As February started, bitcoin was buying and selling round $80,000, with whales dipping their toes in whereas retail buyers had been working for the exits. Only one week later, bitcoin plunged to $60,000 on Feb. 5, and the market is now displaying a broad shift towards accumulation throughout almost all cohorts as buyers begin to see worth.

This variation follows probably the most extreme capitulation occasions in bitcoin’s historical past. Which now seems to be evolving right into a extra synchronized accumulation part.

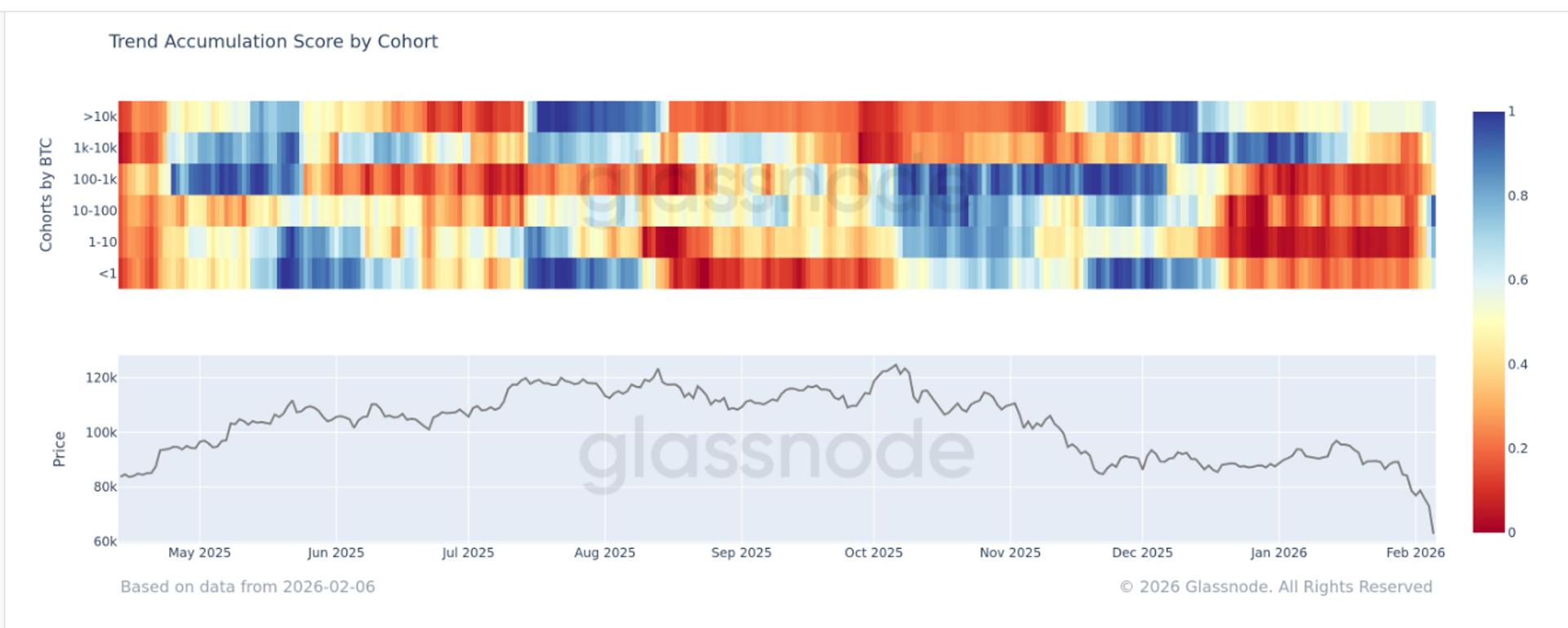

Glassnode’s Accumulation Development Rating by cohort highlights this shift in conduct. The metric measures the relative energy of accumulation throughout completely different pockets sizes by factoring in each entity dimension and the quantity of BTC collected over the previous 15 days. A rating nearer to 1 indicators accumulation, whereas a rating nearer to 0 signifies distribution.

On an mixture foundation, the Accumulation Development Rating by cohort has now climbed above 0.5, reaching 0.68. This marks the primary time since late November that broad-based accumulation has been noticed, a interval that beforehand coincided with bitcoin forming a neighborhood backside close to $80,000.

The cohort displaying probably the most aggressive dip shopping for has been wallets holding between 10 and 100 BTC, notably as costs fell towards $60,000

Whereas it stays unsure whether or not the last word backside is in, it’s evident that buyers are as soon as once more discovering worth in bitcoin after a drawdown of greater than 50% from its October all-time excessive.