A big, dormant Bitcoin pockets moved a large quantity of cash to an trade on Thursday, rattling merchants and reigniting debate about the place massive holders stand.

Associated Studying

In line with on-chain information, a Satoshi-era pockets that had not moved funds for 13 years transferred roughly 12,000 BTC — about $1.4 billion at present costs — in a set of transactions that landed on an trade ledger.

Whale Strikes Stir Markets

Stories have disclosed that the transfers got here as Bitcoin hovered close to a key worth band. The coin fell about 2% after the exercise, a fast response as merchants guessed the funds could be put up on the market.

BREAKING

SATOSHI ERA WHALE JUST SOLD 12,000 $BTC AFTER 13 YEARS OF HODLING.

HE MADE A MIND BLOWING $1.4 BILLION – ONE OF THE MOST PROFITABLE ON-CHAIN SALES EVER.

MASSIVE CRYPTO SELL-OFF INCOMING?? pic.twitter.com/NvCo9mamzT

— 0xNobler (@CryptoNobler) November 13, 2025

Some market watchers warned that if bigger promote orders hit exchanges, positions utilizing borrowed cash may very well be pressured to shut, which might make worth strikes sharper.

Others stated the market’s temper was extra nervous than panicked; giant transfers usually spark nervousness even when no instant sale follows.

Technical Stress Round Resistance

Outstanding analyst Ted commented that Bitcoin is dealing with stiff resistance round $104,000–$105,000. In line with his view, holding above $105,000 might encourage renewed shopping for and push costs towards $107,000.

If that fails, he warned that the subsequent clear assist sits close to $100,000. Merchants will watch order books and trade flows carefully in coming periods to see whether or not the transferred cash are transformed to fiat or just shifted between wallets.

Lengthy-Time period Holders Take Earnings

Primarily based on studies from Chris Kuiper, CFA, the broader promoting strain seems pushed extra by long-term holders than by panicked sellers.

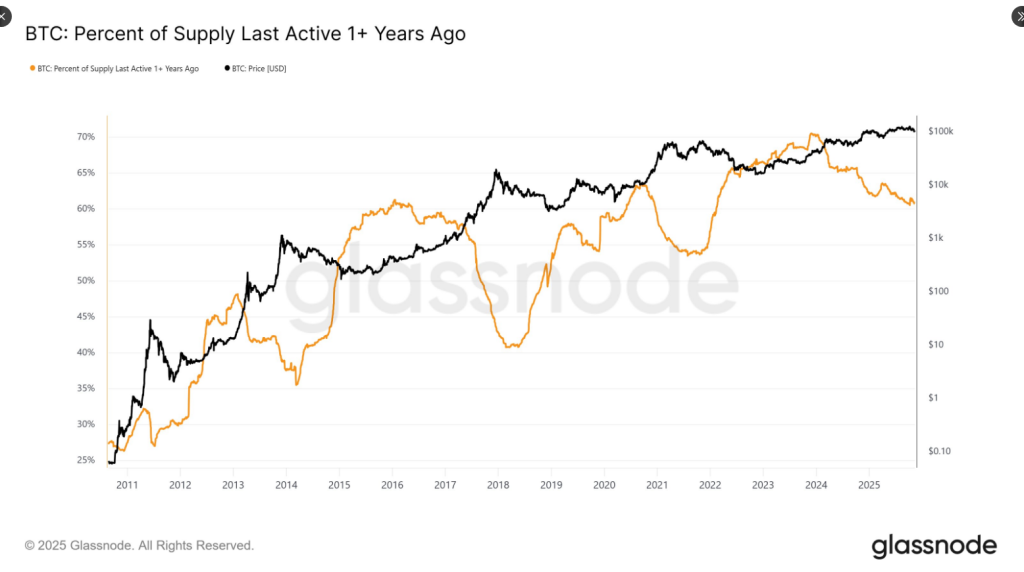

Kuiper pointed to the share of Bitcoin that has remained inactive for one 12 months or longer. That metric often climbs in sluggish markets and drops sharply throughout quick rallies.

This time, the decline has been gradual. The sample suggests regular profit-taking over time relatively than a sudden exodus.

“Who’s promoting?”

Is the primary query I’ve been getting concerning #bitcoin‘s continued worth strain in opposition to a backdrop of seen shopping for (by ETPs, companies and so on.)

I’m not distinctive in suggesting it’s the long-term holders (or HODLers).

However one information level that offers… pic.twitter.com/9PVoolrtwm

— Chris Kuiper, CFA (@ChrisJKuiper) November 12, 2025

Market observers say gradual gross sales match a maturing market the place older holders lock in features with out making an attempt to time an ideal prime.

The place previous cycles noticed abrupt strikes from giant dormant wallets, the present development seems extra measured. That doesn’t rule out short-term volatility, nevertheless it adjustments how merchants interpret massive transfers.

Associated Studying

For now, the market’s subsequent strikes will possible be set by a mixture of on-chain flows and the way worth behaves across the $104,000–$105,000 space.

Brief-term merchants will react to trade information. Lengthy-term traders might watch the inactive-supply metric and regulate plans extra slowly.

The switch of 12,000 BTC is an enormous piece of knowledge. How merchants act on it would decide whether or not this turns into a headline occasion or simply one other second in Bitcoin’s lengthy rise.

Featured picture from Unsplash, chart from TradingView