Bitcoin is getting into a consolidation section, holding regular above the $100,000 mark however struggling to interrupt previous $105,000. The market seems to be stabilizing after weeks of volatility, but on-chain information alerts that profit-taking stays energetic. In response to prime analyst Darkfost, because the distinctive liquidation occasion in early October, many traders have began to safe earnings and cut back their publicity as the present cycle nears its finish.

Associated Studying

Knowledge from CryptoQuant reveals a notable uptick in Bitcoin inflows to Binance. The 30-day shifting common of day by day inflows has climbed sharply all through October, exhibiting that, on common, roughly 7,500 BTC are being transferred to Binance day-after-day. That is the very best influx charge because the March correction, indicating renewed promoting stress and cautious positioning amongst merchants.

Whereas such inflows usually replicate revenue realization and short-term promoting, Bitcoin’s skill to consolidate close to the $100K stage suggests resilient underlying demand. Patrons proceed to soak up the provision getting into the market, stopping a deeper breakdown — no less than for now. Because the cycle matures, this section might show essential in figuring out whether or not Bitcoin stabilizes for an additional leg up or faces a extra extended correction.

Quick-Time period Holders Add To Promoting Strain As Bitcoin Consolidates

Darkfost explains that the latest surge in Bitcoin inflows to Binance and different exchanges displays rising promoting stress throughout the market. Regardless of this, Bitcoin’s worth continues to consolidate comparatively cleanly across the symbolic $100,000 stage — an indication that current demand stays robust sufficient to soak up the elevated provide. This steadiness between distribution and accumulation signifies that the market is present process a structural reset relatively than a full-blown capitulation.

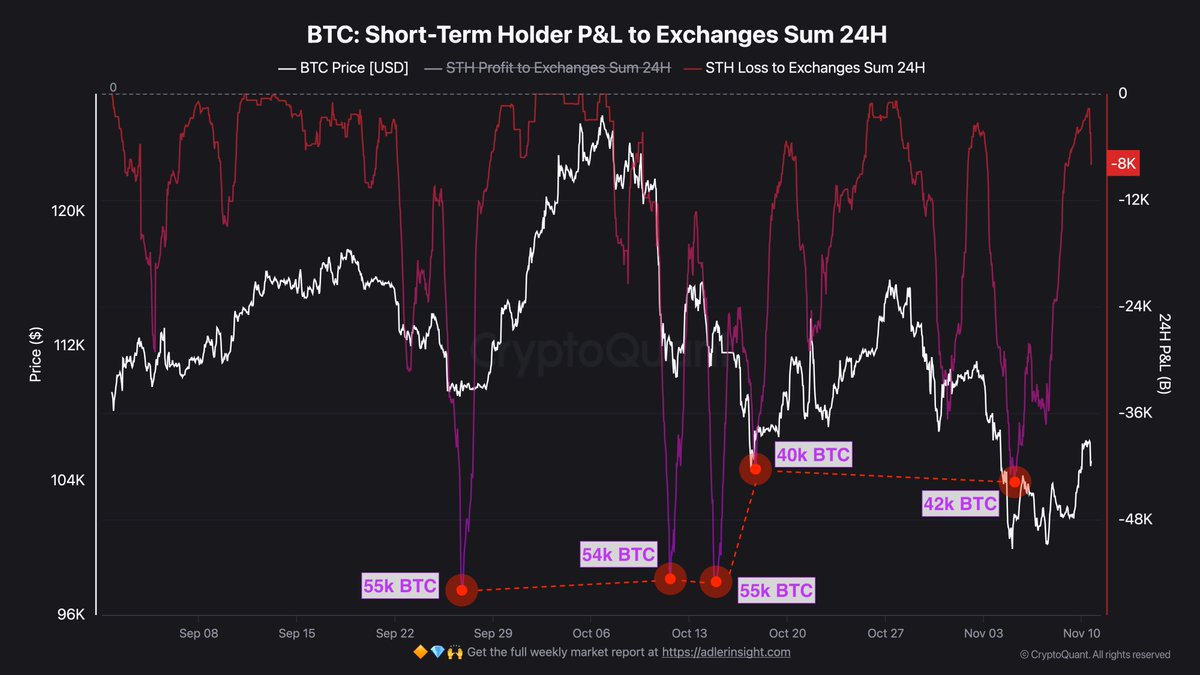

Including to this dynamic, short-term holders (STHs) have turn out to be a serious contributor to the continuing promoting stress. These members are sometimes probably the most reactive phase of the market, responding shortly to volatility and sentiment shifts. With a realized worth close to $112,000, many STHs have been underwater for a few month, prompting them to ship vital quantities of BTC to exchanges at a loss.

Traditionally, this kind of habits has coincided with late-stage corrections — what analysts usually name a “cleaning section.” Throughout such phases, speculative capital exits the market whereas long-term traders quietly soak up the provision, setting the muse for renewed stability and potential future development.

If demand continues to offset this wave of short-term promoting, Bitcoin might quickly type a stronger base above $100,000 — paving the best way for a gradual restoration as promoting stress fades and confidence returns.

Associated Studying

Weekly Chart: Holding the Line Above Key Assist

Bitcoin continues to consolidate inside a good vary between $102,000 and $107,000, exhibiting resilience across the essential $100K psychological stage. On the weekly chart, BTC stays supported by the 50-week shifting common (blue line), which is performing as a powerful dynamic flooring for worth. Regardless of a number of retests over latest weeks, bulls have managed to defend this stage, signaling that underlying demand stays intact at the same time as profit-taking intensifies.

The broader construction nonetheless factors to a wholesome long-term uptrend. The 100-week (inexperienced) and 200-week (crimson) shifting averages proceed sloping upward, confirming that Bitcoin’s macro bias stays bullish. Nonetheless, the shortage of robust quantity throughout latest rebounds means that market members are cautious, awaiting affirmation of renewed momentum earlier than including to positions.

Associated Studying

If Bitcoin manages to reclaim the $110K area, it might invalidate short-term bearish sentiment and set off a restoration towards the $117K–$120K resistance zone. Conversely, a weekly shut under $100K would mark a major technical breakdown, doubtlessly opening the door to a deeper retrace towards $92K–$95K.

Featured picture from ChatGPT, chart from TradingView.com