Crypto analyst Jackis has shared insights into Ethereum’s latest worth actions, indicating when traders ought to exit the market solely. In a latest X social media put up, the analyst famous that the ETH worth motion is intently mirroring its habits from earlier market cycles.

Associated Studying

Trying on the chart, Ethereum had hit considered one of its main cycle tops in January 2018, adopted by one other peak in November 2021. Furthermore, each cases had been preceded by a pointy upward trajectory that culminated in heavy corrections. Jackis additionally factors out that in these earlier cycles, ETH was buying and selling considerably above prior highs earlier than topping out. This time, nevertheless, the altcoin has not even damaged into a brand new all-time excessive but, though it’s at present approaching that vital resistance.

Notably, the timing of ETH’s present setup is critical, because the four-year cycle principle means that the cryptocurrency may very well be simply 4 weeks away from a significant prime. Jackis famous that this window aligns with September, which might function a vital second for traders to reassess dangers and take into account whether or not “promoting the whole lot” is warranted.

The analyst additional highlighted that whereas Ethereum’s construction exhibits energy, most altcoins are lagging far behind. Cryptocurrencies comparable to Binance Coin (BNB), XRP, and Dogecoin (DOGE) have already established their tops in 2021 and stay far beneath these ranges.

Jackie said that their worth motion suggests a market surroundings extra in step with ETH buying and selling round $2,200, moderately than its present stage beneath $4,500. Bitcoin, in the meantime, has continued to march increased since its November 2022 lows, forming increased lows and better highs in a textbook bull market construction.

ETH Panic Promoting Or Pre-Breakout Alternative?

In different information, crypto market professional Ether Wizz argues that the present panic promoting of Ethereum mirrors the identical mistake merchants made with Bitcoin in previous cycles. On the time, early sellers underestimated the energy of institutional demand and long-term patrons, solely to look at BTC surge far past expectations.

Associated Studying

The analyst highlighted a latest rebound within the Ethereum worth above the 50-week Easy Transferring Common (SMA), which traditionally has signaled the start of explosive rallies. The comparability between Ethereum’s 2025 chart and its 2017 breakout additionally highlights a similarity. In each circumstances, the cryptocurrency consolidated, reclaimed its shifting common, after which accelerated increased.

Notably, Ether Wizz factors out that Ethereum might nonetheless expertise a short-term correction of 5% to 10%. Nevertheless, he argues it’s misguided to imagine ETH has already peaked, sustaining as a substitute that the cryptocurrency is within the early levels of a transfer that would ultimately drive its worth towards a brand new all-time excessive of $10,000.

Featured picture from Pixabay, chart from Tradingview.com