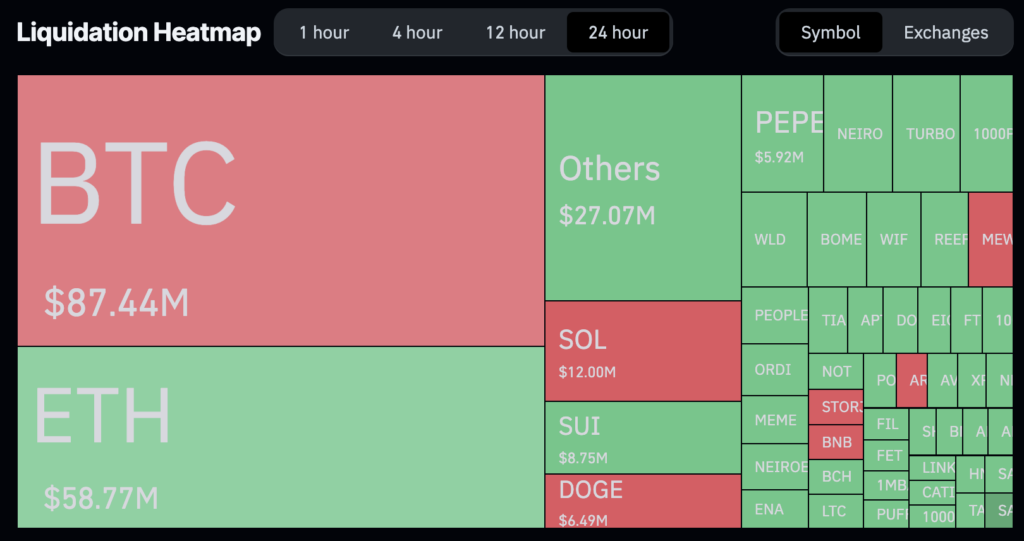

Over the previous 24 hours, $280.71 million price of crypto positions have been liquidated, impacting 79,153 merchants. Bitcoin’s worth elevated by 2.79% to $67,861.28, approaching its all-time excessive of $73,686.93, earlier than retracing barely to round $67,400. Ethereum noticed an increase of 0.93% to $2,628.81.

Lengthy positions accounted for $151.47 million of the liquidations, whereas shorts made up $129.24 million, in line with information from Coinglass. The most important single liquidation occurred on OKX’s ETH-USDT-SWAP, valued at $6.55 million.

Within the final 4 hours, $31.73 million was liquidated, with shorts comprising 73.13%. Throughout this era, Binance led exchanges with $18.89 million in liquidations, 78.23% of which have been quick positions.

Bitcoin’s market capitalization is now $1.34 trillion, and Ethereum’s is $316.47 billion. Over the previous week, Bitcoin and Ethereum have gained 9.8% and eight.26%, respectively.

The numerous liquidation of quick positions suggests merchants betting on a market downturn confronted substantial losses as costs climbed. This pattern signifies a possible shift in market sentiment towards bullishness.