After a reasonably optimistic mid-year efficiency, U.S. crypto media visits fell by roughly one-third within the fourth quarter of 2025.

This coincided with the market’s sharp downturn and Bitcoin’s abandonment of hopes of hitting $150,000 by the tip of the 12 months.

Abstract

- Whole visits to U.S. crypto-native websites fell by roughly 33% quarter-over-quarter.

- Regardless of general visitors shrinking, direct visitors accounted for nearly half of all guests – 44%.

- The informal crowd pulled again, however loyal readers saved exhibiting up.

What mattered most was the place the remaining consideration got here from: readers who stayed had been coming instantly, out of behavior. When markets are scorching, consideration comes from all over the place. When issues quiet down, most of that visitors disappears, and what’s left is the regular reader base that comes again on goal, not by chance.

That’s why direct visitors turned the anchor in This autumn, whilst informal discovery light out.

Naturally, the additional eyeballs that had been very throughout the peak of the bull run began disappearing when markets soured.

Our newest Outset Knowledge Pulse evaluation signifies that what’s described as “summer season vacationers,” that’s, informal readers drawn by the bull market, left as shortly as they got here. Earlier within the 12 months, many of those readers had been looking out on Google for subjects like “Ought to I purchase Bitcoin now?” or clicking on trending hyperlinks on X and Reddit.

By the fourth quarter, with no new all-time highs or memecoin rags-to-riches story dominating headlines, that inflow of informal visitors merely evaporated. As soon as the informal viewers dropped off, the actual form of the U.S. crypto media market got here into focus. This pattern performed out almost identically in Asia all through the third quarter. The summer season hype introduced an inflow of tourists for a couple of months earlier than it ended.

