Crypto is seeing a shuffling of playing cards of types. Lengthy-term holders of Bitcoin have eased up on promoting after months of regular reductions, whereas giant Ethereum wallets have been piling on extra tokens, in line with latest reviews.

Associated Studying

Merchants stay cautious as costs swing and knowledge offers blended alerts about the place cash is transferring subsequent.

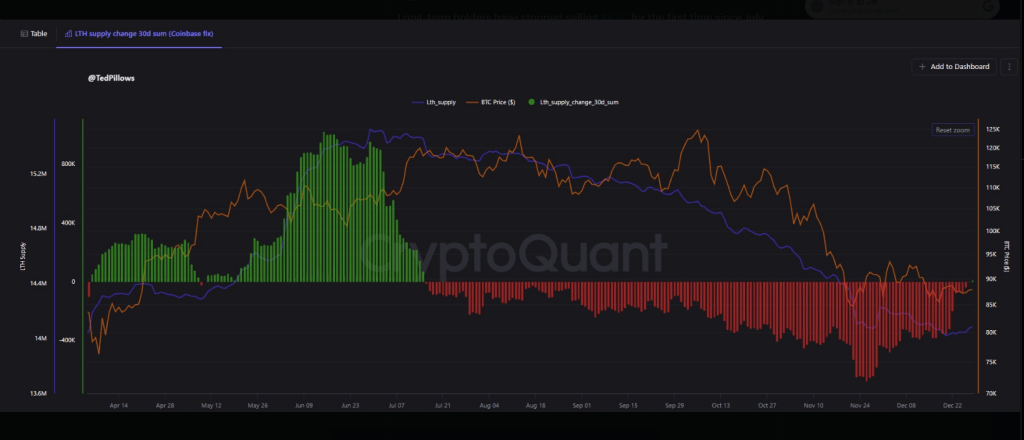

Based on on-chain figures cited in market commentary, wallets which have held Bitcoin for no less than 155 days lower their complete from almost 15 million cash in mid-July to a bit of over 14 million in December.

Ether Whales Enhance Holdings

Primarily based on reviews quoting CryptoQuant and a crypto e-newsletter, addresses holding giant quantities of ether have added round 120,000 ETH since Dec.26.

Analysts at Milk Highway stated wallets with 1,000+ ETH now management roughly 70% of the provision, and that share has been climbing since late 2024.

Heavy focus can level to robust conviction from a number of gamers, and it will probably additionally go away the market uncovered if those self same wallets transfer to promote. Each outcomes would form liquidity and worth swings.

Lengthy-term holders have stopped promoting $BTC for the primary time since July 2025.

Issues are wanting good for a aid rally right here. pic.twitter.com/t7Sl2hS9Ub

— Ted (@TedPillows) December 29, 2025

Lengthy-Time period Bitcoin Holders Pause Promoting

Crypto investor Ted Pillows was quoted on X saying long-term holders “have stopped promoting Bitcoin for the primary time since July 2025,” a degree that market watchers flagged as a attainable turning level in holder habits.

That change in exercise is usually learn as an indication of exhaustion after a protracted stretch of distribution. It may imply sellers are carried out for now, nevertheless it doesn’t assure a contemporary uptrend.

Capital Strikes And Market Chops

Garrett Jin, previously of change BitForex, prompt that some capital could also be shifting from metals into crypto after a brief squeeze in valuable metals.

Studies referenced positive factors in silver and platinum as a part of the backdrop. On the similar time, bitcoin traded in a good vary lately, bouncing between $86,740 and $90,060 over seven days, a sample that has stored many merchants on edge.

Silver’s worth rose by greater than 1,570% this yr, a determine that might symbolize an excessive transfer and which can want unbiased affirmation.

In the meantime, bitcoin stays effectively under its report highs. Some analysts argue that lukewarm ETF demand and market mechanics, together with derivatives and liquidity patterns, play a bigger position in worth motion than headline sentiment.

Associated Studying

Taken collectively, the information factors to a market that’s stabilizing greater than rallying decisively. Massive ether holders are shopping for, long-term bitcoin homeowners have paused promoting, and US flows look delicate.

Featured picture from Unsplash, chart from TradingView