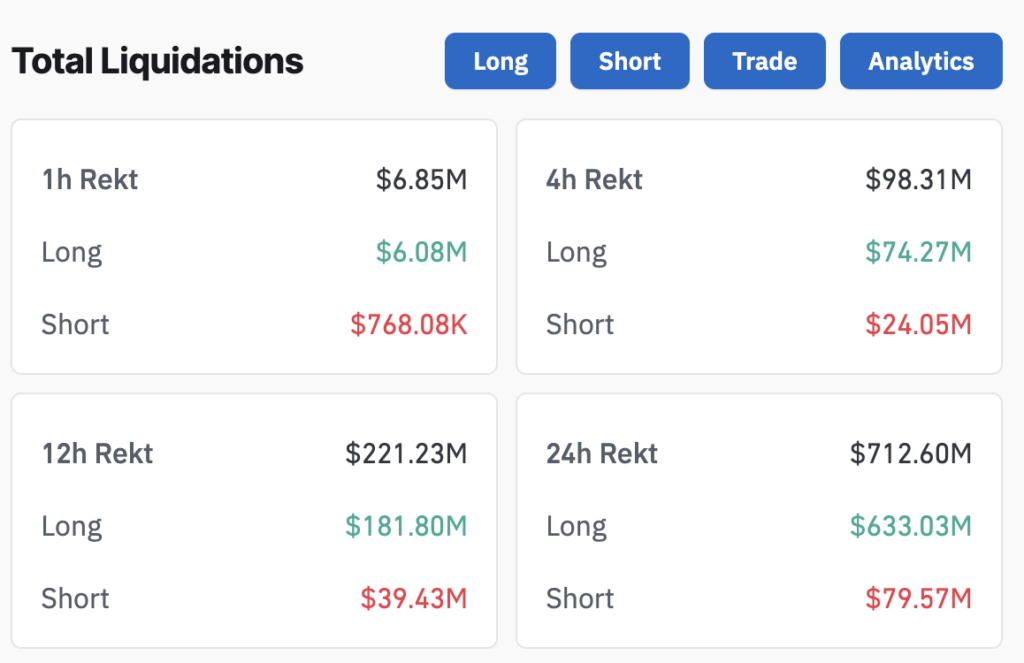

Over the previous 24 hours, the crypto market skilled heightened volatility, resulting in liquidations totaling $712 million throughout 237,375 merchants, in response to Coinglass information.

Lengthy positions bore the brunt of the liquidations, accounting for 88.83% of the entire, with $631.21 million cleared in comparison with $79.35 million briefly positions. Bitcoin noticed $130 million in liquidations, whereas Ethereum led with $150 million.

Binance recorded the very best exercise, contributing $315.12 million in liquidations, together with a single $17.74 million ETHUSDT liquidation, marking the biggest order throughout this era.

Bitcoin’s value actions offered the backdrop for this liquidation surge, which started when the US inventory market opened on January 8. Bitcoin traded round $102,500 early within the day earlier than falling towards $100,000 because the US market opened.

The US inventory market skilled a big downturn on January 7, with all main indices closing decrease. The S&P 500 fell 1.1%, dropping 66.35 factors to shut at 5,909.03, whereas the Nasdaq Composite suffered essentially the most important decline, plummeting 1.9% or 375.30 factors to complete at 19,489.68.

The worth of Bitcoin adopted conventional equities and sharply declined, dropping under $100,000. The downtrend continued into January 8, with Bitcoin touching lows close to $95,300 as of press time.

The extreme sell-off and liquidation cascade spotlight market vulnerability, as merchants miscalculated the energy of the correlation to the US market. Elevated buying and selling volumes through the upward surge and subsequent sell-off counsel important market exercise, amplifying the influence of liquidations. The $102,393 resistance and $96,136 assist ranges, which Bitcoin has fallen under, stay important markers as Bitcoin consolidates.