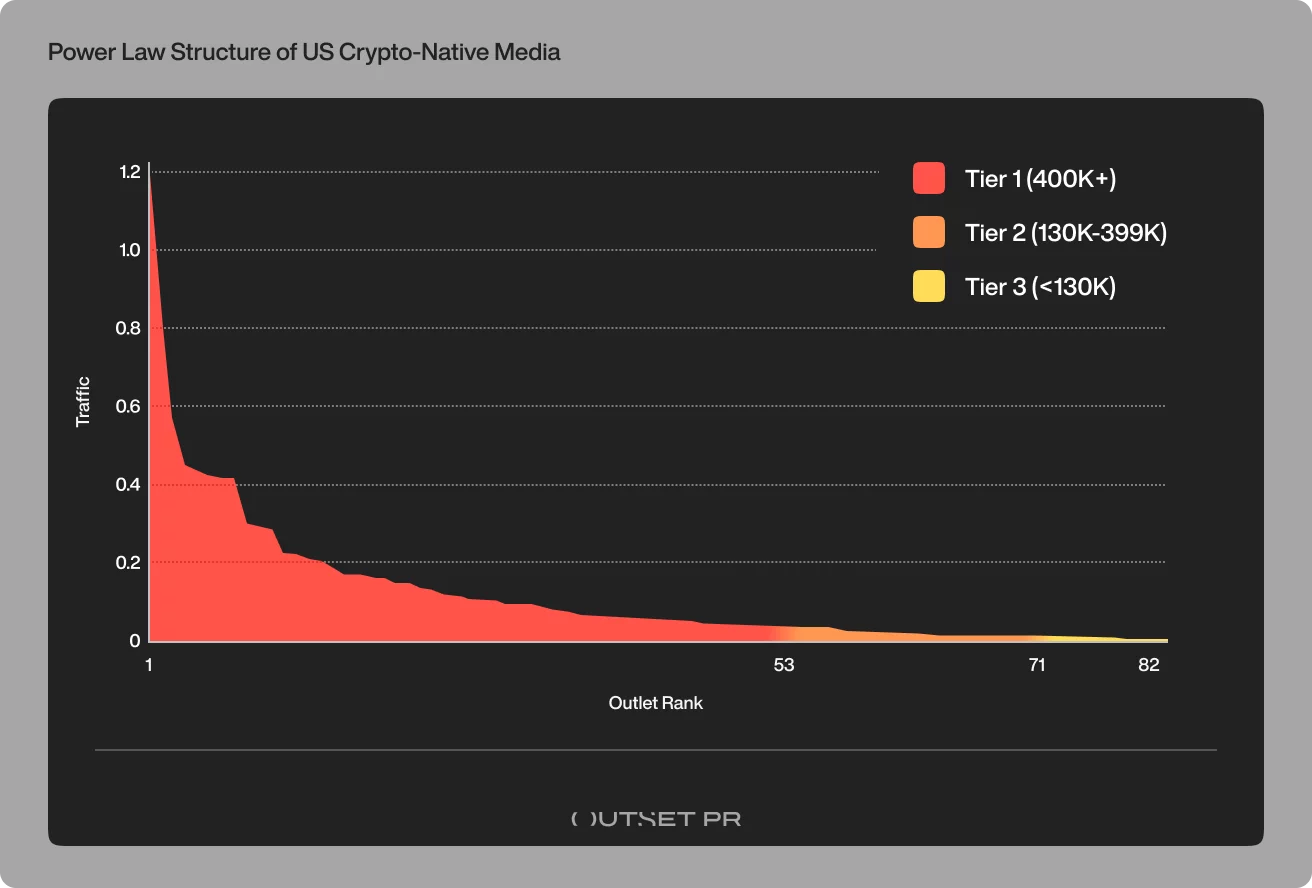

What remained was a market more and more outlined by focus: in This autumn, simply 53 publishers captured greater than 95% of all crypto-native visitors, underscoring how uneven visibility has develop into. Latin America wasn’t a lot completely different. In our earlier report, simply six websites pulled in almost 70% of all visitors throughout 38 crypto-only shops.

This autumn’s visitors crash hid surge in direct-only readers

Search and social visitors had been the primary channels to provide manner. That is smart: when crypto is transferring quick, informal readers usually arrive by way of no matter is circulating on social media.

