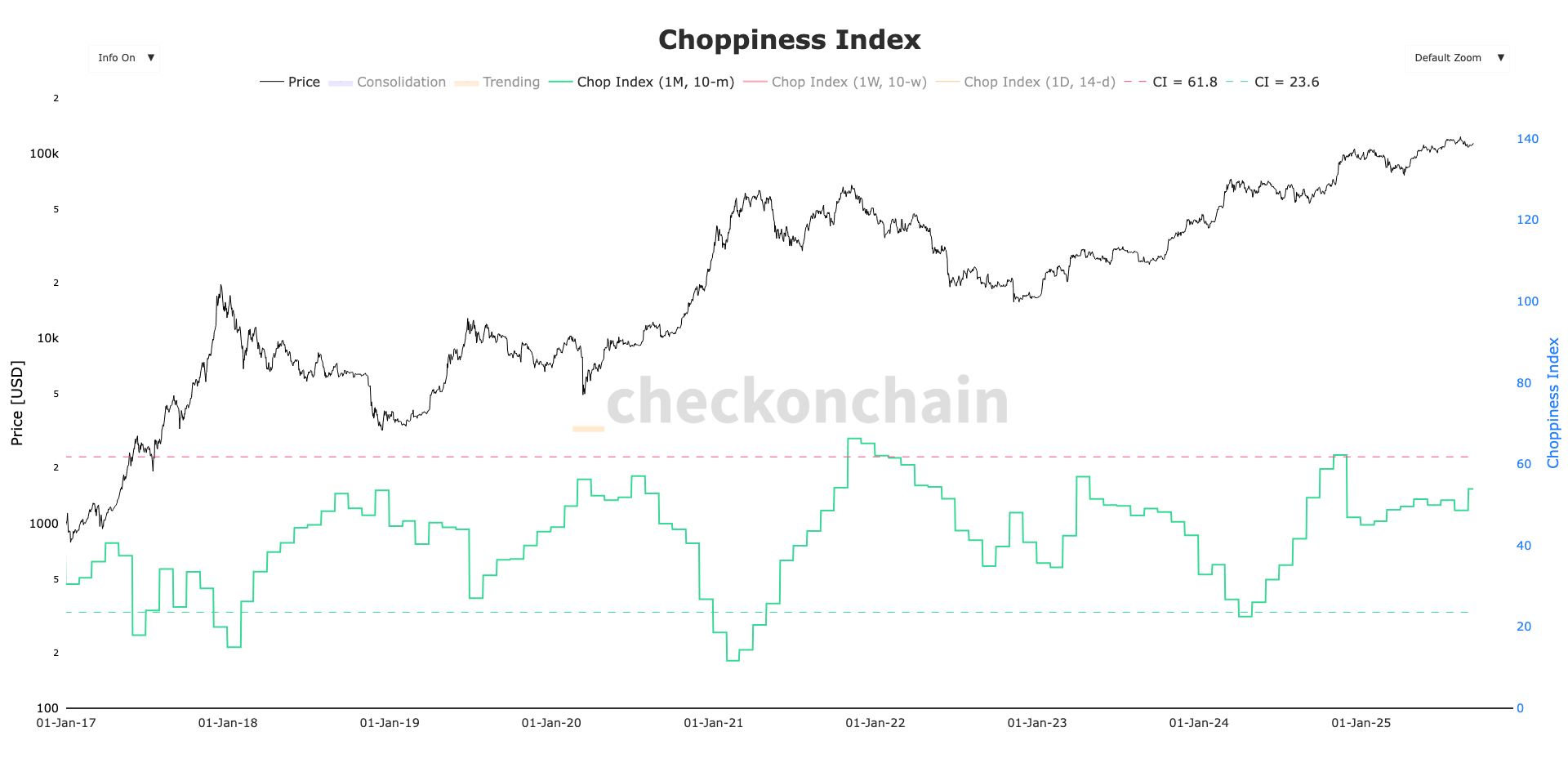

Bitcoin’s continued volatility compression has intensified with what analyst Checkmate refers to because the “choppiness index,” a metric that gauges sideways worth consolidation.

Earlier CoinDesk analysis has highlighted that bitcoin’s implied volatility stays at multi-year lows, which helps the sideways consolidation in bitcoin’s worth.

This choppiness displays bitcoin’s latest rangebound habits. For the previous few months, bitcoin has traded between $110,000 and its all-time excessive of $124,000, at the moment hovering round $113,000.

On the one-month timeframe, in accordance with checkonchain, the choppiness index has risen to 54. The final time it exceeded this stage was in early November 2024, simply earlier than President Trump’s election victory triggered a surge in bitcoin to over $90,000. At that time, the index peaked at 64. The earlier occasion earlier than that was in early 2023, on the onset of the present bull cycle, when the index stood at 57.

This sample suggests there should be room for additional consolidation, particularly as volatility continues to compress.

The subsequent main macroeconomic catalyst is the U.S. Client Worth Index (CPI), scheduled for launch at 12:30 PM UTC. This might act as a set off for a volatility breakout or directional worth transfer.

CoinDesk analysis from February additionally famous a chronic interval of which equally preceded the value decline that finally bottomed out in April round $76,000.