By Omkar Godbole (All occasions ET until indicated in any other case)

Regardless of the growing rhetoric surrounding President Donald Trump’s tariffs, bitcoin (BTC) is holding regular alongside constructive cues from overseas change threat barometers like AUD/JPY. Later right this moment, Trump is because of impose 25% tariffs on metal and aluminum imports on prime of further steel duties.

This market stance forward of an impending tariff escalation contrasts starkly with the chance aversion noticed per week in the past, when Trump fired the primary tariff shot. Maybe market individuals suppose he is utilizing aggressive techniques to barter commerce offers quite than committing to sustained tariffs. This notion has gained traction following lat Monday’s resolution to droop tariffs on Mexico and Canada for 30 days, hinting at a extra strategic strategy to commerce negotiations.

In line with QCP Capital, the present market stability might embolden Trump to take a harder stance. “A suggestions loop is rising — President Trump, extremely delicate to market reactions, is dealing with a market more and more calling his bluff. This might embolden him additional, including one other layer of volatility,” QCP mentioned in a Telegram broadcast.

It is going to be attention-grabbing to see how this develops.

There is a social media submit doing the rounds that reveals report open quick positions within the CME-listed cash-settled ether futures. These shorts should not essentially outright bearish bets and are probably elements of carry trades, the place buyers maintain lengthy positions in ETFs whereas shorting CME futures. Notice that the ETH ETF inflows surged final week. It is potential a few of the shorts are buyers hedging towards lengthy altcoin bets amid considerations over the variety of cash and impending giant unlocks.

Over the weekend, Base member Kabir.Base.eth refuted claims that the sequencer Coinbase had been promoting ETH earned as charges, including a layer of transparency to its operations.

In one other notable growth, Archange Touadéra, president of the Central African Republic, reportedly issued a brand new memecoin that noticed a dealer flip $5,000 into an astonishing $12 million in lower than three hours, reaching a outstanding return of two,450x, in keeping with LookOnChain information.

In the meantime, litecoin (LTC) continues to shine because the top-performing cryptocurrency of the previous 24 hours, up 9%.

On the macroeconomic entrance, the surge within the U.S. client inflation expectations raises considerations in regards to the chance of a protracted pause in Federal Reserve’s price cuts. Plus, the U.S. Shopper Value Index (CPI) is due for launch on Wednesday. Keep alert!

What to Watch

Crypto:

Feb. 13: Begin of Kraken’s gradual delisting of the USDT, PYUSD, EURT, TUSD, UST stablecoins for EEA purchasers. The method ends March. 31.

Feb. 14: Dynamic TAO (DTAO) community improve goes stay on the Bittensor (TAO) mainnet.

Feb. 14, 2:30 a.m. (Estimate): Qtum (QTUM) arduous fork community improve.

Feb. 18, 10:00 a.m.: FTX Digital Markets, the Bahamas-based subsidiary of FTX, will begin reimbursing collectors.

Feb. 21: TON (The Open Community) will turn into the unique blockchain infrastructure for messaging platform Telegram’s Mini App ecosystem.

Macro

Feb. 11, 2:30 p.m.: U.S. Home Monetary Providers Subcommittee (“Digital Belongings, Monetary Know-how, and Synthetic Intelligence”) listening to titled “A Golden Age of Digital Belongings: Charting a Path Ahead.” Witness embrace Jonathan Jachym, who’s Kraken’s deputy common counsel. Livestream hyperlink.

Feb. 12, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases January’s Shopper Value Index (CPI) report.

Core Inflation Price MoM Est. 0.3% vs. Prev. 0.2%

Core Inflation Price YoY Prev. 3.2%

Inflation Price MoM Est. 0.3% vs. Prev. 0.4%

Inflation Price YoY Est. 2.9% vs. Prev. 2.9%

Feb. 12, 10:00 a.m.: Fed Chair Jerome Powell presents his semi-annual report back to the U.S. Home Monetary Providers Committee. Livestream hyperlink.