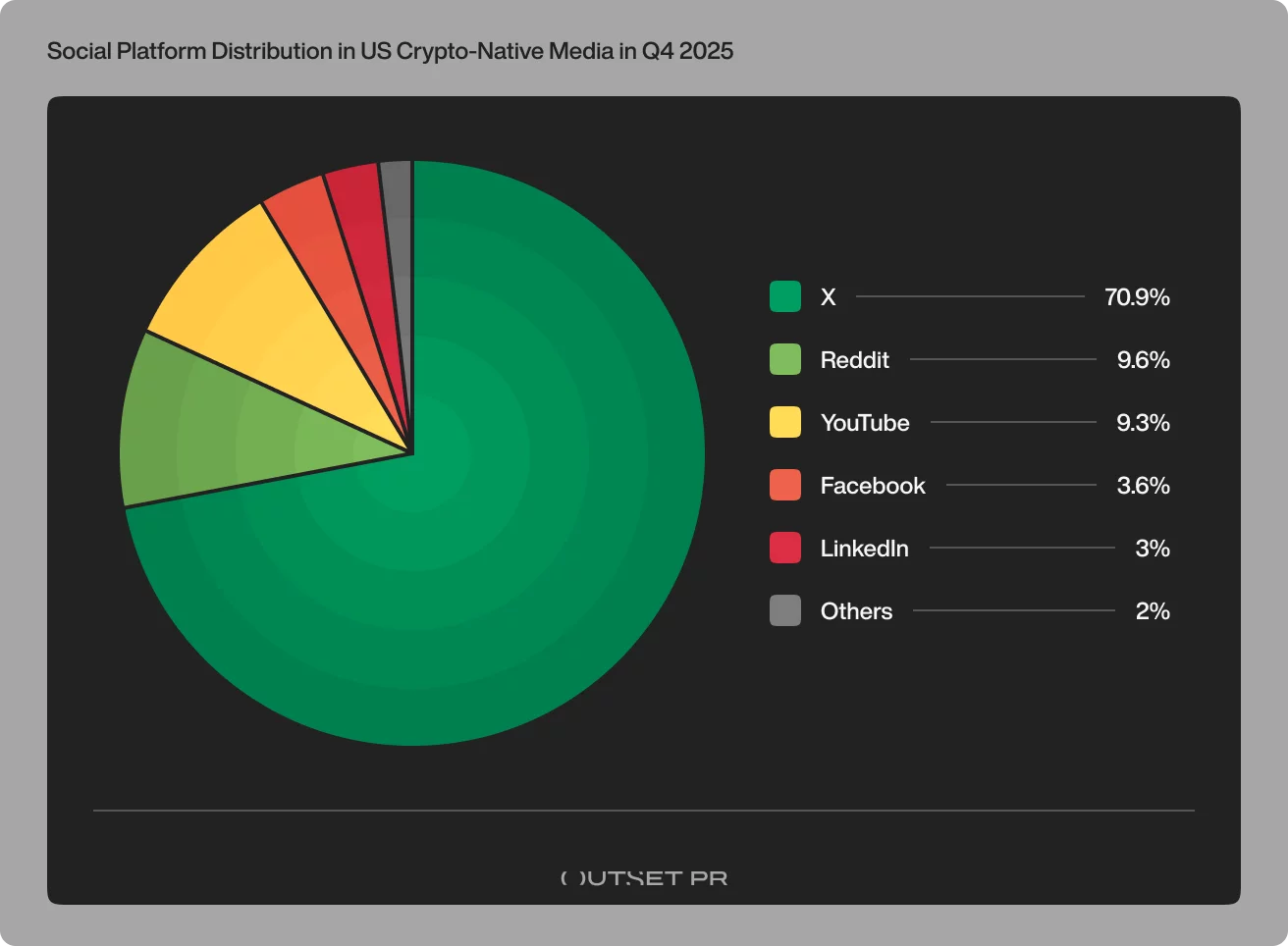

However within the U.S., “social discovery” successfully meant X. In This autumn, greater than 70% of all social visitors throughout crypto-native shops got here from a single platform, whereas the remaining networks: Reddit, YouTube, Fb, LinkedIn contributed solely small fractions.

Social itself was a comparatively skinny layer general, representing solely about 6% of complete visitors, which meant most publishers had been uncovered to a small channel that was nearly fully depending on one platform.

“As soon as the feeds cool down, what’s left is the viewers that comes intentionally, the individuals who already know the place to go,” stated Maximilian Fondé, senior media analyst at Outset PR. “That’s when direct visitors stops being simply one other channel and turns into the principle factor holding publishers up.”

The This autumn numbers bear this out in dramatic style. As search and social weakened, one other discovery layer started to face out: AI instruments already drove roughly 25% of all referral visitors throughout U.S. crypto-native media, creating a brand new visibility filter alongside direct readership.

At the same time as complete visits plunged, almost half of all remaining visitors got here from readers navigating on to crypto websites. This was the strongest direct share we noticed throughout any area in current knowledge.

What this implies is sort of one out of two visits to American crypto press web sites got here from a reader who meant to be there, not by way of some exterior search or immediate. That’s the general image, however for some shops, direct visitors was mainly the entire story. Bankless pulled in nearly 58% direct visits, which is about as shut as crypto media will get to a built-in viewers.

These aren’t unintended clicks however a extra crypto-savvy crowd, consisting of merchants checking the information, analysts maintaining with trade updates, or long-term buyers ensuring they by no means miss a possibility.

Why direct readers are the loyal core of crypto media

Direct visitors in This autumn mirrored a dedicated reader base that continued returning whilst broader curiosity cooled. As Maximilian Fondé beforehand noticed,

“Each direct go to displays intent, not likelihood.”

Even when speculative curiosity wanes, there’s nonetheless a serious viewers for crypto information. On the identical time, the broader ecosystem operates beneath a strict energy legislation: under the highest tier, smaller shops face rising boundaries to discovery no matter output or high quality.

If fewer newbies are googling “subsequent 100x coin”, the websites that thrive are those with a bookmark on their loyal reader’s browser. This can be a testomony to the stickiness of crypto manufacturers that provide belief, reliability, truthful reporting, and credibility.

They may not be sharing as many articles on Fb or rating on Reddit, however they’re nonetheless attracting readers. That is the bottom of customers who will go to their favourite crypto information websites by way of thick and skinny.

When direct loyalty turns into the one actual moat

The rise in direct visitors doesn’t simply replicate stronger reader habits. It additionally displays how concentrated the U.S. crypto media market has develop into.

Our tier evaluation exhibits that that is not an ecosystem the place consideration is broadly distributed. In This autumn, tier-1 shops (publishers with greater than 400,000 month-to-month visits) absorbed 95% of all crypto-native demand. That prime tier alone accounted for greater than 101 million visits throughout the quarter.

Under that, the image adjustments sharply. Tier-2 shops, regardless of working at significant scale, accounted for simply over 4% of complete visitors, whereas tier-3 publishers accounted for lower than 1%. The “center class” of crypto media has largely vanished.

“At this level, competitors principally occurs inside the highest tier,” stated Fondé. “Under that, catching up turns into structurally tough, no matter editorial high quality.”

For this reason direct readership issues a lot. In a market formed by compounding visibility, publishers can not depend on discovery alone. Search, social, and now AI referrals more and more reinforce the identical incumbents. Direct visitors is among the few channels that smaller or mid-tier shops can really personal.

In follow, the This autumn contraction clarified what retains shops alive. The publishers that held up greatest weren’t those chasing volatility-driven clicks. They had been those with readers who nonetheless typed the URL, opened a bookmark, or returned out of routine.

In a market like this, the readers who come straight to you’re the solely consideration you actually personal. With that stated, the implications are clear for crypto web sites: cater to your core viewers. These are the readers who worth substantive reporting, as a result of that’s what retains them coming again.