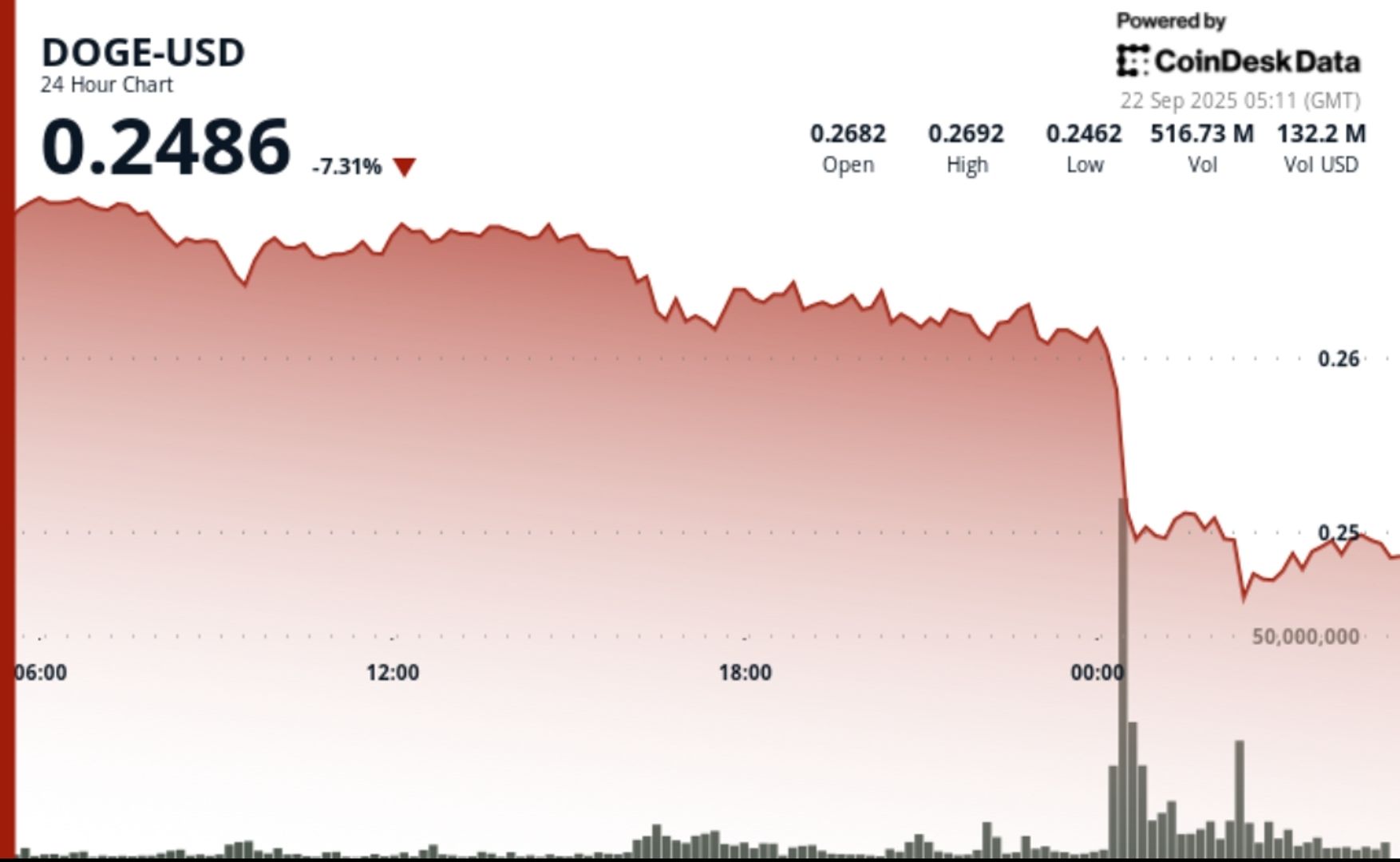

Dogecoin endured a pointy in a single day selloff, sliding from $0.27 to $0.25 throughout the September 21–22 session, as institutional merchants offloaded positions on document volumes exceeding 2.15 billion tokens.

The midnight rout carved by means of help ranges and established contemporary resistance zones, leaving DOGE consolidating round $0.25 as merchants monitor for restoration or continuation decrease.

Information Background

• DOGE fell 7% over the 24-hour interval ending September 22 at 02:00, retreating from $0.27 to $0.25.

• Midnight buying and selling noticed a collapse from $0.26 to $0.25 on document 2.15 billion quantity, dwarfing the 24-hour common of 344.8 million.

• Analysts flagged a “1-2 sample” formation that has traditionally preceded DOGE breakouts above $0.28–$0.30.

Value Motion Abstract

• DOGE’s vary spanned $0.02 (≈8%) between a $0.27 excessive and $0.25 low.

• Resistance solidified close to $0.27 following repeated rejections.

• Institutional help emerged round $0.25, with restoration makes an attempt maintaining DOGE anchored above this degree.

• Within the ultimate hour (01:14–02:13), DOGE bounced inside a slender $0.25–$0.25 channel, exhibiting accumulation patterns with spikes at 01:25 and 02:03.

Technical Evaluation

• File 2.15B tokens traded throughout the midnight dump confirms heavy institutional exercise.

• Help confirmed at $0.25; failure right here dangers extending decline towards $0.23.

• Key resistance sits at $0.27, with subsequent upside checks at $0.28–$0.30 ought to shopping for resume.

• Quantity spikes throughout restoration makes an attempt spotlight potential bottoming curiosity.

• Sample recognition: technicians establish a recurring “1-2 setup” according to prior rally buildings.

What Merchants Are Watching

• Whether or not $0.25 can maintain as sturdy help after document liquidation flows.

• Institutional positioning across the $0.28–$0.30 resistance band if restoration good points traction.

• Comply with-through volumes in upcoming classes to verify whether or not accumulation or additional distribution dominates.

• Broader sentiment impression from ETF delays and ongoing regulatory uncertainty.