Feb. 13, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases January’’s Producer Value Index (PPI) report.

Core PPI MoM Est. 0.3% vs. Prev. 0%

Core PPI YoY Prev. 3.5%

PPI MoM Est. 0.2% vs. Prev. 0.2%

PPI YoY Prev. 3.3%

Feb. 13, 8:30 a.m.: The U.S. Division of Labor releases the Unemployment Insurance coverage Weekly Claims report for the week ended Feb. 8.

Preliminary Jobless Claims Est. 215K vs. Prev. 219K

Earnings

Feb. 10: Canaan (CAN), pre-market, $-0.08

Feb. 11: HIVE Digital Applied sciences (HIVE), post-market, $-0.15

Feb. 11: Exodus Motion (EXOD), post-market, $0.14 (2 ests.)

Feb. 12: Hut 8 (HUT), pre-market, $0.05

Feb. 12: IREN (IREN), post-market, $-0.01

Feb. 12 (TBA): Metaplanet (TYO:3350)

Feb. 12: Reddit (RDDT), post-market, $0.25

Feb. 12: Robinhood Markets (HOOD), post-market, $0.41

Feb. 13: Coinbase World (COIN), post-market, $1.89

Token Occasions

Governance votes & calls

Aave DAO is discussing recognizing HyperLend as a pleasant fork of Aave deployed on the Hyperliquid EVM chain, in addition to the deployment of Aave v3 on Ink, Kraken’s layer-2 rollup community.

Sky DAO is discussing, amongst different issues, onboarding Arbitrum One to the Spark Liquidity layer, growing the PSM2 price limits on Base, and minting 100 million USDS value of sUSDS into Base to accommodate for development on the community.

Feb. 10, 10:30 a.m.: OKX to carry a listings AMA with Chief Advertising Officer Haider Rafique and Head of Product Advertising Matthew Osofisan.

Feb. 12, 2 p.m. : Render (RENDER) to host an AI Scout Discord AMA session.

Unlocks

Feb. 10: Aptos (APT) to unlock 1.97% of circulating provide value $71.14 million.

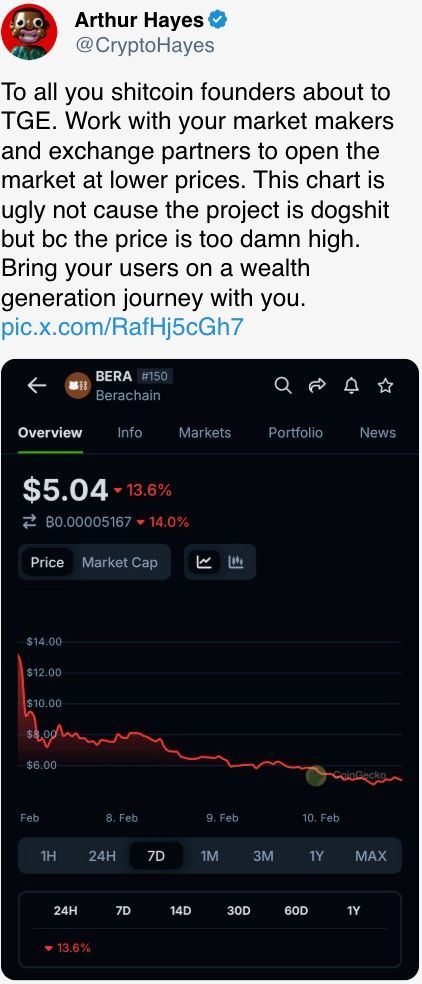

Feb. 10: Berachain (BERA) to unlock 12.08% of circulating provide value $66.07 million.

Feb. 12: Aethir (ATH) to unlock 10.21% of circulating provide value $23.80 million.

Feb. 14: The Sandbox (SAND) to unlock 8.4% of circulating provide value $80.2 million.

Token Launches

Feb. 10: Analog (ANLOG) to be listed on Bitget, Gate.io, MEXC and KuCoin.

