- Solana’s value continues to hit decrease lows regardless of elevated buying and selling quantity.

- A correction could be on the horizon for SOL, with latest bullish momentum needing to maintain to alter the pattern.

Solana [SOL] was lately grappling with intense bearish strain, which has pushed its value to decrease lows regardless of makes an attempt by bulls to keep up momentum.

Elevated buying and selling quantity suggests heightened market exercise, however the general sentiment stays cautious as merchants await indicators of a possible turnaround.

Solana bulls stay cautious

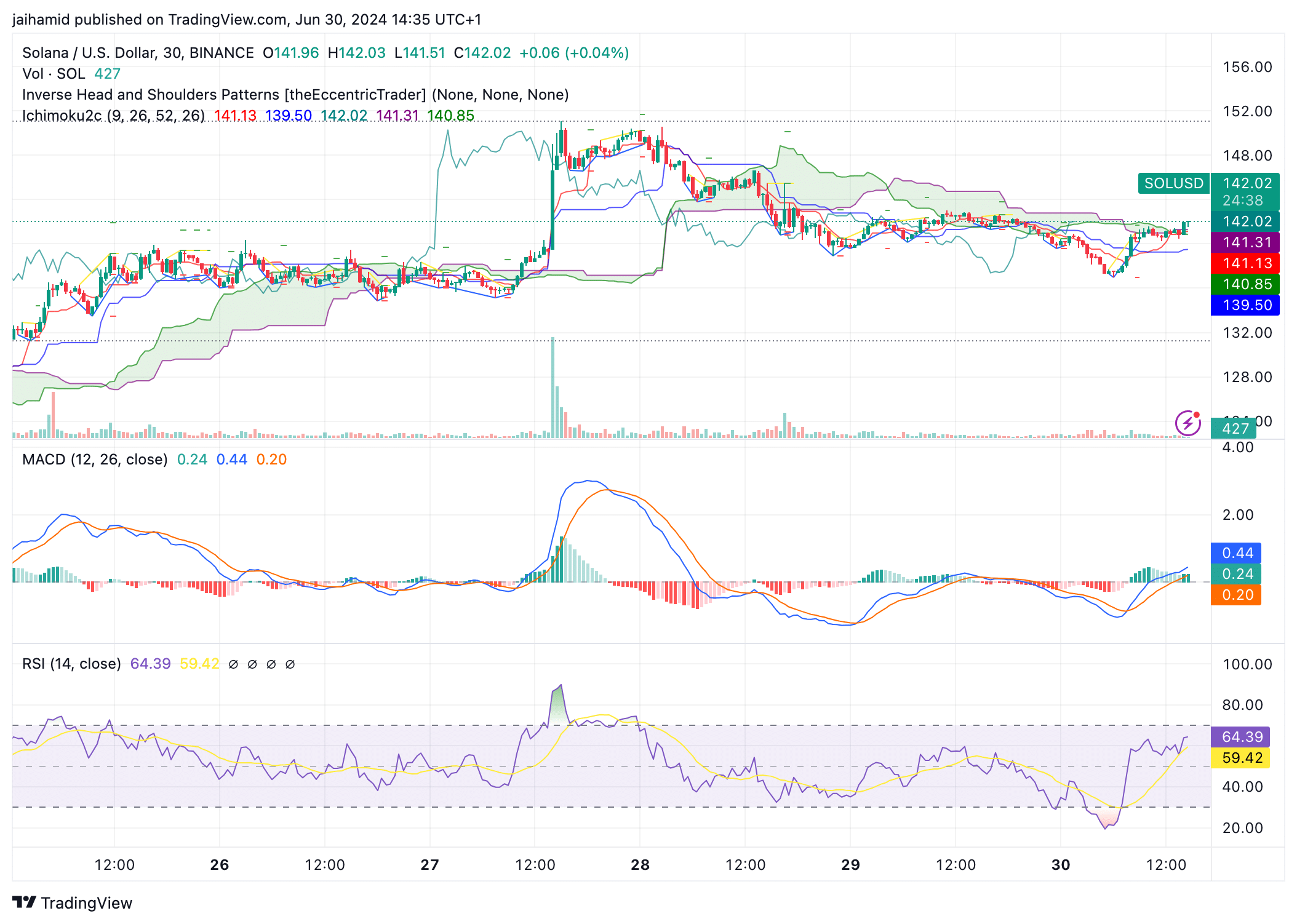

Over the previous 5 days, SOL has seen a number of annotations of an Inverse Head and Shoulders (IH&S) sample, which is usually a bullish reversal sample.

Nevertheless, the success of this reversal sample depends on a robust breakout above the neckline (the resistance line shaped on the tops of the heads).

Supply: TradingView

As for the Ichimoku Cloud, SOL’s value is at the moment buying and selling inside the cloud, which typically signifies a zone of indecision or potential pattern change.

The cloud acts as a assist/resistance space, with its colour turning from crimson to inexperienced, suggesting a shift towards bullish situations within the quick time period.

