Disclosure: This text doesn’t signify funding recommendation. The content material and supplies featured on this web page are for academic functions solely.

As Bitcoin trades sideways in a well-known pre-breakout sample, investor consideration is quietly shifting towards utility-driven PayFi initiatives like Remittix that proceed constructing whereas the market waits.

Abstract

- Bitcoin’s present consolidation mirrors its 2020 construction, with tightening ranges and rising derivatives curiosity suggesting a possible growth part somewhat than weak point.

- Whereas BTC stays range-bound, capital is rotating into real-use initiatives, with Remittix elevating over $28.8 million because it prepares to launch its crypto-to-fiat PayFi platform in February 2026.

- Buyers are more and more pairing Bitcoin publicity with utility-focused platforms, positioning for each a possible BTC breakout and sustained development in payment-driven crypto adoption.

Bitcoin value (BTC) is once more buying and selling in a sideways vogue, and to the long-time market observers, the setup will not be new. The identical breaks occurred in 2020 when Bitcoin had a powerful breakout within the crypto market. At the moment, merchants concentrate on construction versus hype as a result of volatility is slackening and positioning is tightening. In the meantime, capital is secretly shifting to its utilization in initiatives which might be being constructed actually, similar to Remittix, which has raised over $28.8 million by promoting over 701 million tokens for $0.123 every.

This endurance in Bitcoin and rising consideration in the direction of PayFi is an indicator of a change within the perspective that the crypto buyers are taking available on the market. It’s not a query of the place the value of Bitcoin goes, however which initiatives are prone to acquire probably the most in case historical past repeats itself.

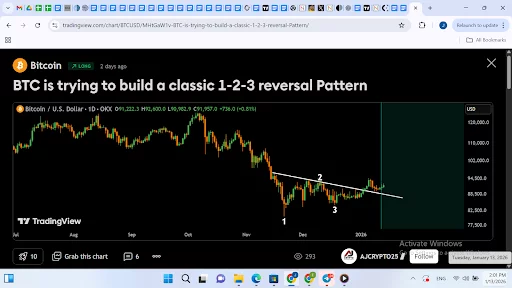

Bitcoin value prediction as construction compresses like 2020

The Bitcoin value conduct on the present second is characterised by tight consolidation, not weak point. Bitcoin is buying and selling above the Ichimoku cloud on the 4-hour chart, and this makes the short-term construction optimistic. Nonetheless, the follow-through by patrons has remained low, which suggests warning, versus fatigue. The realm of the market at $92,300 nonetheless has to restrict the upward strikes, and that is the primary goal that merchants are monitoring to confirm.

On the draw back, the help has taken form between $91,200 and $90,900, the place the help is $90,500, which is a vital pivot level. The broader construction wouldn’t be damaged so long as the Bitcoin value is above this zone. A decline under it might allow additional sinking to the extent of round $89,200 or $86,300, however this has not but been enforced by the sellers. Based on Kamran Asghar on X, the help zone can be pulled again if the resistance fails to carry.

The derivatives data agrees with the compression earlier than growth notion. There was a gradual enhance in open curiosity in futures open, and this means that merchants usually are not giving up. This has been a steady value and rising publicity mixture that in earlier cycles had led to large directional strikes prior to now. Spot market information, nevertheless, exhibits defensive positioning. Internet outflows dominate, suggesting bigger holders are defending liquidity somewhat than chasing value.

This steadiness between cautious spot flows and lively derivatives positioning is one purpose analysts evaluate the present Bitcoin value setup to 2020. Again then, Bitcoin spent months shifting sideways earlier than volatility returned in a significant approach. If historical past repeats, the following part might reward these positioned early somewhat than these chasing momentum.

Remittix PayFi affords utility whereas Bitcoin waits

Whereas the Bitcoin value stalls close to key ranges, Remittix is constructing momentum for a special purpose. As a substitute of relying on market cycles, it focuses on how individuals really use crypto in each day life. Remittix is a PayFi platform designed to make sending, receiving, and changing cash easy, particularly for customers who battle with sluggish banks and excessive charges.

The Remittix pockets is already stay on the Apple App Retailer, giving customers a working product at present. There may be an Android launch on the best way, and this will increase the attain to areas which might be experiencing the speedy development of crypto use. The largest achievement is the one which comes on February 9, 2026, when the crypto-to-fiat PayFi platform is launched. This replace allows people to switch worth amongst crypto straight into financial institution accounts and remodel digital assets into on a regular basis fee instruments.

This concentrate on actual issues is why curiosity within the token retains rising. Remittix will not be making an attempt to exchange Bitcoin or compete with store-of-value narratives. It enhances them by fixing funds. Proper now, provide is tightening as solely a restricted variety of tokens stay obtainable with a 200% allocation utilizing the RTX2026 promo code, which is drawing consideration from buyers positioning early.

Why Remittix is standing out on this market

- Constructed to unravel real-world fee and remittance issues

- Pockets is already stay and used for on a regular basis transfers

- Crypto to fiat PayFi launch scheduled for February 9, 2026

- Designed for freelancers, staff, and small companies

- Backed by an audited infrastructure and a verified growth crew

- Supported by main trade listings to enhance entry and liquidity

Not like pure hypothesis performs, Remittix grows as utilization grows. That creates demand even when the Bitcoin value is quiet.

Utility usually trails Bitcoin strikes

When the value of Bitcoin actually repeats the 2020 sample, the next breakout might reinvent the entire crypto market. Bitcoin will be the primary to leap, however historical past signifies that when utilization is rising sooner, utility-focused platforms are likely to obtain the most important share of consideration. In that atmosphere, PayFi initiatives constructed for actual funds are well-positioned.

Remittix matches that position by bridging crypto and on a regular basis finance. Whereas Bitcoin defines worth storage, Remittix defines worth motion. As buyers are about to enter the following stage, not as a response, however as an organization that’s about to reply, the mix of Bitcoin publicity and early PayFi positioning is how the market itself is taking form.

To be taught extra about Remittix, go to the web site and socials.

FAQs

1. What does the present Bitcoin value setup counsel for the broader crypto market?

The present Bitcoin value construction exhibits consolidation somewhat than weak point. This part usually seems earlier than bigger strikes in previous crypto cycles. The low volatility and tight ranges counsel merchants are ready for affirmation. If Bitcoin breaks increased, it often lifts general crypto market confidence, and that shift can set off renewed exercise throughout digital property and altcoins.

2. Why are crypto buyers trying past Bitcoin towards PayFi initiatives?

Many crypto buyers now need greater than value hypothesis, and PayFi initiatives concentrate on actual funds and on a regular basis monetary use. They help crypto adoption by fixing issues like sluggish transfers and excessive charges, which makes them enticing throughout each bull and bear market situations. Remittix is usually highlighted for combining utility with rising market curiosity.

3. How does Remittix match right into a long-term crypto funding technique?

Remittix focuses on shifting worth, not simply storing it like Bitcoin. Its PayFi mannequin helps real-world utilization by wallets and fiat bridges. This creates demand pushed by exercise, not solely market sentiment. It additionally enhances Bitcoin publicity by including sensible utility to a portfolio, and that steadiness appeals to buyers getting ready for the following part of crypto development.

Disclosure: This content material is supplied by a 3rd occasion. Neither crypto.information nor the writer of this text endorses any product talked about on this web page. Customers ought to conduct their very own analysis earlier than taking any motion associated to the corporate.