Bitcoin’s

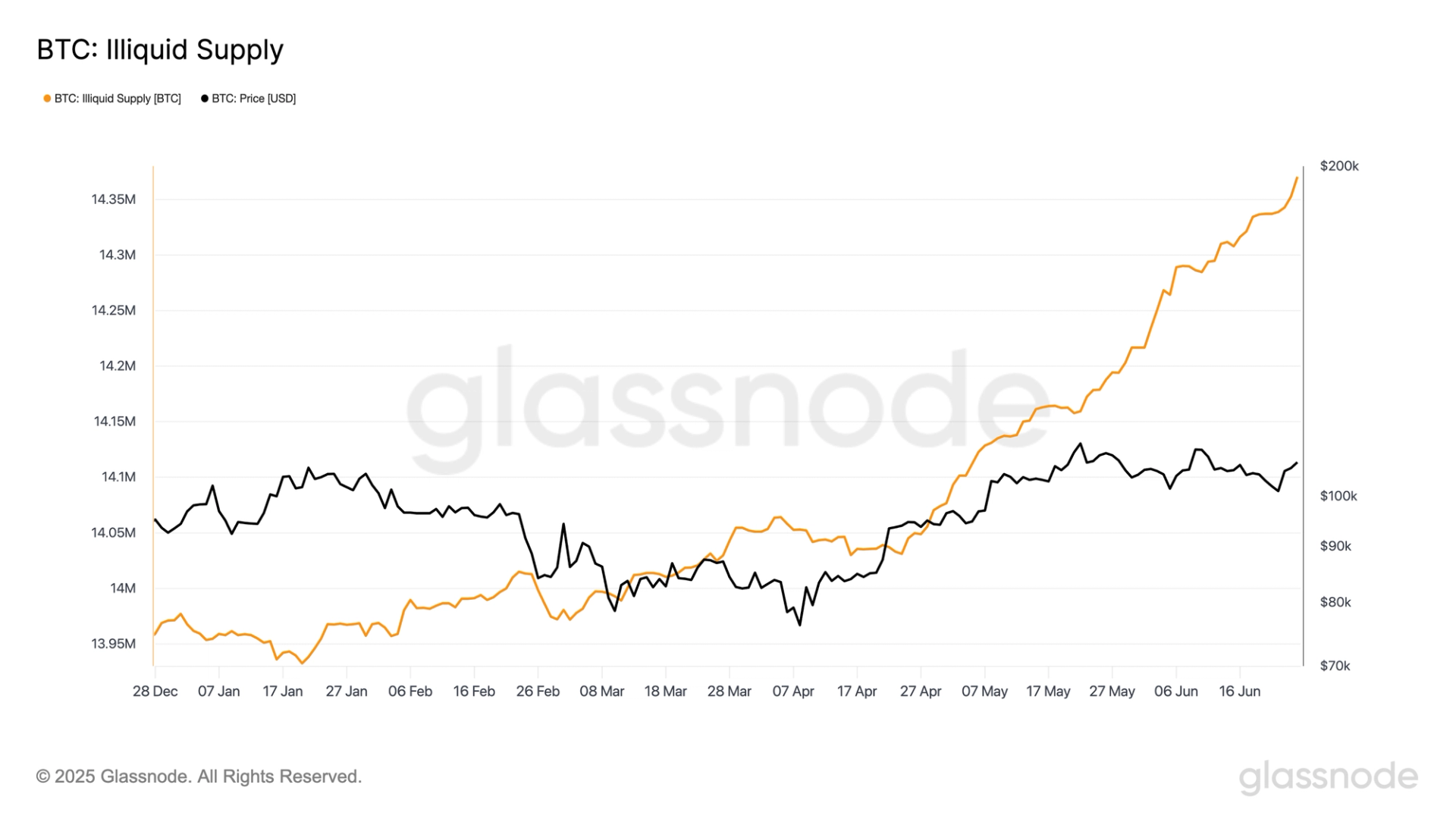

illiquid provide has surged to 14.37 million BTC, leaping from 13.9 million BTC at first of 2025, in line with Glassnode knowledge.

With bitcoin’s present circulating provide standing at roughly 19.8 million, this implies over 72 % of all mined BTC is now labeled as illiquid.

Illiquid provide refers back to the portion of BTC held by entities with minimal spending habits, reminiscent of long-term traders and chilly pockets holders. These cash are successfully taken out of the market, lowering the quantity out there for buying and selling.

As extra traders decide to retailer bitcoin relatively than commerce it, the liquid portion of the availability shrinks, tightening market availability.

This development is important as a result of a rising illiquid provide typically displays rising investor confidence and long-term conviction. It additionally creates the potential for a supply-side shock, the place rising demand meets restricted out there provide, traditionally related to bullish value actions.

The continued rise in bitcoin illiquidity helps the narrative of bitcoin as a retailer of worth. If this trajectory holds, it might place upward strain on value, notably within the context of heightened market curiosity and diminishing miner issuance.

This underscores liquidity evaluation as a key indicator for market sentiment and future value motion.