The Tenkan-sen and Kijun-sen traces are comparatively shut collectively underneath the worth, indicating short-term momentum is barely bullish however nonetheless lacks sturdy conviction.

The MACD histogram, which measures the gap between these two traces, has moved from adverse to constructive values, suggesting a rise in bullish momentum, albeit cautious.

The RSI was round 59 at press time, which is neither overbought nor oversold. The RSI’s latest peak just under the overbought threshold (70) and subsequent downturn displays the rise in promoting strain after makes an attempt by bulls to push the worth up, aligning with the cautious sentiment.

Is SOL headed for a correction?

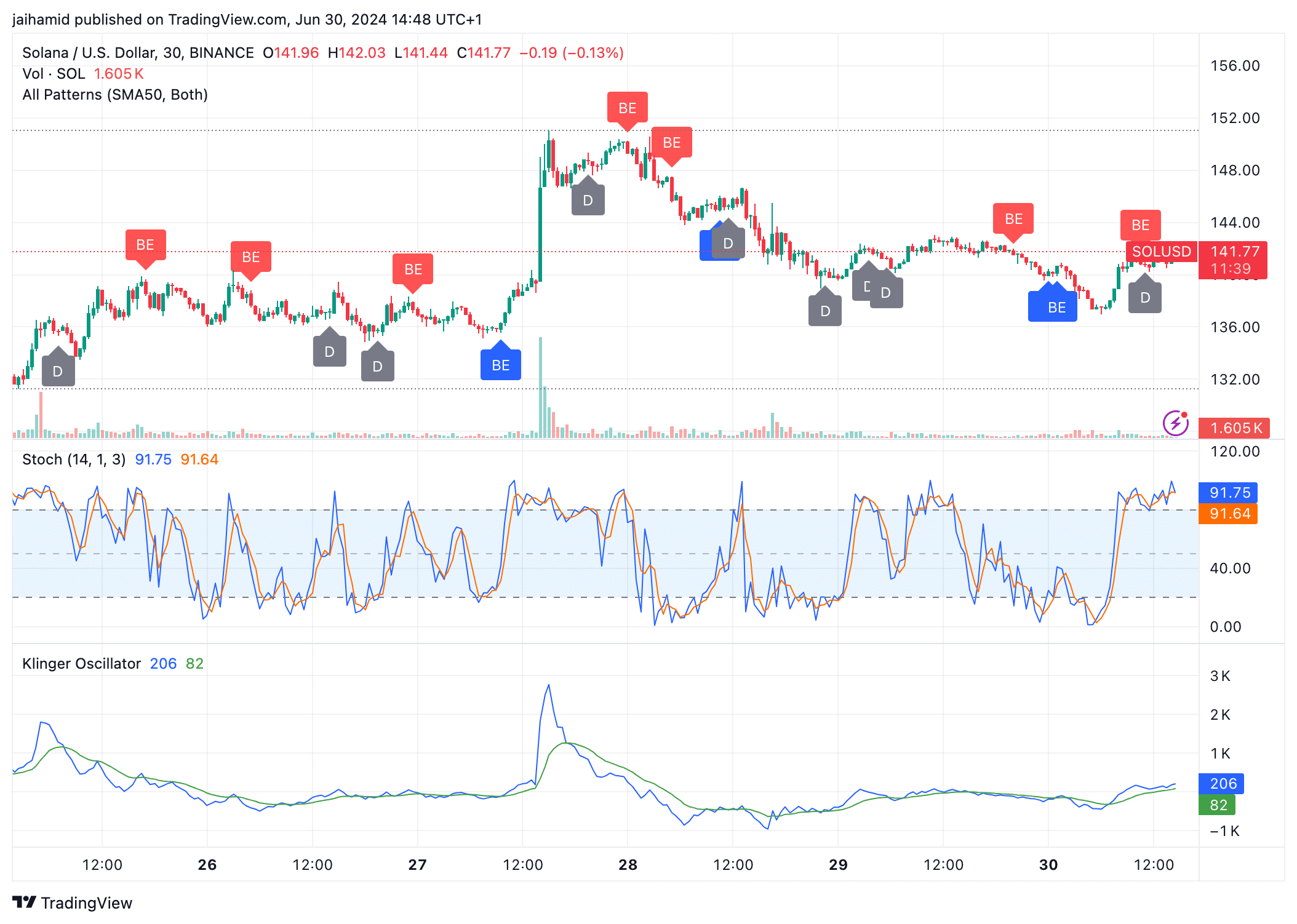

Because the bulls try and unsuccessfully flip the narrative, one other one is forming. The Stochastic Oscillator tells us {that a} correction could be underway.

Supply: TradingView

Solana could be due for a correction as the worth could possibly be perceived as comparatively excessive in comparison with its latest buying and selling vary.

Is your portfolio inexperienced? Take a look at the SOL Revenue Calculator

The Klinger Oscillator exhibits a crossing the place the sooner line (inexperienced) strikes above the slower line (blue), indicating a possible bullish momentum within the quick time period.

It is a constructive signal for bulls if sustained.