Fast Take

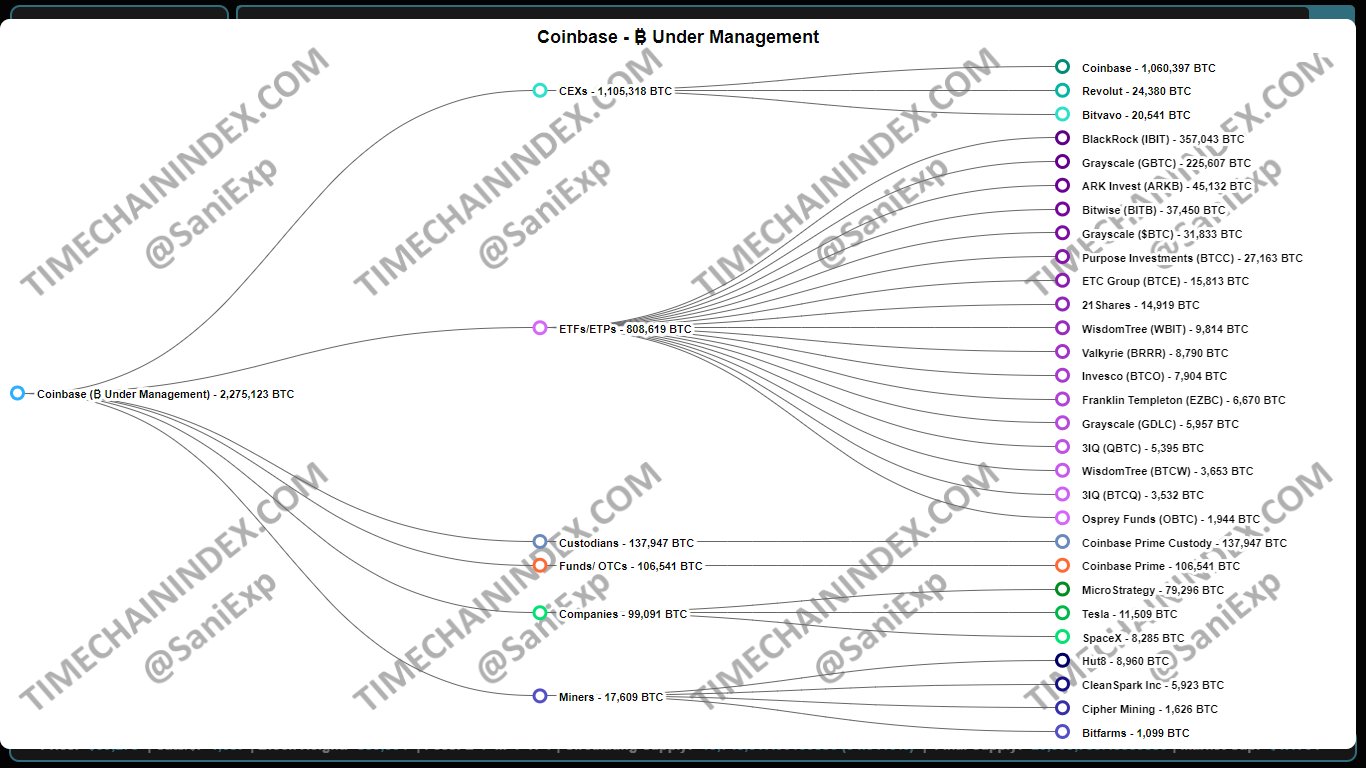

In keeping with an X account, Sani, the founding father of TimeChainIndex.com, the Coinbase group at the moment custodies a complete of two,275,123 BTC, representing roughly 10.83% of Bitcoin’s most provide of 21 million. The chart compiled by TimeChainIndex highlights the breakdown of those property throughout numerous sectors.

Centralized exchanges (CEXs) maintain a good portion, with 1,105,318 BTC. Coinbase’s retail trade alone has over 1 million BTC, with extra holdings from Revolut and Bitvavo. The second-largest class, ETFs/ETPs, accounts for over 808,000 BTC, consisting primarily of US ETFs, which management a major share of Bitcoin held by funding merchandise.

Coinbase Prime Custody, a specialised service for institutional-grade asset storage, safeguards 137,947 BTC. In the meantime, Coinbase Prime’s broader companies, together with liquidity entry and buying and selling instruments, account for 106,541 BTC by means of funds and over-the-counter (OTC) companies.

Companies comparable to MicroStrategy, Tesla, and SpaceX collectively maintain over 99,000 BTC, with MicroStrategy main the pack.

In keeping with an X publish by “level39,” MicroStrategy disclosed in a February 2023 10-Okay submitting that it holds its Bitcoin throughout a number of custodians, together with Constancy, to reinforce the safety and diversification of its property.

Lastly, miners, together with firms like Hut 8, CleanSpark, Cipher Mining, and Bitfarms, maintain round 17,609 BTC.

This information emphasizes Coinbase’s vital position in Bitcoin custody, doubtlessly opening as much as centralization issues.