Feb. 12: Avalon (AVL) and Recreation 7 (G7) to be listed on Bybit.

Feb. 13: EthereumPoW (ETHW) and Polygon (MATIC) to now not be supported at Deribit.

Conferences:

CoinDesk’s Consensus to happen in Hong Kong on Feb. 18-20 and in Toronto on Could 14-16. Use code DAYBOOK and save 15% on passes.

Feb. 13-14: The 4th Version of NFT Paris.

Feb. 18-20: Consensus Hong Kong

Feb. 19: Sui Join: Hong Kong

Feb. 23 to March 2: ETHDenver 2025 (Denver, Colorado)

Feb. 25: HederaCon 2025 (Denver)

Token Discuss

By Shaurya Malwa

Varied memecoins raffled world wide from Asia to America, bringing again indicators of a frenzy that tends to grip the crypto market each few months.

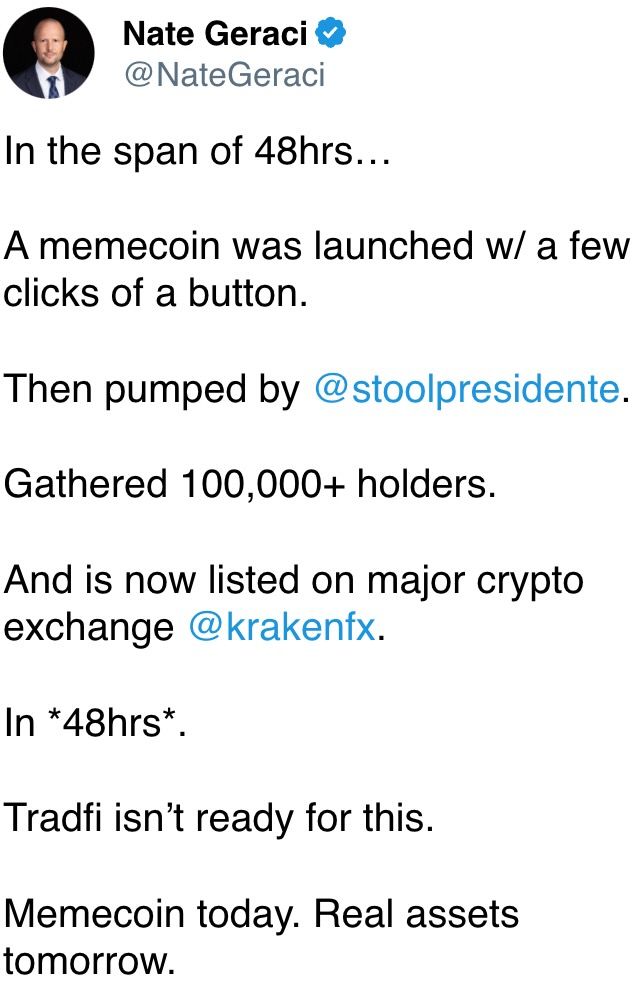

BNB Chain’s TST token, initially created in a tutorial, skyrocketed to a $300 million market cap following mentions by Binance founder Changpeng Zhao. The token gained reputation in Chinese language communities, posts present.

David Portnoy of U.S.-based Barstool Sports activities promoted JAILSTOOL as market watchers accused him of utilizing his social affect to pump the lowcap token, which peaked at over $200 million earlier than settling at a $78 million market cap.

The Central African Republic issued its personal memecoin, CAR, aiming to help nationwide growth and enhance the nation’s world visibility.

Derivatives Positioning

Foundation in BTC and ETH CME futures dipped beneath 10%, which can translate into slower inflows into the ETFs.

Perpetual funding charges on offshore exchanges for many main cash stay marginally bullish between an annualized 5% to 10%. XLM stands out as having probably the most adverse funding price — in extra of -20% — reflecting a bias for shorts.

