In a latest in-depth video evaluation, Matt Crosby, the lead analyst at Bitcoin Journal Professional, explores the data-driven potential of Technique’s (previously MicroStrategy, Nasdaq: MSTR) inventory to succeed in or exceed the $1,000 mark. You possibly can watch the total video right here: Will MicroStrategy Realistically Surpass $1,000 – Knowledge Evaluation

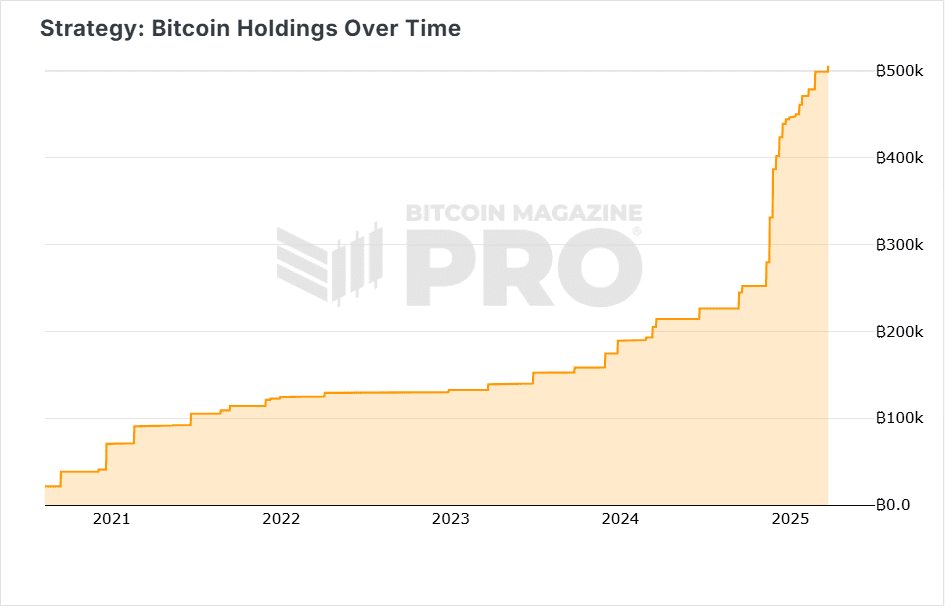

Technique’s Strategic Bitcoin Accumulation: Over 500,000 BTC

Technique, below the management of Michael Saylor, has firmly positioned itself as a Bitcoin-centric firm. In lower than 5 years, it has gathered over 500,000 BTC—accounting for greater than 2.5% of Bitcoin’s whole provide—turning its inventory right into a proxy for Bitcoin publicity.

Technique Knowledge Dashboard: A New Instrument from Bitcoin Journal Professional

The video introduces the brand new Treasury Analytics dashboard on BitcoinMagazinePro.com. This device gives very important insights into Technique’s:

- Actual-time Bitcoin holdings

- Internet Asset Worth (NAV) premiums

- Inventory worth knowledge

- Historic volatility

This dashboard empowers buyers to evaluate the intrinsic worth of MSTR and its correlation to Bitcoin worth actions.

Can Technique’s MSTR Worth Attain $1,000? Knowledge-Backed Situations

Matt Crosby walks by way of a number of valuation fashions based mostly on the next assumptions:

- Bitcoin worth ranges at $100K, $150K, and $200K

- BTC holdings increasing to 700K and even 800K BTC

- NAV premiums starting from 2x to three.5x

Utilizing these inputs, Crosby outlines real looking Technique inventory worth targets between $950 and $2,000. In ultra-bullish situations, excessive targets of $15,000 and even $25,000 are modeled, although acknowledged as speculative.

Capital Raises Gasoline Future BTC Accumulation

To help additional Bitcoin acquisition, Technique is leveraging a number of monetary devices:

- A $2.1 billion at-the-money inventory providing

- A $711 million perpetual most well-liked inventory issuance

These capital raises might allow the corporate to buy an extra 200K to 300K BTC.

