The crypto market slipped on Dec. 5, with Bitcoin and most altcoins being within the crimson as liquidations rebounded and open curiosity dipped.

Abstract

- The crypto market got here underneath strain on Friday, with Bitcoin and altcoins falling by over 2%.

- This decline coincided with the hovering liquidations and falling open curiosity.

- These tokens additionally dropped forward of a $4.5 billion choices expiry occasion.

Bitcoin (BTC) moved from over $93,000 earlier this week to under $90,000. Among the high laggards had been cash like Canton, MYX Finance, Aptos, Hyperliquid, Morpho, and Aerodrome Finance.

The crypto market crash coincided with an enormous drop in every day open curiosity within the futures market. It dropped by 4.35% to $127 billion, down from the October excessive of $225 billion.

The open curiosity has slipped as traders have continued to deleverage after the $20 billion wipeout on October 10. Most often, crypto costs stay underneath strain every time the open curiosity is in a downward pattern.

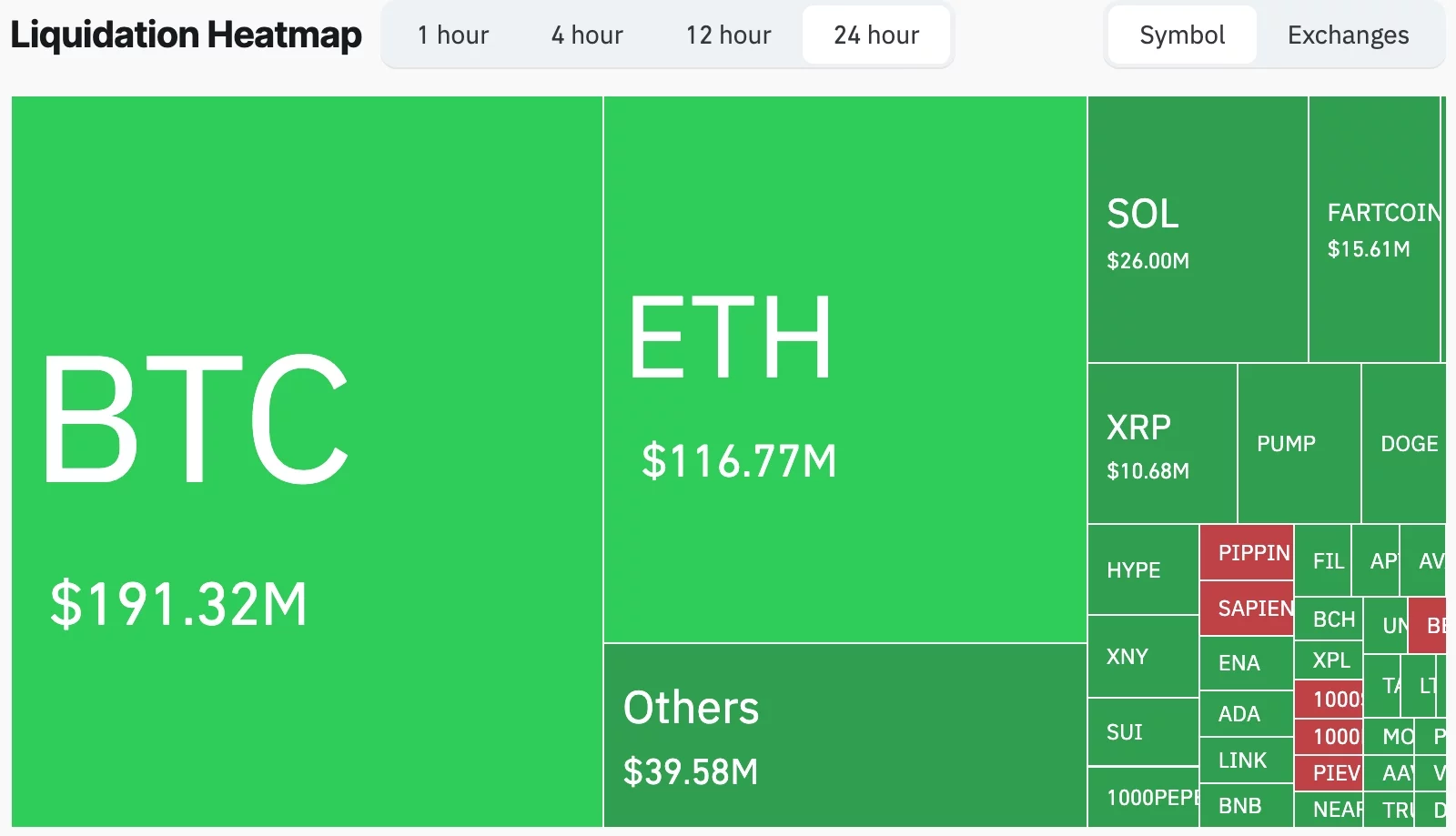

In the meantime, complete liquidations soared by over 75% from a day earlier. They rose to $491 million, with 135,667 merchants being worn out. Bitcoin liquidations rose to $191 million, whereas Ethereum jumped to $116 million. Among the different high liquidated tokens had been Solana, XRP, and Fartcoin.

Crypto costs usually drop sharply every time bullish liquidations are rising as a result of it will increase the quantity of promoting.

The continued crypto market crash is occurring forward of the choices expiry value over $4.8 billion. Bitcoin positions value over $3.5 billion will expire with a most ache of $91,000.

Alternatively, Ethereum choices are value over $700 million with a most ache of $3,050 expiring. Crypto costs typically expertise substantial volatility forward of and after a serious choices expiry occasion.

The crypto market crash can be taking place as traders ebook earnings after the current rebound, when Bitcoin rose from $80,000 to over $93,000 inside lower than two weeks.

Trying forward, the subsequent essential catalyst for Bitcoin and different altcoins would be the upcoming Federal Reserve rate of interest resolution, which is able to come out on Wednesday subsequent week.

Polymarket knowledge exhibits that odds of the financial institution reducing charges by 0.25% have jumped to 93% from final week’s low of under 50%. Whereas a price lower is bullish for Bitcoin and different altcoins, the financial institution’s steering could hit their efficiency.