Entrance-end ETH places commerce a vol premium of two to 5 factors relative to calls, exhibiting draw back fears. BTC front-end choices additionally present a put bias, in keeping with information supply Amberdata.

Market Actions:

BTC is up 1.80% from 4 p.m. ET Friday to $97,805.98 (24hrs: -1.01%)

ETH is down 0.79% at $2,647.53 (24hrs: -0.63%)

CoinDesk 20 is up 2.92% to three,209.42 (24hrs: +0.19%)

CESR Composite Staking Price is down 3 bps to 2.97%

BTC funding price is at 0.0087% (9.48% annualized) on Binance

DXY is up 0.12% at 108.16

Gold is up 1.44% at $2,902.17/oz

Silver is up 1.29% to $32.22/oz

Nikkei 225 closed unchanged at 38,801.17

Dangle Seng closed up 1.84% at 21,521.98

FTSE is up 0.53% at 8,746.63

Euro Stoxx 50 is up 0.34% at 5,343.63

DJIA closed -0.99% to 44,303.40

S&P 500 closed -0.95% at 6,025.99

Nasdaq closed -1.36% at 19,523.40

S&P/TSX Composite Index closed -0.36% at 25,442.91

S&P 40 Latin America closed -1.10% at 2,410.24

U.S. 10-year Treasury went up 4 bps to 4.48%

E-mini S&P 500 futures are up 0.46% at 6,077

E-mini Nasdaq-100 futures are up 0.70% at 21,742

E-mini Dow Jones Industrial Common Index futures are up 0.35% at 44,576

Bitcoin Stats:

BTC Dominance: 61.70% (0.05%)

Ethereum to bitcoin ratio: 0.02717 (-0.22%)

Hashrate (seven-day shifting common): 808 EH/s

Hashprice (spot): $54.1

Complete Charges: 5.04 BTC / $337,318

CME Futures Open Curiosity: 164,510

BTC priced in gold: 33.5 oz

BTC vs gold market cap: 9.52%

Technical Evaluation

Shares of Technique (MSTR) have dived out of a mini rising channel, hinting at an finish of the bounce from the Dec. 31 low and potential resumption of a broader pullback from late 2024 highs.

Costs have discovered acceptance beneath the 38.2% Fibonacci retracement of the fourfold rally seen from September to November.

A golden rule of technical evaluation is that for a market to keep up its present pattern, it should maintain above the 38.2% stage. If it fails to take action, the bull pattern is claimed to have ended.

Crypto Equities

MicroStrategy (MSTR): closed on Friday at $327.56 (+0.56%), up 2.27% at $334.98 in pre-market.

Coinbase World (COIN): closed at $274.49 (+1.52%), up 1.83% at $279.52 in pre-market.

Galaxy Digital Holdings (GLXY): closed at C$26.89 (-0.66%)

MARA Holdings (MARA): closed at $16.77 (-0.18%), up 1.97% at $17.10 in pre-market.

Riot Platforms (RIOT): closed at $11.64 (+0.26%), up 1.89% at $11.86 in pre-market.

Core Scientific (CORZ): closed at $12.56 (+0.24%), up 0.88% at $12.67 in pre-market.

CleanSpark (CLSK): closed at $11.33 (+9.15%), up 1.5% at 11.50 in pre-market.

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $23.15 (+1.71%), up 0.52% at $23.27 in pre-market.

Semler Scientific (SMLR): closed at $49.20 (-1.44%), up 2.20% at $50.28 in pre-market.

Exodus Motion (EXOD): closed at $48.37 (+0.75%), +0.52% at 48.62 in pre-market.

ETF Flows

Spot BTC ETFs:

Each day internet stream: $171.3 million

Cumulative internet flows: $40.70 billion

Complete BTC holdings ~ 1.176 million.

Spot ETH ETFs

Each day internet stream: No flows reported.

Cumulative internet flows: $3.18 billion

Complete ETH holdings ~ 3.793 million.

