Information reveals the plunge in Bitcoin and the altcoins has despatched a shockwave by way of the derivatives market, leading to huge lengthy liquidations.

Bitcoin Has Simply Witnessed A Crash To $104,000

Final Friday was a shock for the cryptocurrency market and it appears this Friday is constant the development as Bitcoin and firm have simply seen one other leg down. The beneath chart reveals how BTC’s current worth motion has seemed.

The value of the coin appears to have plunged over the previous day | Supply: BTCUSDT on TradingView

From the graph, it’s seen that shortly after the sooner crash, Bitcoin noticed a rebound again to $116,000, giving traders hope for a market restoration. This surge, nevertheless, has now turned out to be only a dead-cat bounce.

With a plunge of over 6% within the final 24 hours, BTC has returned to the $104,200 degree. The altcoins have confronted even heavier losses, with Ethereum being down virtually 9% to $3,700. Identical to how final week’s crash caught out derivatives merchants, the identical has occurred this time round as effectively.

Crypto Derivatives Market Has Seen Liquidations Of Practically $1.2 Billion

In line with information from CoinGlass, numerous liquidations have occurred within the cryptocurrency derivatives sector in the course of the previous day. A “liquidation” takes place when an open contract amasses losses of a sure proportion and is forcibly shut down by its platform.

Right here’s a desk that reveals the numbers associated to the liquidations which have occurred on cryptocurrency exchanges over the past 24 hours:

Seems like liquidations have closely been lopsided towards lengthy contracts | Supply: CoinGlass

As displayed above, the sector as a complete has seen a complete of $1.18 billion in liquidations in the course of the previous day. Since many of the liquidity on this interval has been towards the draw back, it’s no shock that lengthy traders took the brunt of the squeeze. Extra particularly, $917 million or 77% of the liquidations concerned bullish bets.

When it comes to the person belongings, Bitcoin-related contracts contributed essentially the most towards the occasion, with over $431 million in liquidations.

The breakdown of the newest liquidations by image | Supply: CoinGlass

Ethereum got here second with $267 million in contracts and Solana third with $89 million. Apparently, XRP, which has a notably bigger market cap than SOL, noticed solely $27 million in liquidations, regardless of the same diploma of volatility on this window. This means speculative curiosity across the asset hasn’t been as sturdy just lately.

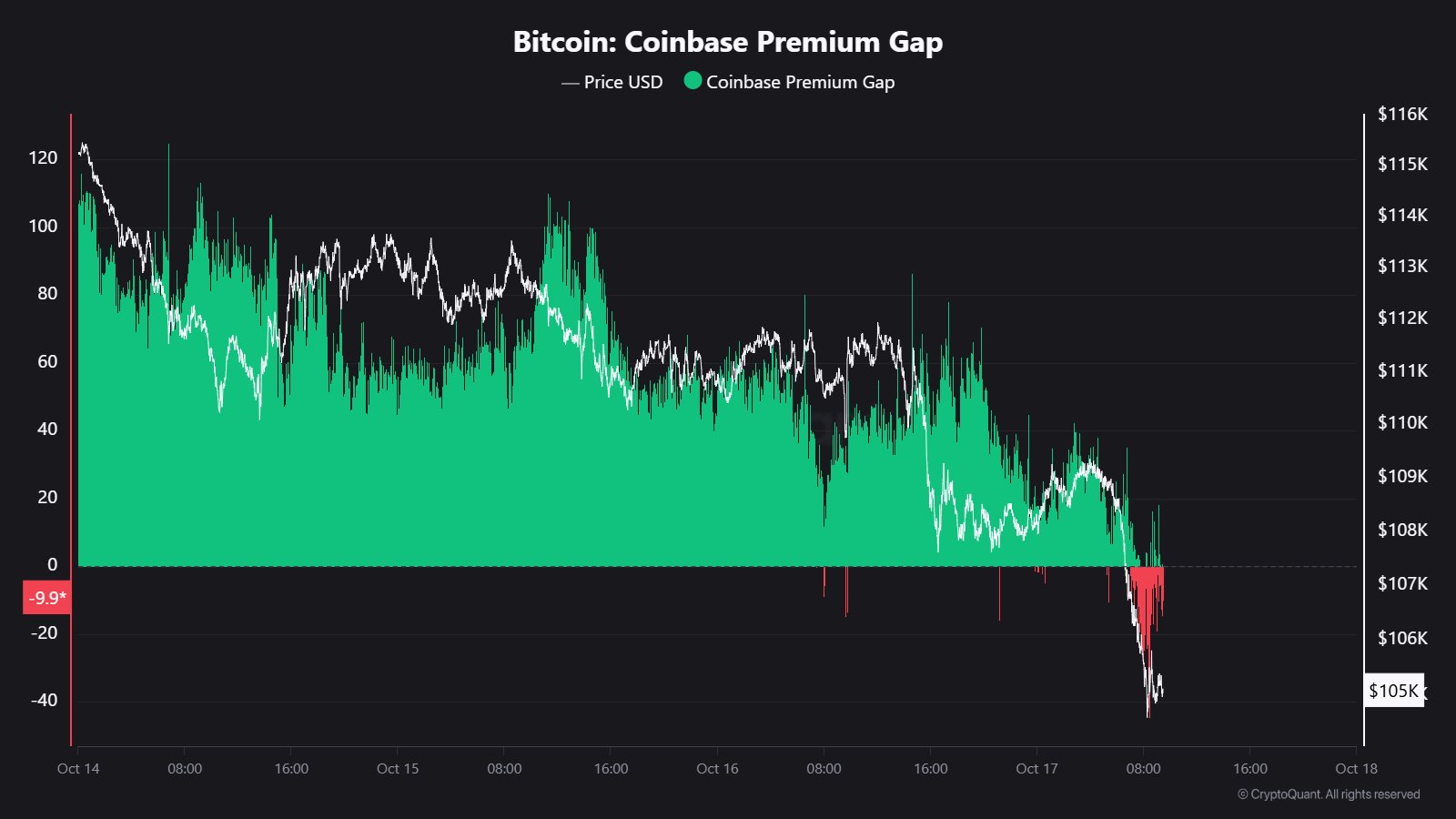

In another information, the Bitcoin crash seems to have come alongside a shift to pink values on the Coinbase Premium Hole, as CryptoQuant group analyst Maartunn has identified in an X put up.

The development within the BTC Coinbase Premium Hole over the previous few days | Supply: @JA_Maartun on X

The Coinbase Premium Hole tracks the distinction between the Bitcoin worth listed on Coinbase (USD pair) and that on Binance (USDT pair). A adverse worth on the indicator suggests customers of the previous are making use of the next promoting strain than merchants on the latter. Thus, given the newest shift, it could seem attainable that institutional entities utilizing Coinbase might, partly, be behind the bearish motion.

Featured picture from Dall-E, CryptoQuant.com, CoinGlass.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our group of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.