Former New York Metropolis Mayor Eric Adams is going through a whole lot of warmth immediately after his high-profile launch of a brand new cryptocurrency, dubbed the NYC Token, crashed inside hours of launching. Adams launched the token on Monday, however the coin misplaced 80% of its worth inside a pair hours.

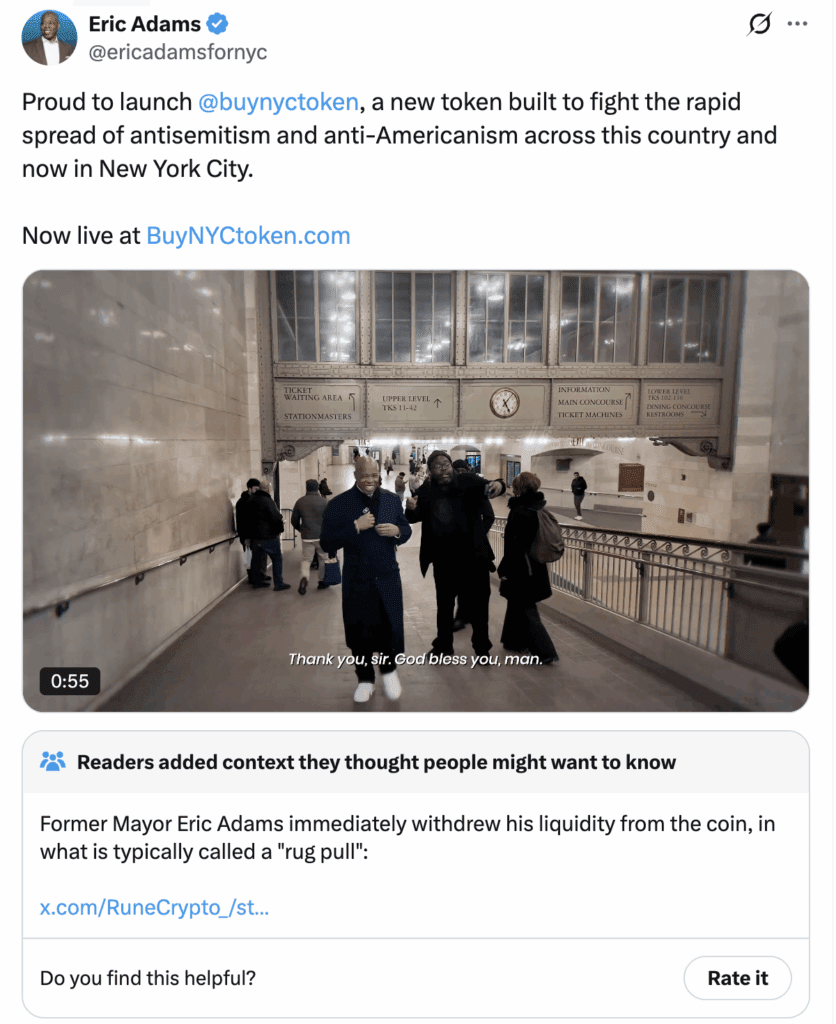

Adams unveiled the Solana-based token at a Instances Sq. occasion on Monday, selling it as a software to generate funding for social causes together with the battle in opposition to antisemitism and “anti-Americanism,” in addition to blockchain training and pupil scholarships.

Eric Adams informed Fox Enterprise that proceeds would help nonprofits like Fight Antisemitism and traditionally Black faculties and universities with out elevating taxes.

The announcement got here lower than two weeks after Eric Adams left workplace as mayor, the place he had lengthy championed crypto adoption — together with changing his first mayoral paychecks into Bitcoin and different crypto and signing an govt order to advertise digital belongings.

A mayoral ‘pump and dump’ from Eric Adams

Investor curiosity was robust for the primary couple of hours following the coin’s launch, briefly driving the NYC Token’s market capitalization into the a whole lot of hundreds of thousands of {dollars}. However inside hours of its debut, the token’s value collapsed — dropping greater than 80% from its peak, in accordance with market information.

On-chain analysts and merchants shortly accused the mission of a rug pull, a situation through which insiders withdraw liquidity from a token to the detriment of atypical buyers.

The coin hit $580 million in market cap earlier than crashing -80% in a matter of minutes. Practically $500 million in market cap was misplaced, as of earlier January 13.

Social media and buying and selling boards erupted with criticism. Many within the crypto house noticed this dump coming.

Some retail merchants accused the coin’s sample as a basic pump-and-dump scheme, whereas others questioned the token’s sparse disclosures, restricted technical particulars, and the absence of named companions or a working mission roadmap.

The case for Bitcoin

Right here we go once more. This basic second and rug pull exhibits the dangers inherent within the broader memecoin and altcoin market and makes a robust argument for Bitcoin’s relative stability.

Initiatives like this are vulnerable to massive liquidity withdrawals, both instantly after a token’s launch or because it reaches new highs. Reputation alone could make it straightforward to draw patrons, giving insiders a chance to promote. After they do, it usually triggers sharp value drops and vital investor losses — practices which might be manipulative and, frankly, resemble a rip-off.

Bitcoin, in distinction, provides an extended monitor report, clear issuance, and decentralized governance. Its mounted provide and consensus mechanisms are its key to resilience, setting it aside from short-lived tokens with concentrated management or opaque buildings.

Eric Adam’s token exemplifies recurring pitfalls we see in speculative, celebrity- or politically branded cash: opaque tokenomics, centralized provide, and sudden collapses that depart retail buyers uncovered.

Bitcoin’s structure is designed to mitigate these dangers via decentralized proof-of-work safety and a predictable issuance schedule. Bitcoin’s a long time‑lengthy resilience has stood the take a look at of any speculative churn coming from memecoins.

Crypto pump-and-dump schemes like this one from Eric Adams actually spotlight why Bitcoin stands aside from the broader crypto market.