Including to the surprising downward jobs progress revisions on Friday — which despatched crypto costs tumbling — the ISM Providers PMI abruptly is starting to constantly point out softer-than-though financial exercise.

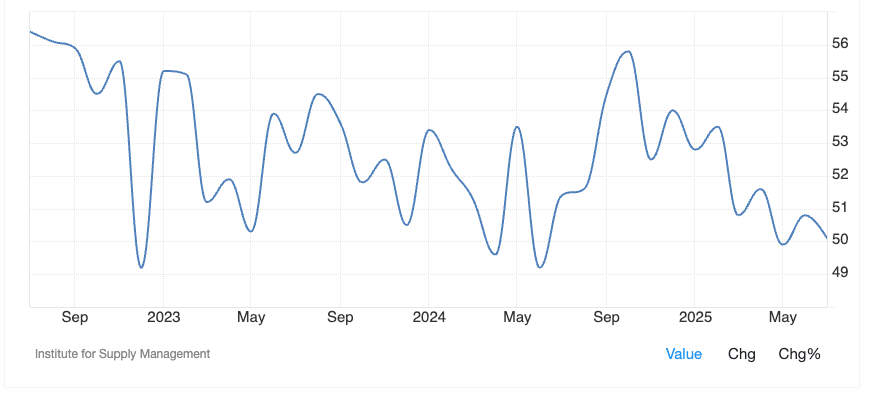

The ISM Providers for July got here in at 50.1, sizably decrease than the 51.5 anticipated. A quantity above 50 signifies financial growth, and under that degree contraction.

The tender print is notable because it's now a three-month sample of weak point, with Might's quantity having been 49.9 and June's 50.8 — a really notable slowdown from earlier months.

Compounding that signal of financial weak point was a stagflationary sign embedded within the report, the Costs Paid subindex, which shot as much as a cycle excessive of 69.9.

“Tariffs are inflicting extra prices as we proceed to buy tools and provides … the associated fee is important sufficient that we’re suspending different tasks to accommodate these price modifications,” learn one remark from the report.

Neither crypto nor conventional markets took kindly to the Tuesday information, with bitcoin (BTC) pulling again from above $114,000 to $112,800, decrease by practically 2% over the previous 24 hours. The Nasdaq reversed from earlier good points to a 0.5% loss.

Fed reduce now?

“The information all the time suffers massive revisions when the economic system is at an inflection level, like a recession,” wrote economist Mark Zandi after the large downward jobs revisions Friday.

“The economic system is on the precipice of recession,” he continued. “Client spending has flatlined, development and manufacturing are contracting, and employment is about to fall. With inflation on the rise, it's robust for the Fed to return to the rescue.”

Longtime managers at Hoisington Funding Administration, Lacy Hunt and Van Hoisington aren't so positive the Fed can wait. Calling inflation good points from tariffs momentary and a first-round impact, Hunt and Hoisington say the second, third and later spherical contractionary results are of much more import.

“The Fed must be shortly shifting to an accommodative coverage,” they concluded. “The Fed can be ailing suggested to attend … The much more important consideration is the approaching contraction in international financial exercise.”