Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

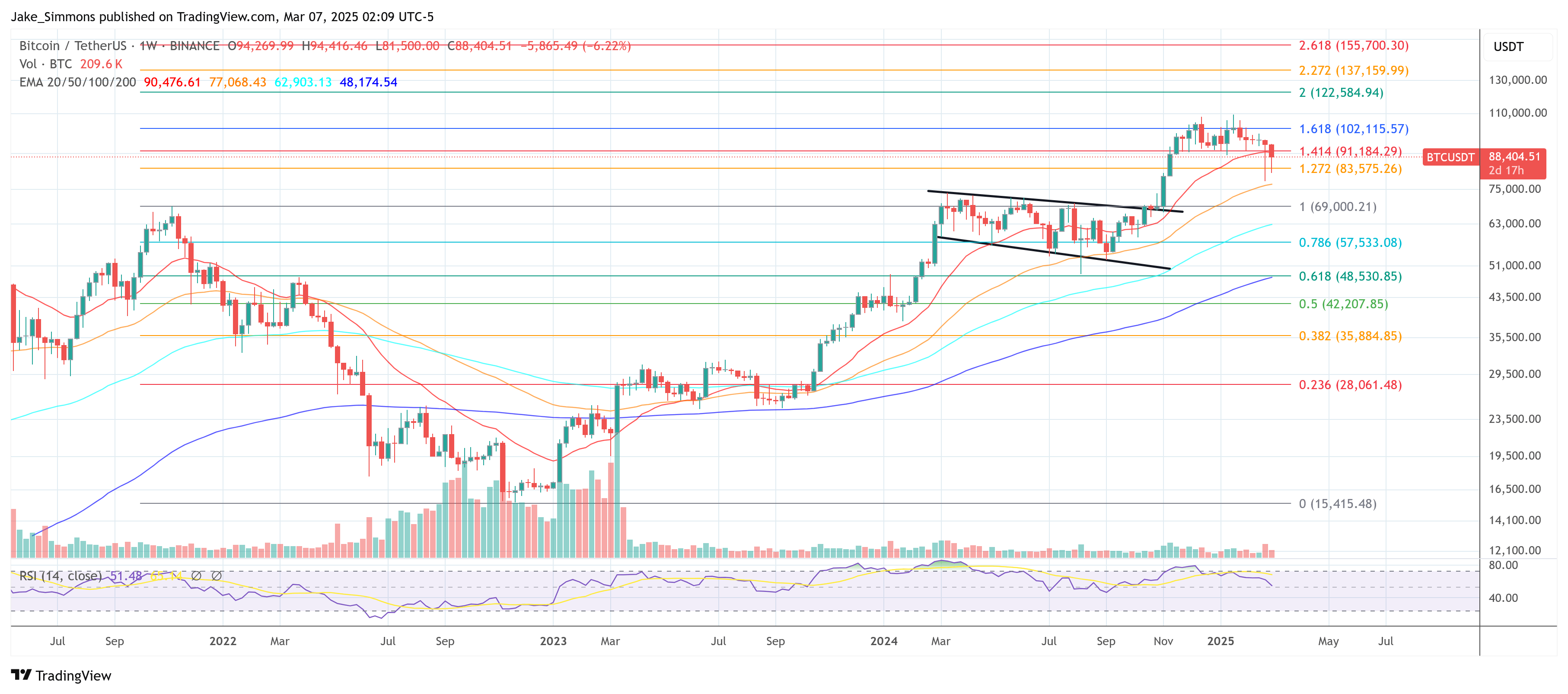

This week, the US Greenback Index (DXY) has recorded considered one of its largest three-day adverse performances in latest historical past. Since Monday, the DXY is down -5.4%, falling from 109.881 to 103.967—an occasion some market observers interpret as a bullish inflection level for Bitcoin. Jamie Coutts, Chief Crypto Analyst at Actual Imaginative and prescient, has drawn on historic comparisons to argue that the steep DXY decline might portend a big upswing on the earth’s largest cryptocurrency by market capitalization.

DXY’s Historic Drop Indicators A Main Bitcoin Rally

Coutts introduced the findings of two historic backtests on X, detailing how comparable DXY drops have coincided with pivotal moments in Bitcoin’s worth cycles. He wrote: “When this latest transfer within the DXY via a historic lens, it’s difficult to be something however bullish. I ran a sign display for 3-day adverse strikes of greater than -2% & -2.5% and located they’ve all occurred at Bitcoin bear market troughs (inflection factors) or mid-cycle bull markets (development continuations).” Though the statistical significance is restricted by Bitcoin’s comparatively quick buying and selling historical past, Coutts underscored that these knowledge factors are nonetheless price contemplating.

Associated Studying

In his first backtest overlaying DXY declines of greater than -2.5%, Coutts discovered such a situation on eight events since 2013. Over a 90-day interval following these declines, Bitcoin rose each single time, giving it an ideal 100% win fee. The common return was +37%, which might translate to an estimated BTC worth of round $123,000, whereas a transfer of 1 normal deviation above that common reached +63% (roughly $146,000 BTC). Even within the worst occasion, Bitcoin nonetheless managed to achieve 14%, placing it round $102,000 BTC.

In his second backtest specializing in DXY declines of greater than -2.0%, there have been 18 such occurrences since 2013, and Bitcoin was up 17 out of these 18 occasions for a 94% win fee. The common 90-day return stood at +31.6%, near $118,000 BTC, whereas a one normal deviation transfer was +57.8% (round $141,000 BTC). The worst 90-day return after such a DXY drop was -14.6% (roughly $76,500 BTC).

Associated Studying

Acknowledging that these backtests can not provide ensures, Coutts acknowledged, “I made a daring name yesterday about new highs by Could. I attempt to base projections on sturdy knowledge factors. Ofc this time could be totally different. Let’s see.”

Analysts typically view a declining DXY as an indication of enhancing danger urge for food in international markets, which might favor various shops of worth and danger property, together with Bitcoin and different cryptocurrencies. The US Greenback Index’s abrupt retreat comes on the heels of regulatory issues and a difficult February for Bitcoin, but Coutts maintains that the bigger development appears to be like remarkably just like historic factors of resurgence.

He additionally famous in a submit from the day prior to this: “Don’t suppose folks perceive the importance of the DXY transfer up to now 3 days and what it means for Bitcoin. […] The DXY noticed its 4th largest adverse 3-day transfer—massively liquidity-positive. Simply as Bitcoin nuked and had its worst Feb in a decade. In the meantime, in altcoin land, the High 200 crypto index puked yet another time. The chart reveals that three hundred and sixty five days of New Lows hit 47%, an indicator of capitulation in a bull cycle. The stage is about for a brand new all-time excessive in Bitcoin and High 200 combination market cap by Could.”

At press time, BTC traded at $88,404.

Featured picture created with DALL.E, chart from TradingView.com