The crypto market produced one in all its most disappointing performances within the closing quarter of 2025, with most large-cap belongings ending the yr within the pink. Whereas costs struggled to make any mark in the previous couple of months of the yr, liquidity additionally continued to seep out of the market.

In response to the newest on-chain knowledge, the crypto derivatives market posted its lowest buying and selling volumes of 2025 in December. This downturn in exercise displays the shift in buyers’ threat urge for food, particularly with costs remaining down in the previous couple of months of the yr.

Low Market Exercise Indicators Rising Threat Aversion: Analyst

In a Quicktake put up on the CryptoQuant platform, pseudonymous analyst Darkfost revealed that December was the bottom buying and selling month for the crypto derivatives market in 2025. In response to the on-chain pundit, this decline of derivatives market exercise indicators a disengagement of leveraged merchants.

Utilizing a chart exhibiting the buying and selling volumes of the highest 10 cash aggregated throughout a number of main exchanges, Darkfost highlighted a broad decline in liquidity. The broad nature of this liquidity decline confirms that the low buying and selling quantity pattern is unfold throughout the whole derivatives market.

Supply: CryptoQuant

As noticed within the chart above, the Binance change dominates the crypto futures market with roughly $1.19 trillion in buying and selling quantity in December. Nonetheless, this determine is comparatively low—its weakest buying and selling exercise previously yr—in comparison with its efficiency in different months in 2025. For context, Binance recorded nearly double that buying and selling quantity in August 2025.

An analogous pattern of liquidity decline might be seen throughout different main exchanges. As an example, OKX recorded solely $581 billion in buying and selling quantity, whereas Bybit was restricted to $421 billion. “These ranges additional verify a big liquidity contraction within the derivatives markets, mechanically decreasing threat urge for food and using leverage,” Darkfost added.

Moreover, the crypto analyst famous that this fall in buying and selling quantity exhibits how buyers behave in an unfavorable market situation.

Darkfost stated:

The rise in liquidations, mixed with a interval of heightened market uncertainty and unclear directionality, has bolstered threat aversion. In such situations, market individuals clearly prioritize capital preservation over efficiency.

Darkfost concluded that this degree of decline in derivatives has traditionally usually aligned with transitional phases, the place the market flushes out extra leverage forward of constructing a stronger and more healthy pattern.

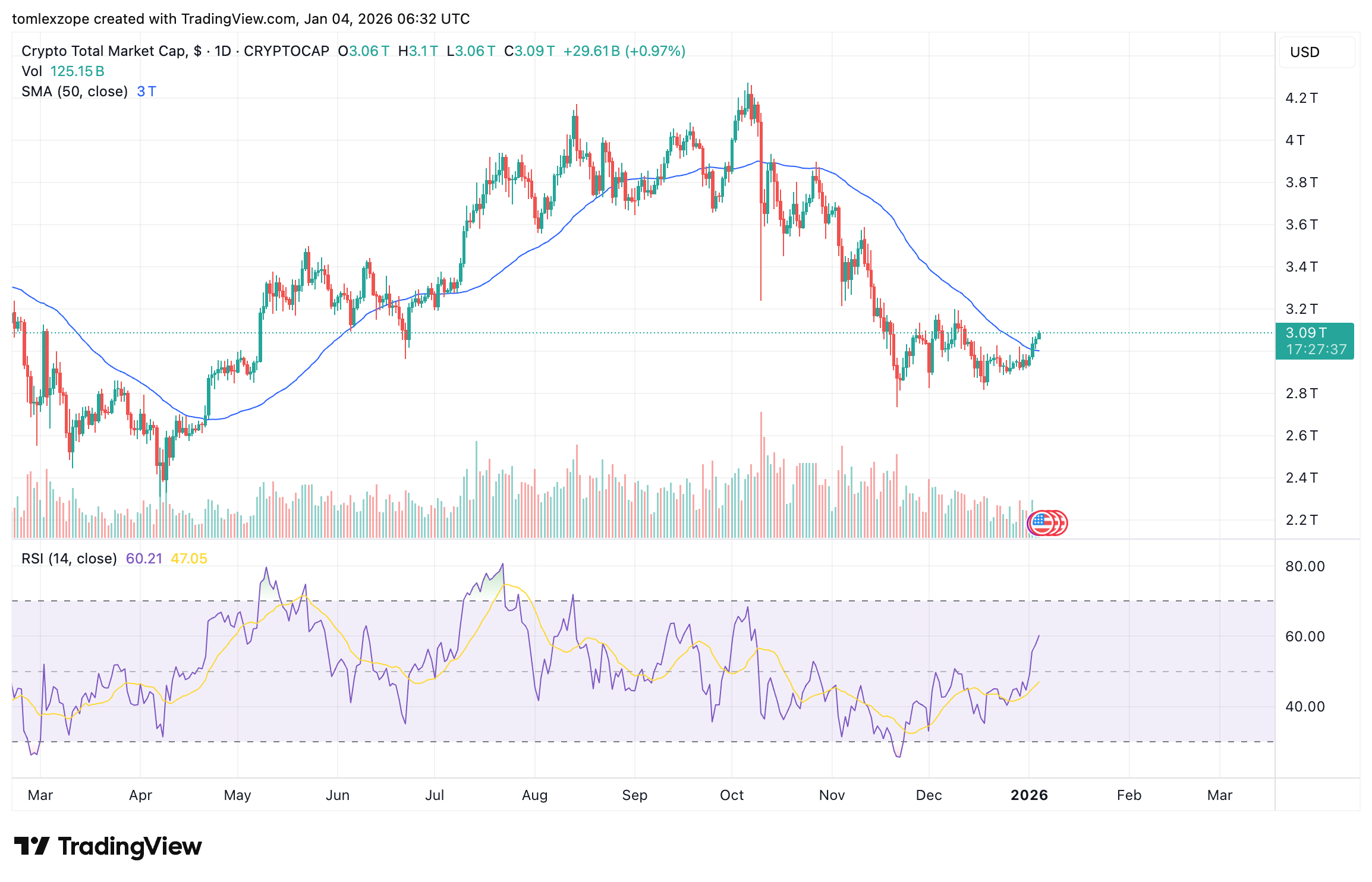

Whole Crypto Market Capitalization At $3.17 Trillion

As of this writing, the overall cryptocurrency market stands at about $3.17 trillion, reflecting a 0.3% soar previously 24 hours, in line with CoinGecko knowledge.

The full cryptocurrency market capitalization on the each day timeframe | TOTAL chart on TradingView

Featured picture from Shutterstock, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our group of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.