Supply: Farside Traders

In a single day Flows

Chart of the Day

The yield on 10-year U.S. inflation-indexed securities, the so-called actual yield, has dropped by 34 foundation factors in simply over three weeks.

A continued decline might set off a seek for increased returns, galvanizing demand for threat property, together with BTC.

Whereas You Had been Sleeping

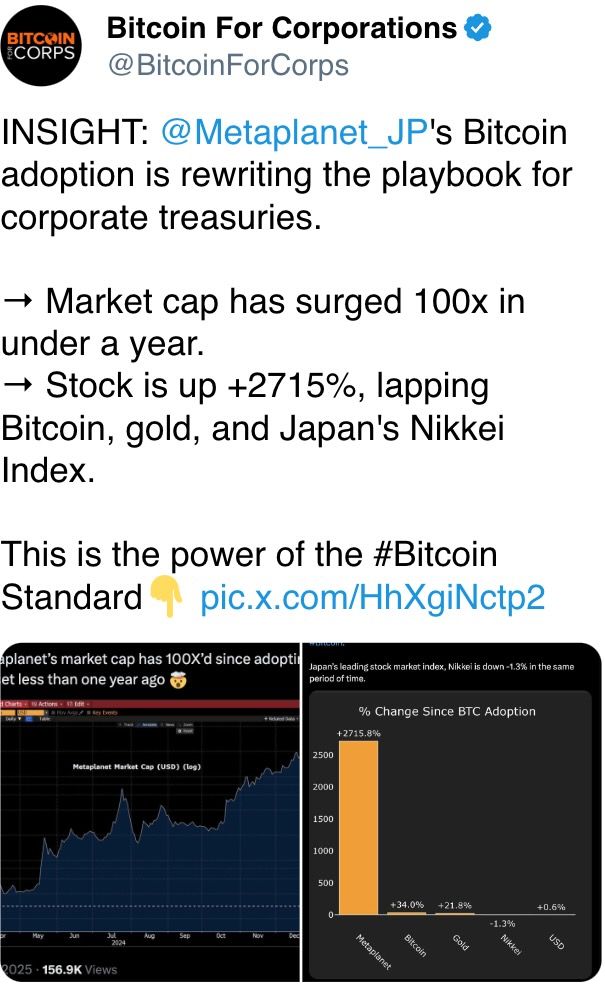

Bitcoin HODLer Metaplanet Achieves $35M Unrealized Positive factors in 2024 Because of BTC Treasury (CoinDesk): The Japanese firm, which already holds 1,761 bitcoin, mentioned it plans to have 10,000 BTC by 12 months finish.

Bitcoin Indicator That Signaled $70K Breakout Turns Bearish as Trump’s Commerce Conflict Rhetoric Grows (CoinDesk): A preferred technical indicator is displaying bitcoin weak point amid rising U.S. trade-tariff rhetoric. A drop beneath $90K would affirm persistent bearish momentum.

US Endowments Be part of Crypto Rush by Constructing Bitcoin Portfolios (Monetary Occasions): U.S. foundations and college endowments are ramping up cryptocurrency investments, pushed by FOMO and Trump’s pro-crypto stance, regardless of considerations over worth volatility and a scarcity of regulatory readability.

Trump Unveils Plans for 25% Tariffs on Metal, Aluminum Imports (Bloomberg): The U.S. is ready to announce 25% tariffs on metal and aluminum imports, and reciprocal tariffs on nations taxing U.S. items will observe this week.

Inflation Rises Amid Lunar New Yr Spending As European Shares Profit (Euronews): China’s January inflation climbed 0.5% YoY, fueled by Lunar New Yr spending and stimulus. Persistent PPI deflation and U.S.-China commerce tensions stay a priority.

China’s Technique in Commerce Conflict: Threaten U.S. Tech Firms (The Wall Avenue Journal): China is reportedly planning to focus on extra U.S. tech giants like Apple and Broadcom with antitrust investigations, aiming to bolster its bargaining place in commerce negotiations with the U.S.

Within the Ether