Money App, the favored digital pockets and funds app, introduced a collection of adjustments to its Bitcoin providing, together with an enormous improve in withdrawal limits, decrease charges, new funding rails, and tons extra in an unique interview with Miles Suter, Product Lead at Block Inc.

“Our mission is to make dwelling on bitcoin easy and sensible,” Suter advised Bitcoin Journal. The corporate, which at the moment serves over 58 million lively customers, lately introduced a deep set of upgrades to the app, additional integrating Bitcoin into the consumer expertise whereas bettering high quality of life for Bitcoiners on the app, and unlocking additional performance.

Probably the most awaited and noteworthy replace is probably going the growth of the withdrawal limits, which had been raised to 10,000 a day from 2,000 and 25,000 per week from 5,000 for eligible prospects. This replace was rolled out by default to the overwhelming majority of customers, who ought to have entry to it now. Suter additionally talked about that those that don’t see the withdrawal restrict growth can attain out to him or help for additional evaluation of eligibility.

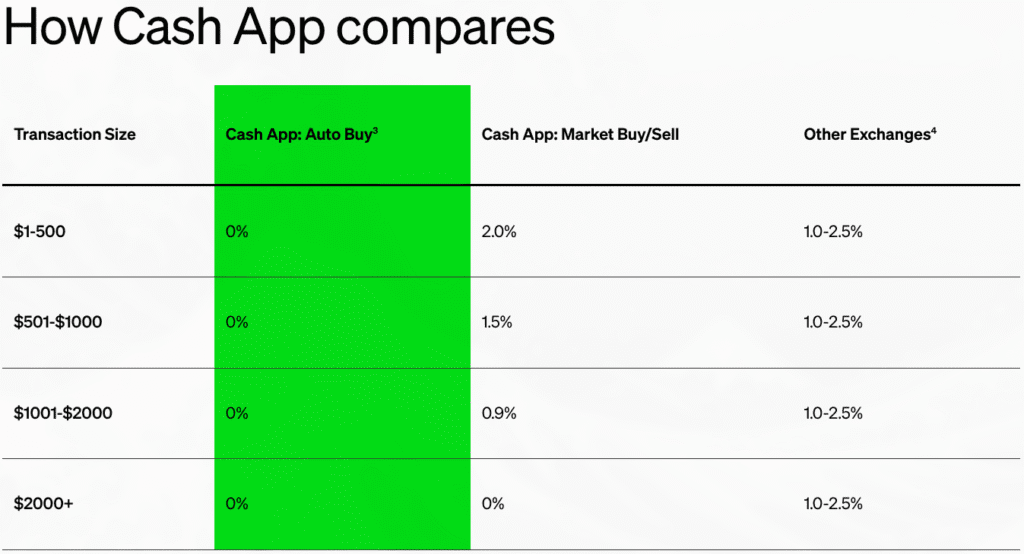

Nonetheless, much more modified below the hood. Charges and clearing costs additionally improved with “no spreads” on pricing, in keeping with Suter, one in every of many consumer expertise updates which will lead the cost throughout the trade when it comes to interface design.

Spreads are gaps within the value of an asset like Bitcoin, relying on whether or not you’re shopping for or promoting. Often, they’re the results of order books that match patrons and sellers on an inventory sorted by trade fee. A small unfold between probably the most anybody is prepared to pay for some bitcoin and the least anybody is prepared to just accept for theirs, is regular in most exchanges. Nevertheless it may also be complicated and seem like inconsistent pricing. Many exchanges conceal a small fee on this unfold, as they search for low-friction income. Money App seems to be eliminating this from the consumer expertise, in flip giving customers a single value level for either side of the market.

This pricing replace, alongside the 0% charges, would possibly make Money App probably the most cost-effective manner to purchase and promote Bitcoin inside the US. Suter goes so far as to say Money App now has the “finest value on the planet” for purchases over 2,000 {dollars}.

Funding Rails and Stablecoins

Funding rails additionally bought an growth on this replace. Traditionally, Money App was constructed to work with debit playing cards, a method that doubtless unlocked quick retail adoption however got here with numerous funding limits. Suter was excited to share that new funding rails have been added to Money App, together with ACH, which unlocks deposits as excessive as 10,000, and in addition built-in wires for giant purchases. As such, that is greater than a top quality of life improve for Bitcoiners inside Money App, it’s a historic milestone for the corporate, which has been servicing retail and small to medium retailers since 2013.

