Este artículo también está disponible en español.

In a freshly shared four-hour chart of the DOGE/USDT buying and selling pair on Binance, crypto analyst Carlos Garcia Tapia warns of potential draw back for Dogecoin as weekend buying and selling approaches. “If bears break this sample, it’ll get ugly… particularly for the reason that weekend is coming,” Tapia warns.

Dogecoin Value Crash Incoming?

His chart posted through X depicts an ascending wedge formation working right into a confluence of resistance between $0.338 and $0.343, in addition to a notable assist zone within the $0.31 area.

The chart highlights greater lows (marked as “LL” on the chart) forming the decrease boundary of an ascending wedge. In the meantime, overhead resistance (an oblong zone round $0.338–$0.343) has repeatedly capped upward worth actions. This wedge seems to be compressing worth motion—typically a setup for a big breakout or breakdown.

A horizontal resistance zone round $0.34 stands out. DOGE’s worth has tried a number of short-term strikes above this degree however did not safe a confirmed breakout, suggesting sellers are firmly defending that zone.

Associated Studying

On the draw back, a inexperienced field spanning roughly $0.310 marks an space the place shopping for curiosity has traditionally picked up. Under that degree, the chart references a decrease assist marker close to $0.262, indicating a extra substantial potential drop if the wedge sample breaks down decisively.

The analyst particularly factors to the upcoming weekend as a wildcard. Traditionally, decrease buying and selling volumes on Saturdays and Sundays can exacerbate volatility. If Dogecoin fails to carry its rising pattern line—at present close to $0.328–$0.330—and liquidity thins out, the value might swiftly take a look at the decrease assist round $0.310, or probably slide towards the $0.262 zone if the promoting momentum accelerates.

Associated Studying

Whereas a breakout above $0.343 might invalidate this bearish setup, Tapia’s cautionary observe underscores the importance of a possible breakdown from the wedge formation. Weekend worth motion typically diverges from midweek patterns because of decreased participation, which means a pointy transfer in both course might unfold extra shortly than normal.

DOGE Wants To Maintain $0.31

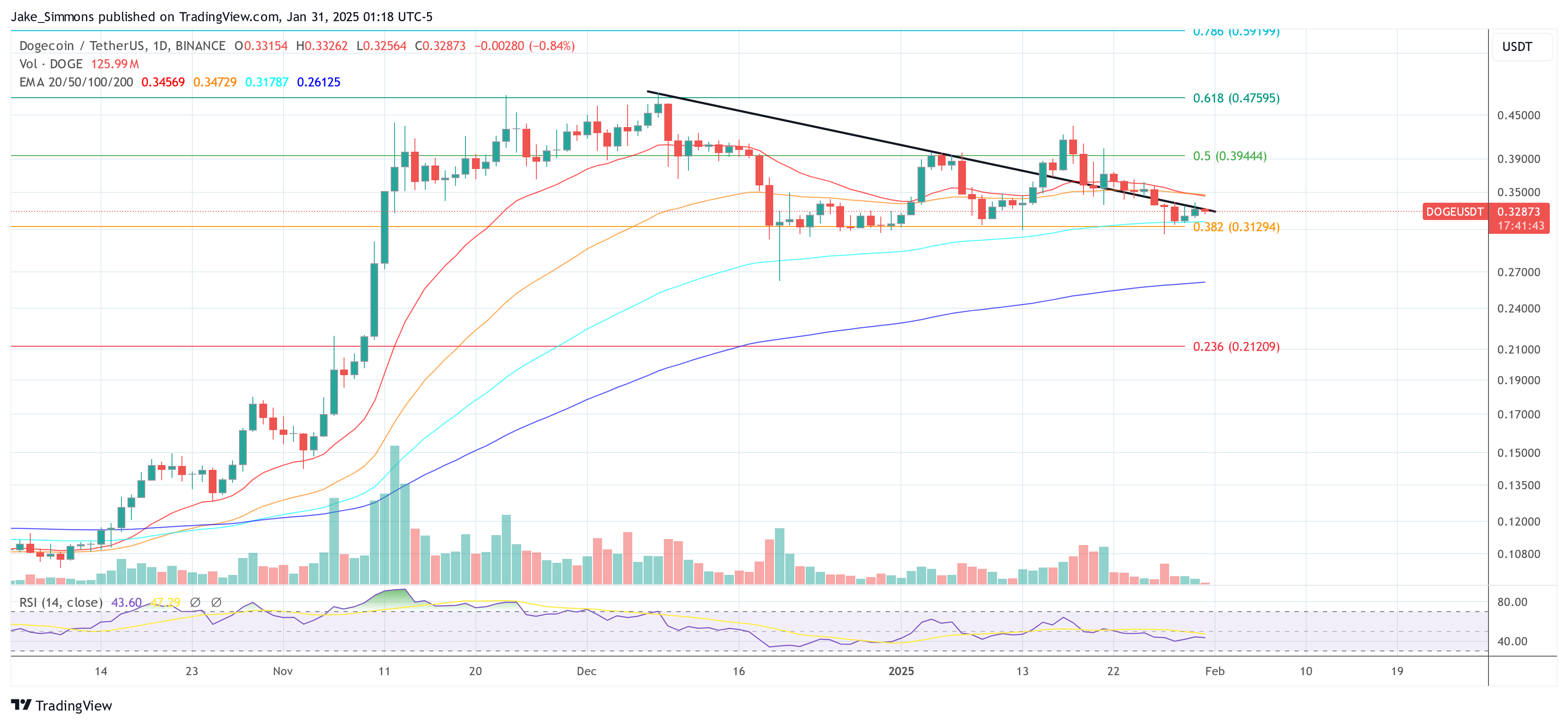

The each day chart helps Tapia’s thesis. There, Dogecoin (DOGE) finds itself below intensifying downward strain as worth motion hugs a persistent downtrend line. After hitting a neighborhood excessive in December, DOGE has retreated under key exponential shifting averages (EMAs). The 20-day EMA (at present at roughly $0.3457) and the 50-day EMA (close to $0.3473) have each curved decrease, signaling waning short-term momentum.

A look on the chart reveals that DOGE is now simply barely above the 0.382 Fibonacci retracement degree, calculated round $0.313. This Fib zone has acted as essentially the most essential assist since mid-December, however any decisive each day shut beneath it might speed up promoting. Merchants are maintaining an in depth eye on the 100-day EMA (round $0.3179), which is sandwiched simply above this Fib degree.

If the value fails to defend the realm between $0.313 and $0.317, then eyes will flip to the 200-day EMA at roughly $0.2613 as a important long-term assist. If this degree breaks to the draw back as effectively, the 0.236 Fib at $0.212 might shortly turn into a actuality.

Featured picture created with DALL.E, chart from TradingView.com