Este artículo también está disponible en español.

Chainlink (LINK) is presently experiencing vital momentum within the cryptocurrency market, resulting in hypothesis that its worth could enhance to $30 within the close to future.

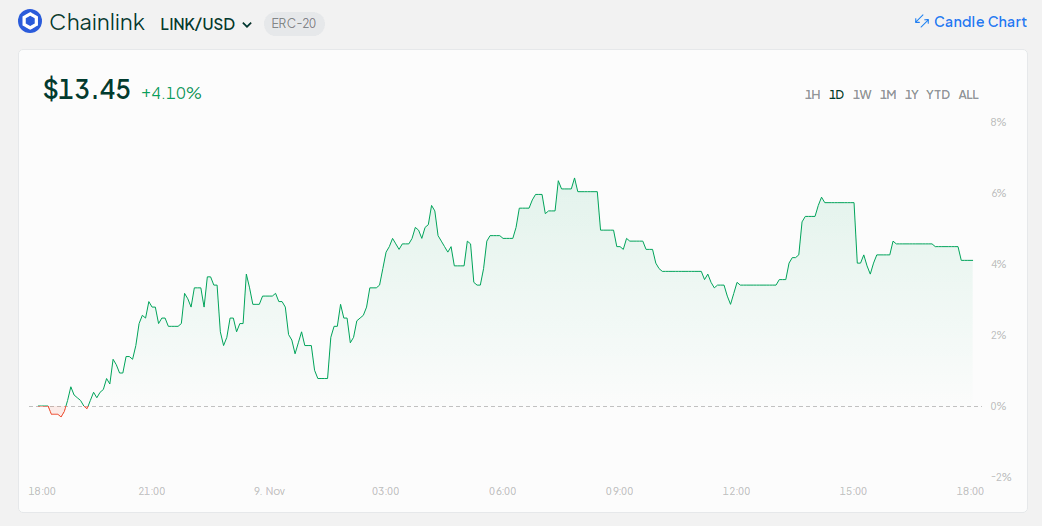

LINK, which is presently buying and selling at roughly $13.45, has not too long ago skilled a surge in worth momentum, which is attributed to a lot of vital elements that point out extra upside potential.

Associated Studying

Analysts particularly discover nice curiosity within the technical framework of the token, whale exercise, and extra common market actions.

Whale buildup, decrease change provide, elevated on-chain exercise, and bullish derivatives information favor Chainlink. If the bullish flag sample breaks, World of Charts predicts LINK worth would possibly problem $30 within the following weeks.

LINK breaching the $30 threshold would trigger the crypto forex to surge 125%.

Whale Accumulation, Incentive For Optimistic Sentiment?

Elevated whale exercise is without doubt one of the main elements contributing to the current worth motion of LINK. Over the previous seven weeks, vital holders of the token, with balances various from 100,000 to 10 million LINK, have amassed a staggering $370 million in LINK.

This marks the best accumulation in three months, amounting to an 8.2% enhance in holdings. Whale accumulation is steadily perceived as a sign of optimism relating to the well being standing of a token, as these traders are inclined to take care of their positions for an prolonged interval.

Extra whale motion is more likely to impact how folks really feel concerning the market as a complete. As moneyed people purchase extra LINK, common patrons could do the identical, which is able to elevate its worth much more. For the reason that worth not too long ago broke above $13.30 it has already sparked extra curiosity in shopping for. Within the occasion that LINK stays above this degree, it’d assist the value rise towards $30.

Getting Prepared For A Worth Improve

Yet another factor which may make the value of LINK go up is that there’s much less strain to promote on platforms. In response to CryptoQuant information, LINK has seen an enormous rise in withdrawals from exchanges. On November 8, it hit a 30-day excessive.

Token removing from exchanges normally means that holders are usually not anticipated to be making any fast trades, thereby suggesting that the market is present process tightness. Given few tokens on exchanges, the value could climb rapidly in response to any demand surge.

The declining sale strain and the upper whale exercise put together the environment for a worth explosion. If extra traders begin seeing LINK as a long-term funding—particularly if demand retains surpassing provide—the token could respect much more.

Listed here are crypto’s high Actual World Property (RWA’s) by improvement. Directional indicators signify every venture’s rating rise or fall since final month:

1) @chainlink $LINK

2) @synthetix_io $SNX

3) @duskfoundation $DUSK

4) @oraichain $ORAI

5) @skyecosystem… pic.twitter.com/t5nnyIWV0g— Santiment (@santimentfeed) November 5, 2024

Chainlink Improvement Exercise Conducive To Lengthy-Time period Growth

Other than worth conduct, Chainlink’s steady enlargement is one other essential issue inspiring people. The community’s creators have enormously stepped up their work; improvement exercise in solely the previous month has surged by an astounding 4,000%.

Associated Studying

In the meantime, the partnership with monetary giants like Swift, Euroclear, or UBS might solely show that Chainlink is a comparatively new ally for aiding the monetary sector in coping with information fragmentation.

Chainlink’s real-time validation by way of the oracles of knowledge would possibly discover it on the forefront of decentralized finance primarily based on AI and blockchain. The extra establishments start to make use of Chainlink know-how, the larger the utility and worth, which might help again up sustained costs on the token.

Chainlink does look relatively well-positioned for a possible rally within the close to time period, particularly if ongoing improvement and whale accumulation proceed to happen, mixed with very robust technical indicators.

Featured picture from Pexels, chart from TradingView