When requested about Money App’s relationships with banks, an space of the Bitcoin trade that many corporations and customers nonetheless wrestle with, even through the pleasant Trump administration, Suter mentioned that customers should not have any challenge sending and withdrawing from Money App to U.S. banks. Suter defined that banks are very conservative and hyper-focused on stopping fraud, an comprehensible enterprise selection for them, however one which highlights “the brittle nature of our present system, the place the whole lot is permissioned,” and a transparent instance of “why we imagine having zero intermediaries in Bitcoin is essential.”

Placing a finer level on the subject of funding rails, Suter additionally expressed curiosity in stablecoin integration, although no timelines got on the discharge date of this specific characteristic. He was additionally very clear about how stablecoins could be built-in into the app and that customers wouldn’t be uncovered to a myriad of decisions when it comes to blockchains or ticker identify denominations. As a substitute, all values could be offered as {dollars}, and all main stablecoin blockchains could be supported within the background. This suggests that charges paid in blockchain’s native token won’t be proven to customers, eradicating a long-standing ache level that the broader trade has failed to deal with. Included on this stablecoin integration dialogue was the point out of {dollars} on high of Bitcoin’s Lightning Community, although no particulars had been mentioned.

2026 Street Map

Wanting forward for the yr as we enter 2026 at full pace, Suter expressed a transparent imaginative and prescient to additional combine Bitcoin into Money App, making it obtainable in seamless methods to its giant userbase, “we would like Bitcoin to be a foundational foreign money inside Money App. So you’ll be able to stay your life on Bitcoin.”

As a way to obtain that, Money App is laying the groundwork to make not simply accepting Bitcoin however paying with Bitcoin utterly automated. Which means any retailer utilizing Sq. fee terminals ought to be capable to settle for bitcoin through Lightning funds, utilizing the identical QR codes and fee circulation as with fiat. Whereas any Money App consumer ought to be capable to pay lightning invoices by scanning QR codes, even when they don’t have bitcoin on their account. That’s proper, automated conversion of USD to BTC, and BTC to USD at checkout, so that everybody will pay how they need and obtain the foreign money they select. In Suter’s phrases, “we would like all prospects and customers to have the ability to obtain and ship bitcoin without having to find out about it or maintain it.”

This strategy solves a number of friction factors which have held again the funds use case of Bitcoin since its inception. On the one hand, if customers should not holding bitcoin after they spend, there’s no tax occasion, Money App does the conversion on behalf of the service provider, so the sender has no bitcoin sale tax occasion. Suter didn’t go into particulars however talked about this specific challenge as an vital piece of the puzzle, saying that “Block Inc can pay the lightning bill in your behalf. No tax legal responsibility, no value fluctuation”.

Alternatively, retailers who select to just accept bitcoin as fee are prone to get it extra usually, as anybody utilizing Money App will successfully have it to pay with. If a service provider, for instance, decides to solely settle for Bitcoin as fee, all Money App customers will be capable to buy from them, even when they don’t have Bitcoin on their account. Retailers might also give reductions on purchases with Bitcoin, one thing prospects will be capable to profit from by utilizing Money App with out having to carry any Bitcoin.

This complete design could introduce tens of millions of Individuals to Bitcoin who in any other case should not actually acquainted with it, “there’s mothers on the market who’ve by no means used bitcoin,” Suter famous, “I need to make it so each Money App consumer has a lightning URL that matches their Money App username”.

On the lively Bitcoiner aspect of the market, Suter commented briefly on the rising marketplace for Bitcoin-backed loans, saying that the corporate is actively “exploring” and “participating prospects on-line” on the use case, and “prospects need it”. The corporate is exploring numerous methods of providing Bitcoin collateralized loans, together with maybe a line of credit score, although particulars stay scarce. Suter highlighted this use case as an vital monetary device for Bitcoiners to “stay on bitcoin”, thus aligning with the corporate’s imaginative and prescient. Whereas no extra was mentioned on the subject, Suter did casually add that an announcement was coming for Bitcoin Vegas in Could.