CRV, the native token of Curve, a stablecoin decentralized trade (DEX), is underneath immense promoting stress. After the hack of July 2023, CRV has by no means been the identical once more. Nonetheless, the painful liquidations of Michael Erogov’s loans have worsened the state of affairs for holders.

Curve Founder Pressured To Promote $677,000 Of CRV, Token Falling

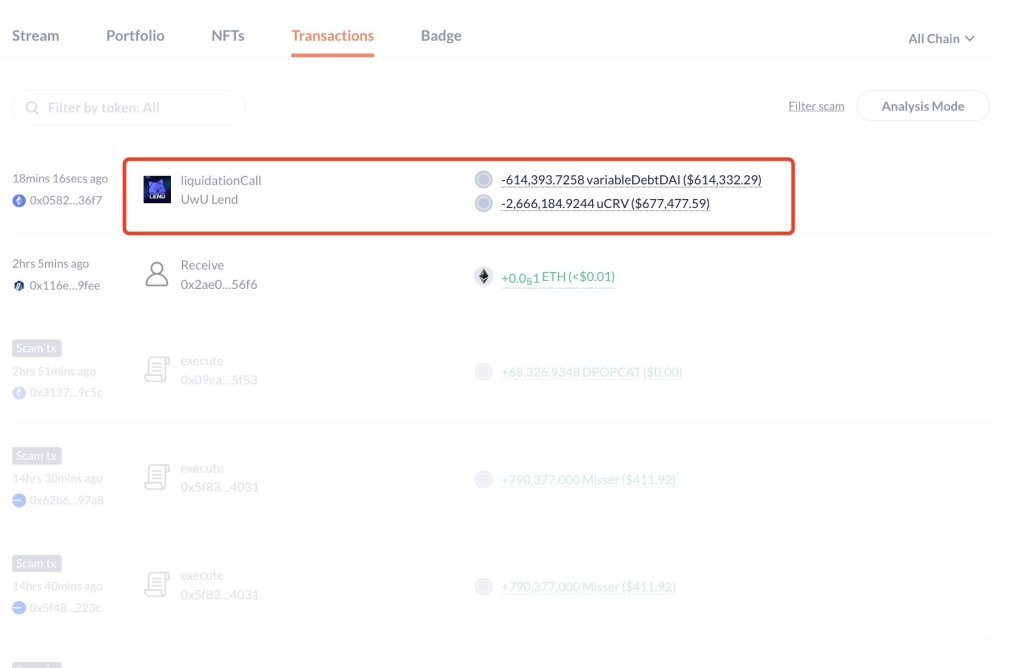

After the compelled liquidation in mid-June, which pushed costs beneath $0.30, knowledge confirmed that the founder was additionally compelled to promote CRV available in the market to repay a part of his mortgage. Yesterday, on July 25, Lookonchain knowledge confirmed that Erogov was liquidated for $677,000 price of CRV.

At the moment, CRV continues to print, discouraging decrease lows. Though the dump has not been as fast as in June, the token is weak and will plunge beneath essential assist ranges. For now, this stage is on the double backside at $0.21. On the higher finish, resistance lies at $0.30.

Apparently, this resistance stage served as assist in June when costs slammed by the ground, accelerated by Erogov’s loans being liquidated. Then, as a result of quantity within the image, there was concern throughout the crypto board that the founder’s loans would additional destabilize the protocol, negatively impacting CRV holders.

On-chain knowledge reveals that Erogov had borrowed roughly $100 million in stablecoins utilizing $140 million in CRV as collateral. Some declare the founder purchased prime actual property with this mortgage.

Nonetheless, what’s identified is that the collection of compelled liquidations and the scramble by the founder to dump CRV, which allowed him to be liquidated after the hack, compelled costs even decrease.

Hopes On Spot Ethereum ETFs And Group Initiatives

For the reason that hack on July 30, CRV has cratered by over 50%. Holders are dealing with it tough now that crypto costs are additionally sliding, retracing from their March 2024 peaks.

Promoting stress has since eased after a lot of the CRV collateral posted by Erogov was reclaimed by lending protocols—together with Frax and Aave. Nonetheless, the token remains to be struggling for momentum.

This weak spot is a priority, particularly contemplating the constructive developments this week. As an Ethereum-based DEX, the approval and buying and selling of spot Ethereum ETFs would profit the protocol in the long term.

Past the by-product product opening up establishments to Ethereum, Curve can also be rising in power. Just lately, the neighborhood okayed a proposal to additional increase CRV liquidity by bridging the hole between Solana and Ethereum by way of USDT.

By means of this initiative floated by Picasso Community, a pool of USDT on Solana and USDT on Ethereum was launched. The aim is to encourage cross-chain exercise and supply much more incentives for liquidity suppliers.