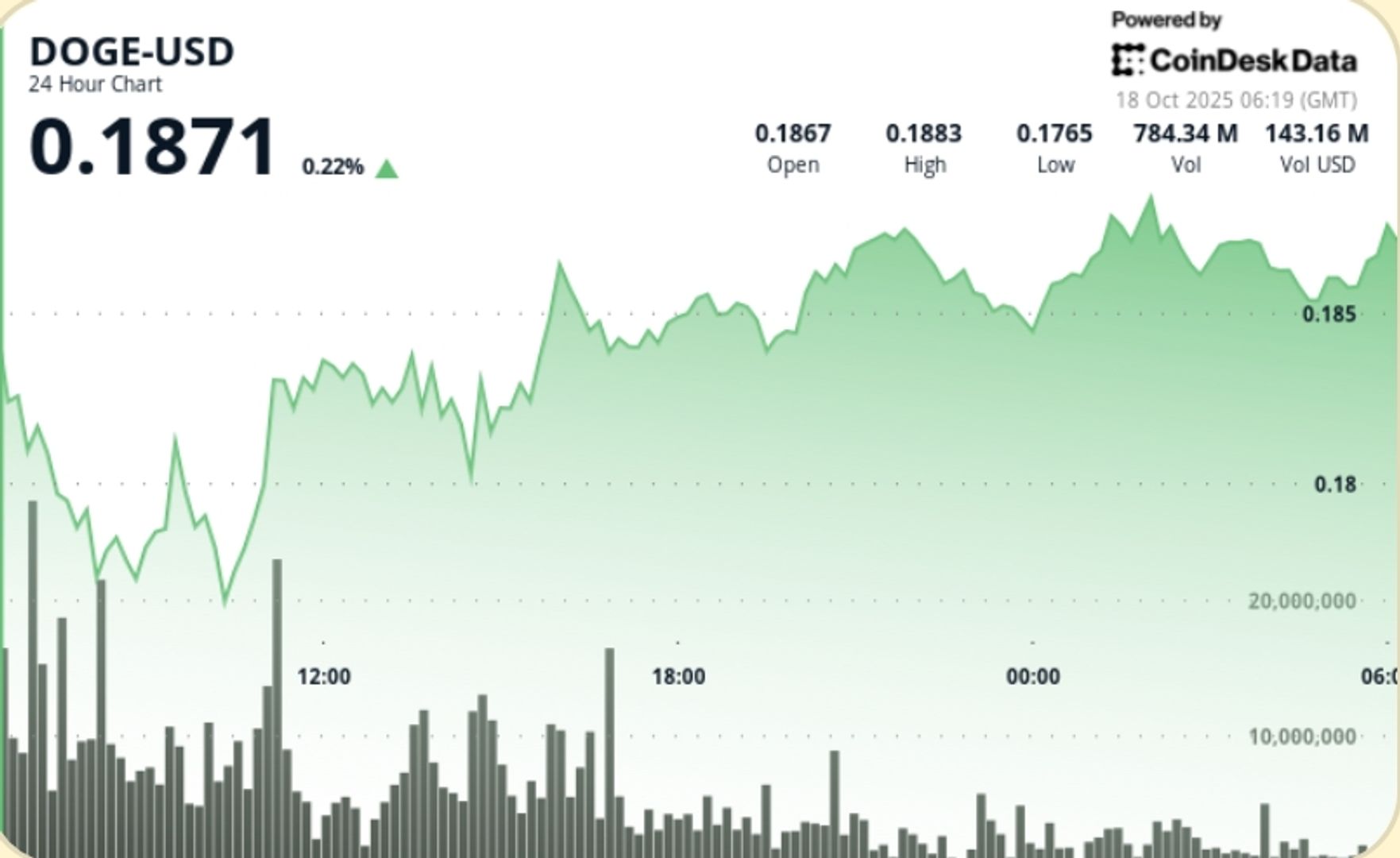

Dogecoin stabilized Friday after early volatility noticed worth drop to $0.176 earlier than recovering into a good $0.18–$0.19 vary. The session’s 7% swing got here amid renewed macro jitters and experiences of enormous whale liquidations totaling over $74 million.

What to Know

• DOGE traded between $0.176 and $0.189 by Oct 17, 06:00 – Oct 18, 05:00, a 6.7% vary.

• Buying and selling volumes topped 1.4B in the course of the 07:00–08:00 UTC selloff, setting robust assist close to $0.18.

• Giant holders reportedly offloaded 360M DOGE ($74M) as broader crypto markets dropped 6% on tariff headlines.

• Worth rebounded steadily to shut round $0.186, forming greater lows throughout afternoon periods.

• Futures positioning remained blended as merchants weighed Fed coverage indicators towards inflation dangers.

Information Background

The morning dip tracked cross-market weak spot following the Trump administration’s 100% tariff declaration on Chinese language imports — a transfer that despatched threat belongings decrease throughout Asia. DOGE confronted early liquidation strain however discovered stability as whales and market makers absorbed provide close to $0.18. Analysts famous heavy focus of bids round that stage, suggesting accumulation fairly than capitulation. In the meantime, spinoff funding charges normalized after a quick spike in brief positioning, indicating sentiment is stabilizing.

Worth Motion Abstract

• Sharp decline from $0.188 → $0.176 at 07:00 UTC on >1.4B quantity — the day’s capitulation transfer.

• Restoration by mid-session noticed DOGE reclaim $0.184–$0.187, consolidating for the rest of the day.

• Closing hour (04:22–05:21 UTC): check of $0.1853 low met with 10.5M quantity spike, adopted by regular bounce to $0.1862.

• Resistance persevered at $0.188–$0.189 zone with a number of failed breakout makes an attempt.

• Tight late-session vary ($0.1860–$0.1862) and declining quantity sign positioning pause forward of catalysts.

Technical Evaluation

• Assist – $0.175–$0.180 stays vital accumulation zone; consumers defended lows with excessive conviction.

• Resistance – $0.188–$0.190 marks higher consolidation band; breakout might goal $0.20+.

• Quantity – Peak exercise at 1.4B; quantity compression late session helps equilibrium formation.

• Sample – Slim band consolidation following morning flush signifies volatility coil.

• Momentum – RSI impartial close to 49; MACD flattening — neither pattern dominant but.

What Merchants Are Watching

• Affirmation of $0.18 as short-term base forward of weekend periods.

• Renewed whale flows — whether or not accumulation continues after $74M disposal.

• Potential rotation into meme belongings amid ETF optimism subsequent week.

• Fed commentary on tariffs and liquidity influence on speculative flows.

• Breakout above $0.19 as set off for retest of $0.20–$0.21 zone.