MSTR Insights Based mostly on Numbers

For buyers carefully monitoring Technique (MSTR), the numbers inform a robust story:

- 500,000+ BTC Gathered: Technique now holds over 2.41% of all Bitcoin that may ever exist — making it the go-to public inventory for BTC publicity.

- From $9 to $543: Since 2020, MSTR’s inventory has soared from round $9 to over $543 (adjusted for inventory splits), thanks largely to its Bitcoin accumulation technique.

- Income vs. BTC Worth: Whereas Technique pulled in $463 million in software program income in 2024, its Bitcoin holdings are value round $43 billion — it might take a century of software program gross sales to match its BTC portfolio.

- Capital to Purchase Extra BTC: The corporate is elevating $2.1 billion by way of inventory choices and has already secured $711 million by way of most well-liked shares — funding that might add one other 200K–300K BTC to its steadiness sheet.

- NAV Premiums Matter: At occasions, MSTR has traded at a 3.4x premium to its internet asset worth. The present premium is round 1.7x, with room to increase in a bullish market.

- Increased Volatility Than BTC: MSTR’s worth swings are extra intense than Bitcoin’s — its 3-month volatility peaked at 7.56%, in comparison with BTC’s 3.32%.

- Deeper Drawdowns in Bear Markets: In previous down cycles, BTC misplaced about 80%, however MSTR fell as a lot as 90%, displaying it tends to amplify Bitcoin’s strikes.

Collectively, these figures spotlight each the huge upside potential and the excessive volatility threat that include investing in Technique.

Technique vs. Bitcoin: Volatility and Correlation Evaluation

Crosby factors out that Technique tends to maneuver much more sharply than Bitcoin. Over the previous three months, Bitcoin’s volatility averaged round 3.32%, whereas MSTR’s volatility reached 7.56% — greater than double.

Trying again at bear markets, Bitcoin usually retraced about 80%, however Technique’s inventory fell nearer to 90%. This highlights that Technique doesn’t simply comply with Bitcoin — it amplifies it. Meaning greater beneficial properties in bull markets, but additionally steeper losses throughout downturns.

Limitations: Will Technique Ever Rival Apple in Market Cap?

Whereas the numbers may trace at sky-high inventory worth prospects, reaching them is one other story. For Technique to significantly compete with tech giants like Apple, it might must:

- Accumulate between 850,000 and 1 million BTC

- See Bitcoin’s whole market cap rise above gold’s $20 trillion

- Maintain a internet asset worth (NAV) premium of 3x to 4x constantly

Even when all that occurred, Technique’s market cap would want to develop by 45 occasions to match Apple’s $3.3 trillion valuation. That form of leap is extraordinarily unlikely on this present cycle — it’s extra of a long-term, speculative state of affairs.

Conclusion: Technique’s MSTR Worth Outlook is Bullish however Speculative

In line with Matt Crosby’s evaluation, Technique’s MSTR worth reaching $1,000 and even $2,000 is totally inside the realm of risk throughout this market cycle—supplied Bitcoin maintains its upward trajectory and investor sentiment stays bullish. These targets are grounded in knowledge fashions that consider present BTC holdings, potential future acquisitions, and historic NAV premiums.

Nonetheless, this chance doesn’t come with out its caveats. Technique’s inventory is thought for its heightened volatility—usually exceeding that of Bitcoin itself—which makes it a high-beta, high-risk funding car. Buyers contemplating MSTR ought to be ready for vital worth swings and extended drawdowns, notably throughout Bitcoin market corrections.

That stated, for long-term Bitcoin believers and people with the next tolerance for threat, Technique affords a compelling, leveraged play on the broader crypto market. With its continued accumulation technique and substantial institutional backing, MSTR stays some of the data-driven and high-conviction methods to realize publicity to Bitcoin’s future development.

As at all times, potential buyers ought to do their due diligence, consider threat administration methods, and align their investments with private monetary targets and time horizons.

In case you’re involved in extra in-depth evaluation and real-time knowledge, think about trying out Bitcoin Journal Professional for beneficial insights into the Bitcoin market.

Disclaimer: This text is for informational functions solely and shouldn’t be thought of monetary recommendation. At all times do your individual analysis earlier than making any funding choices.